No Changes Expected on the U.S. Economy's Rate of Expansion

Given what looks poised to be a relatively uneventful week ahead, just days before Christmas, the biggest price swings are likely to be observed on the GBPUSD pair. This is especially true given last week's dollar selloff. You can read more about it from our latest EURUSD analysis.

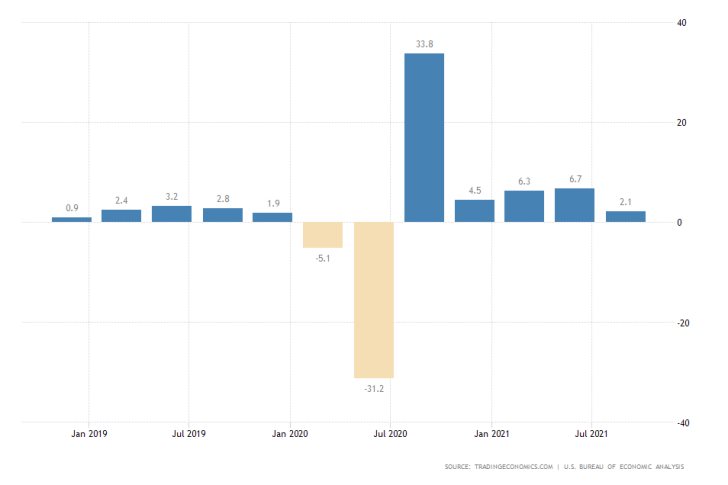

On Wednesday, the Bureau of Economic Analysis in the U.S. is scheduled to publish the final GDP growth rate numbers for the third quarter. No changes are expected to the 2.1 per cent expansion that was recorded in the preliminary reading.

Such a reading would measure a significant drop from the 6.7 per cent growth that was observed in Q2. However, it would be above the initial recovery projections from the beginning of the year. This is one of the primary reasons why Jerome Powell and the FED adopted a more hawkish policy stance last week.

The news is unlikely to have a sizable impact on the struggling dollar in the short term given that this would be the final reading for the period, negating the surprise factor.

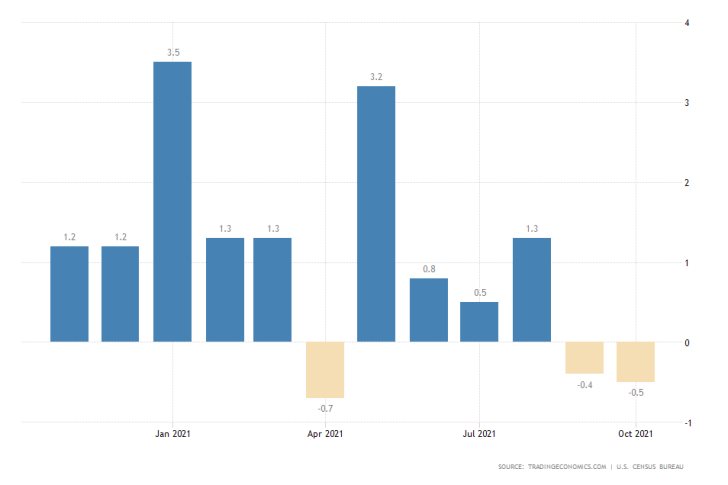

Moderate Increase in U.S. Factory Orders Forecasted for November

The Census Bureau will post the durable goods orders for November a day later. According to the market forecasts, factory orders would rebound by 1.5 per cent from the 0.5 per cent contraction recorded a month prior.

These projections are substantiated by the fact that producer prices jumped sizably over the same period. Despite these optimistic forecasts, traders and investors should be cautious, as the news will be released just a day before the beginning of the Christmas holidays.

Liquidity would very probably drop, with most western markets closing down for the holidays. This would make the general market environment extremely unpredictable and potentially erratic. This is why reactive trading to the news is unadvisable.

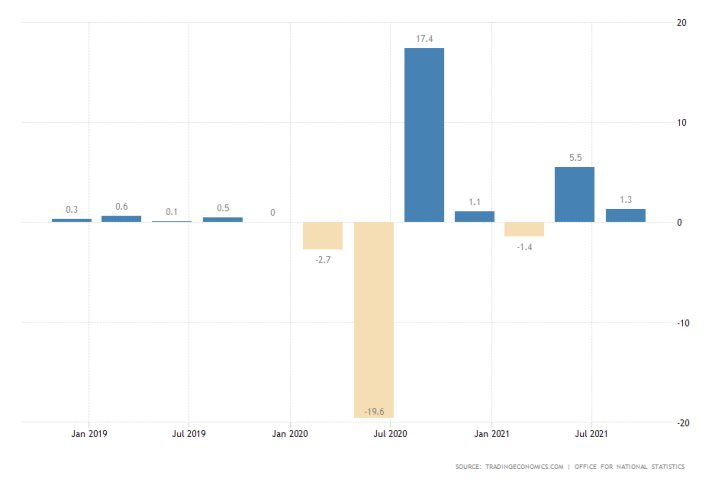

UK's Economic Expansion to Remain Subdued

Again on Wednesday, the Office for National Statistics in the UK will release the British GDP growth rate for the third quarter. This will also be the final report for the period, anticipating no changes from the 1.3 per cent rate of expansion highlighted in the preliminary reading.

The data will come just days after BOE's surprising decision to lift the interest rate by 0.25 per cent in line with the recuperating economic activity. This is what is helping the pound recover some of its recent losses against the shaken dollar.

Even so, the greenback made a noticeable correction in the early hours of this week's session, as shown on the hourly chart below. In the wake of BOE's policy decision last week, the GBPUSD completed a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory.

Notably, this occurred at the 61.8 per cent Fibonacci retracement level at 1.33781. The subsequent dropdown penetrated below the 23.6 per cent Fibonacci at 1.32435, which is currently converging with the 200-day MA (in orange).

The price action can find support at one of the two previous swing lows: at 1.32050 and 1.31750.

Other Prominent Events to Watch Out for:

Tuesday - Canada MoM Retail Sales; Euro Preliminary MoM Consumer Confidence.

Wednesday - U.S. MoM CB Consumer Confidence.

Thursday - U.S. MoM Core PCE Price Index.

Friday - Bank Holiday.