The U.S. dollar underwent through a soft patch last week, having depreciated against most other majors. Even still, the greenback has a chance to recuperate this week on the newest NFP and manufacturing numbers. Check out our detailed GBPUSD analysis for additional information on the broader market sentiment.

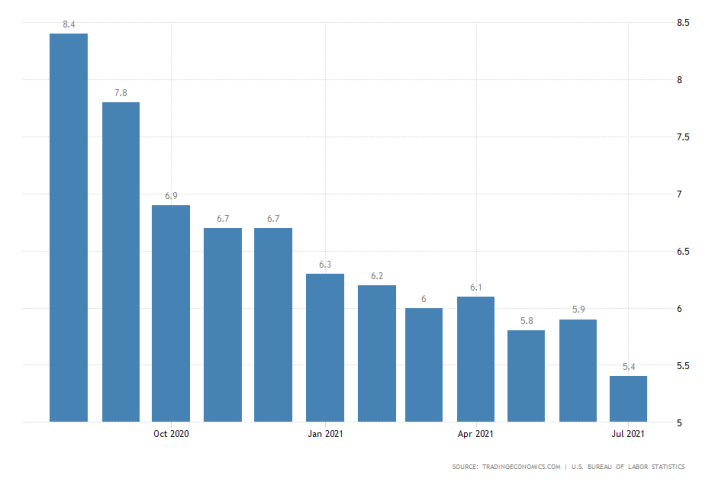

This week's most important event in the economic calendar will be the U.S. non-farm payrolls, scheduled for publication on Friday. According to the preliminary forecasts, headline unemployment is expected to drop from July's 5.4 per cent to a new record low of 5.2 per cent.

If realised, this would mark the lowest reading since the beginning of the coronavirus pandemic in early 2020. The labour market is also projected to have added 750 thousand new jobs in August, representing a moderate decline in the pace of jobs creation. In contrast, 943 thousand jobs were added over the previous month.

If Friday's labour force survey meets the initial forecasts, this would be good news for the struggling dollar. Robust employment data could be enough to end last week's tumble of the greenback and catalyse another bullish rebound.

OPEC Conformity under DoC Still Vital for the Energy Market

On Wednesday, the OPEC joint ministerial meeting is set to stir extra volatility in the energy market. The Committee will deliberate on the latest changes in market fundamentals, which would be of crucial significance for the next direction of crude's price.

During the previous meeting in July, the Committee observed that demand for oil was "showing clear signs of improvement […] as the economic recovery continued in most parts of the world".

This time, OPEC would have to weigh in on the latest political turmoil in Afghanistan, which could have a fallout impact on the global supply chains, thereby exacerbating the persisting problems of supply bottlenecks.

In charts | Supply squeezes, labor shortages and a still-spreading coronavirus continue to complicate recoveries in many economies.https://t.co/1qFZADJocq

— BloombergQuint (@BloombergQuint) August 29, 2021

Moreover, conformity under the Declaration of Cooperation (DoC) would also play a huge role in driving crude oil's price action in the medium term. Last time, the Committee announced a 113 per cent conformity between all members and non-member countries.

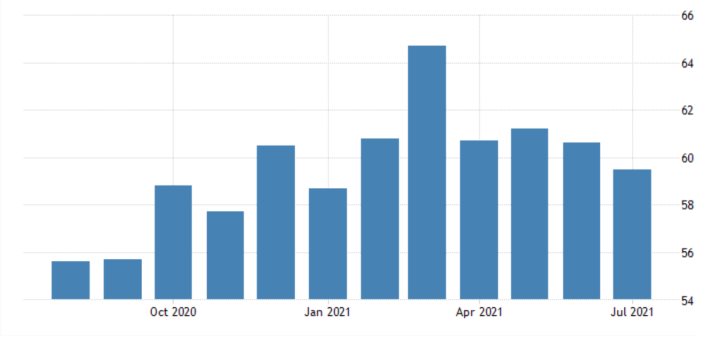

U.S. Factory Activity to Continue Waning in August

Again on Wednesday, the Institute for Supply Management (ISM) is scheduled to post the latest U.S. factory activity numbers. The manufacturing PMI is expected to fall from July's 58.5 index points to a fresh low of 58.7 points in August.

If these forecasts are realised, this will mark the third consecutive month of depreciating factory activity, which is once again an outcome of the aforementioned global supply squeeze.

Such a potential performance would signify a moderate depreciation in the pace of economic recovery in spite of the expected growth of the labour market. This would likely add to the underlying volatility currently observed on all currency pairs involving the dollar.

Given the two major releases in the U.S. and the OPEC meeting, the USDCAD is the pair that is most likely to register significant price fluctuations over the next several days.

The price action currently finds itself at a crucial junction, as can be seen on the 4H chart below. It is consolidating around the 61.8 per cent Fibonacci retracement level at 1.26245, the ascending trend line (in black) and the 100-day MA (in blue).

If it manages to rebound from the three, the price action would then likely head towards the 38.2 per cent Fibonacci at 1.27486. That is if it manages to penetrate above the minor resistance level at 1.26870, underpinned by the 50-day MA (in green).

Conversely, a decisive breakdown below the three could lead to a potential continuation of the correction towards the previous swing low (at 1.25000).

Other Prominent Events to Watch for:

Tuesday - China MoM Manufacturing PMI; Eurozone MoM Preliminary CPI; Canada QoQ GDP Growth Rate; U.S. CB Consumer Confidence.

Wednesday - Australia QoQ GDP Growth Rate; Germany MoM Retail Sales.

Thursday - Australia MoM Trade Balance.

Friday - U.S. MoM ISM Services PMI; Eurozone MoM Retail Sales; UK BOE Monetary Policy Minutes.