U.S. Inflation Growth Rate Expected to Slow Down in December

This week's U.S. inflation data will be a crucial indicator of future recovery, and investors and traders alike would be keen to learn whether prices have finally started to grow at a slower pace. Have a look at our comprehensive gold analysis to learn more about the report's likely impact on lower-risk securities.

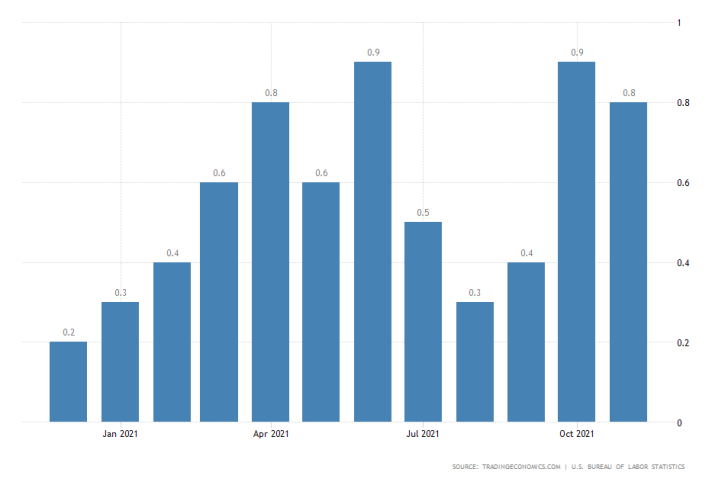

On Wednesday, the Bureau of Labour Statistics (BLS) would publish the Consumer Price Index (CPI) change for December. The preliminary forecasts anticipate a moderate decrease in the pace of inflation growth from a month prior.

Therefore, consumer inflation is expected to have accelerated by 0.4 per cent over the last month of 2021, measuring a marked decrease from the 0.8 per cent expansion that was recorded in November. Global inflationary pressures remain strong elsewhere.

If these forecasts are realised, this would likely help the struggling dollar in the short term, whose woes were exacerbated by the weaker-than-expected non-farm payrolls data for the same period.

No Changes Expected in U.S. Consumption

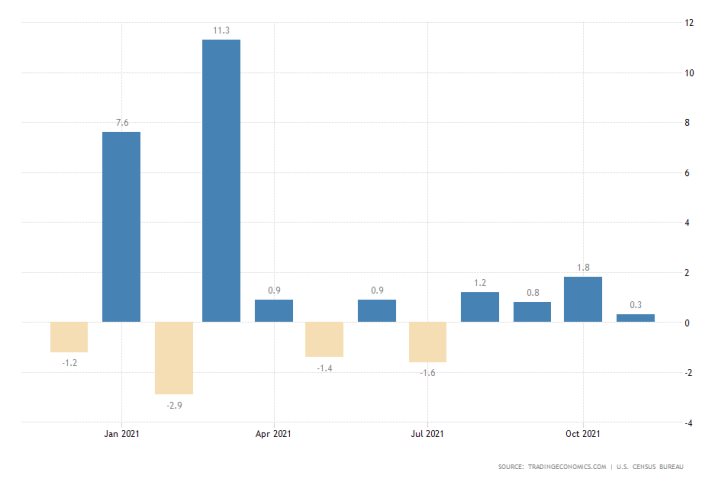

The decline in the pace of jobs creation would likely correlate to a parallel contraction in U.S. retail sales. These projections are compiled against a moderate pick-up in consumption globally.

According to the preliminary forecasts, retail sales would grow at a negative rate in December, compared to a 0.3 per cent increase that was recorded a month prior. The Census Bureau is scheduled to release the latest consumption numbers on Friday.

Stymied consumption is forecasted despite the otherwise growing economic activity that was observed over the same period.

UK Industrial Production to Finally Register a Monthly Increase

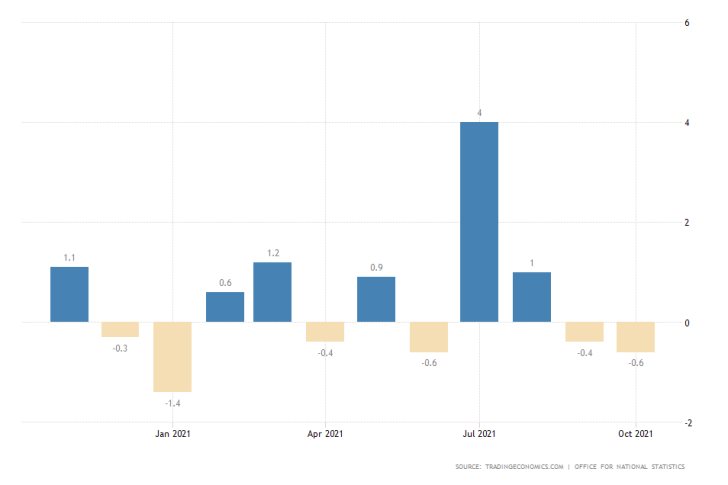

Again on Friday, the Office for National Statistics in the UK is expected to observe a 0.2 per cent rebound in industrial production from the 0.6 per cent contraction that was recorded in the previous month.

If the consensus forecasts are met, this will break the two-month trend of contracting activity, despite a sizable drop in labour activity that was observed over the same period. Meanwhile, the pound is likely to continue outperforming the greenback in the medium term.

As can be seen on the 4H chart below, the GBPUSD is currently developing a new uptrend within the boundaries of an ascending channel. It started developing following the completion of a major Elliott Wave cycle.

This pullback from the previous dip has now reached the 61.8 per cent Fibonacci retracement level at 1.35820, representing the last Fibonacci obstacle as measured against the preceding downtrend. This is why a minor correction towards the 38.2 per cent Fibonacci at 1.34225 may emerge next.

These bearish expectations are substantiated by the fact that the MACD indicator is currently signalling a possible divergence in the making. The 100-day MA (in blue) is currently converging with the 38.2 per cent Fibonacci, making it an even stronger support level.

Meanwhile, the next correction may be terminated even before that. The 50-day MA (in green) is threading alongside the lower limit of the channel, which makes the latter an even stronger turning point.

Other Prominent Events to Watch Out for:

Tuesday - U.S. FED Chair Jerome Powell Testifies; Australia MoM Retail Sales.

Wednesday - Eurozone MoM Industrial Production.

Thursday - U.S. MoM PPI Change.