A Significant Upsurge in UK Inflation Expected

The top-tier trading events in the economic calendar for next week include British inflation and unemployment data, and U.S. consumption. The expected increase in volatility would very probably have the most significant impact on the GBPUSD. You can read more about the pair's current market sentiment from our latest comprehensive analysis.

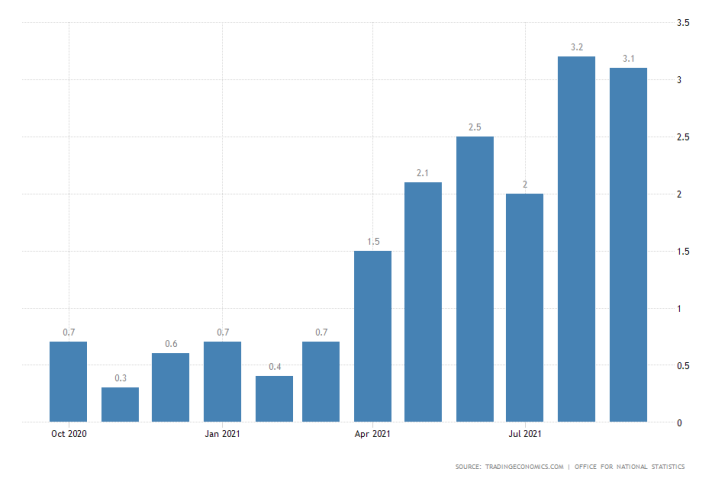

In arguably the most highly anticipated economic release over the next five days, the Office for National Statistics in the UK is scheduled to publish the October inflation numbers on Wednesday.

According to the market forecasts, the consumer prices index (CPI) is expected to jump to 3.8 per cent in October from the 3.1 per cent that was recorded a month prior.

Headline CPI would likely increase because of global supply disruptions that continue to be the most significant catalyst for rising inflation. Consumer prices are rising elsewhere as well, most notably in the U.S.

The Bank of England's response was to dial back the pace and scope of its asset purchase facility. This happened despite a stagnating rate of expansion of the British economy in the third quarter.

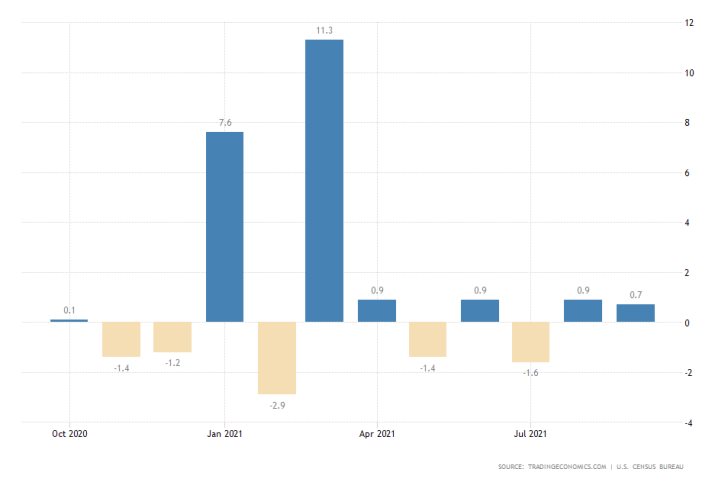

U.S. Consumption to Grow Moderately in October

Retail sales in the U.S. are estimated to grow by 1.2 per cent in October, measuring a marginal increase from the 0.7 per cent expansion that was recorded in September. The Census Bureau will post the latest consumption numbers on Tuesday.

The increase in consumption will reflect the above-mentioned hike in consumer prices, which ran parallel to a moderate pick-up in production prices. This divergence would likely continue favouring the underlying strengthening of the dollar.

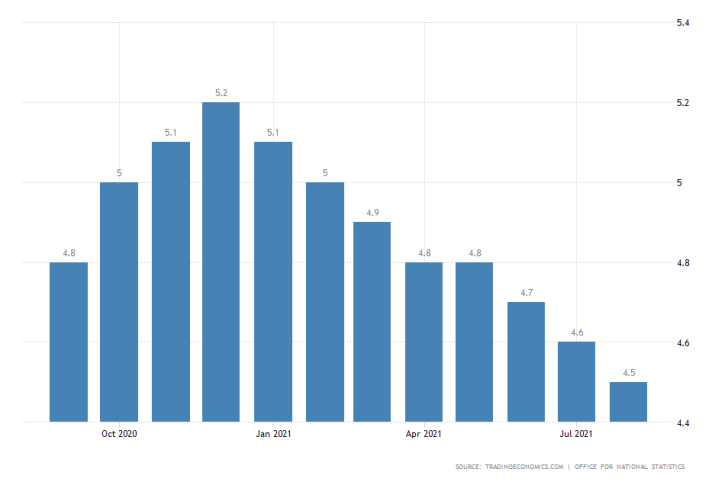

No Changes Expected in the British Labour Market

Again on Tuesday, the Office for National Statistics will publish the October employment and unemployment numbers. According to the consensus forecasts, headline unemployment will remain unchanged at 4.5 per cent.

With no notable gains in employment projected, the pound's selloff would likely continue to pick up speed over the next several days. This tendency would have a very intriguing impact on the EURGBP pair.

As can be seen on the 4H chart below, the price action appears to be behaving as per the expectations of the Wyckoff Cycle method. Following the decisive breakout above the Accumulation range, the price action started establishing a new Markup.

A failed breakout above the 61.8 per cent Fibonacci retracement level at 0.85605 was followed by a consolidation of the price action above the 400-day MA (in green). The latter underpins the major support level at 0.85300. Meanwhile, the 300-day MA (in purple) highlights another very important support level (at 0.85200) nearby.

If the price of the EURGBP breaks down below the two, the trend reversal would then probably be followed by a subsequent dropdown to the 38.2 per cent Fibonacci at 0.85000. This psychologically significant threshold is about to be crossed by the 100-day MA (in blue) soon, making it an even more prominent turning point.

Conversely, a potential rebound from either of the two moving averages would likely lead to another attempt at the previous swing peak at 0.85900.

Other Prominent Events to Watch Out for:

Monday - China MoM Retail Sales.

Tuesday - Australia RBA Monetary Policy Meeting Minutes; U.S. MoM Industrial Production; Eurozone Preliminary QoQ GDP Growth Rate.

Wednesday - Canada MoM Inflation Rate; UK MoM Retail Sales.

Thursday - Eurozone MoM Inflation Rate.

Friday - UK MoM Retail Sales; Canada MoM Retail Sales; Japan MoM Inflation Rate.