Serious Slump in British Gross Domestic Product Forecasted for Q2

The Office for National Statistics in the UK is scheduled to publish crucial GDP growth rate data for the three months ending in June this Wednesday.

The significance of this GDP report is substantiated by the fact that it is going to reflect on preliminary data for the second quarter, and early data almost always excites more market volatility compared to releases of final GDP numbers.

Investors' anticipation is running high because this is going to be the first major economic release of quarterly GDP numbers since the beginning of the crisis, which is going to reveal the real extent of the British economy's contraction from the weight of the coronavirus to date.

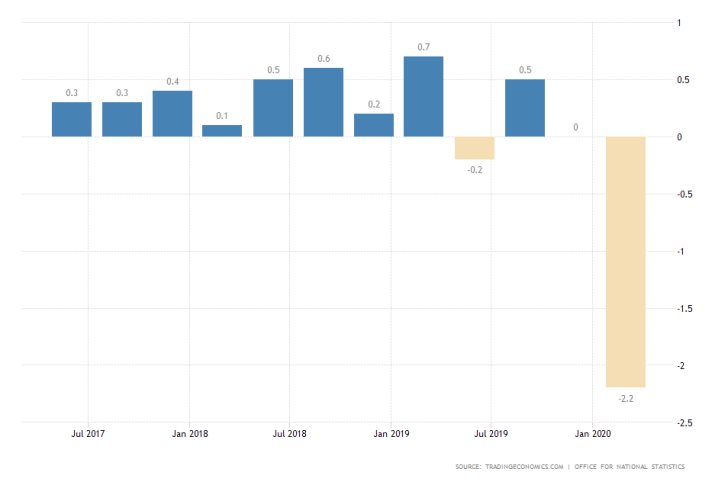

The consensus forecasts project a massive crunch of 20.5 per cent, which, if realised, is going to manifest the biggest quarterly slump on record. By comparison, the observed downturn in the first quarter reached 2.2 per cent, which was revised down from the initially reported contraction of 2.0 per cent.

Wednesday's economic report is expected to demonstrate the worst of the coronavirus fallout, as it will cover a time period that saw limited economic activity and stringent lockdown measures.

During the second quarter, most non-essential businesses suspended their operations; foreign trade was massively interrupted, while consumer demand for most goods and services plummeted to record lows.

The market has already started to price in Wednesday's GDP growth rate forecasts, so no major surprises are likely to stir some extra volatility following the economic release. Even still, the possibility of 'Black Swan' events hitting the markets from seemingly nowhere should never be disregarded or neglected.

Meanwhile, traders' opinions concerning the future of the sterling's bullish run appear to be shifting. As it is about to be seen below, the pound is quickly exhausting its strength, and its underlying bullish bias is thus waning.

Tomorrow's GDP numbers could exacerbate this process and cause the emergence of a temporary correction on the GBPUSD pair, whose trending sentiment from our last analysis of the pair seems to be lessening.

Muted Inflationary Pressures in the US Emerging on the Horizon Yet Again to FED's Dislike

Again on Wednesday, the US Bureau of Labor Statistics is scheduled to publish the findings of its Consumer Price Index survey for July.

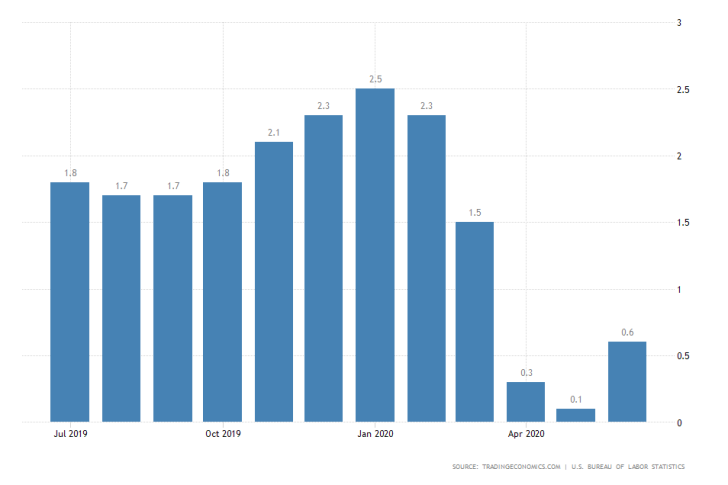

The initial market forecasts anticipate a minor contraction of 0.3 per cent from June's improvement of 0.6 per cent. Thus, the US economy is likely to edge closer towards entering structural deflation once again as inflation tumbles to 0.3 per cent.

This is troubling news for FED officials as muted inflationary pressures would mean crumbling prospects for a robust recovery. During the FOMC July meeting, Chair Jerome Powell expressed his concerns that a protracted stabilisation of consumer prices would spell slow and uneven recovery.

Such a demonstration of weakened price stability on Wednesday would compel the FED to keep the Federal Funds Rate near-negative at 0.25 per cent at least by the end of the year, in addition to maintaining the Bank's accommodative monetary policy.

All of this is likely to result in more economic woes for the already strained dollar, which continues to struggle to recover its previous status as a leading safety currency amidst a growing number of COVID-19 cases in the US.

The RBNZ to Remain on its Current Course

The Governing Council of the Reserve Bank of New Zealand is meeting on Wednesday to deliberate on its current monetary policy stance. The consensus forecasts do not anticipate any changes to the Official Cash Rate, which is currently at 0.25 per cent.

Traders would be looking for hints in the Council's Monetary Policy Minutes concerning the impact of possibly unfavourable exchange rates on the growth outlook for New Zealand's economy.

Similar remarks during RBNZ's monetary policy gathering in June sparked temporary disruptions for the kiwi, which tanked in the aftermath of the release.

The market is likely to react likewise on Wednesday, provided that the RBNZ expresses concerns regarding the recent resurgence of COVID-19 cases in the region and globally.

Meanwhile, the following 4H chart illustrates the current relationship between the pound and the greenback. As can be seen, the GBPUSD continues to exhibit prevailingly bullish bias; however, it is also failing to break out above the major resistance level at 1.31700.

The price action appears to be developing a triple top pattern, which typically entails the termination of a recent bullish momentum and possible reversal. Yet, the market does not look entirely ready to become prevailingly bearish either, judging by the snap rebound from the major support level at 1.30200.

The divergence on the MACD indicator underpins the gradual transition of the underlying market momentum, which could be interpreted as the slow exhaustion of the recent bullish pressures that could result in the creation of a new consolidation range.

Other Prominent Events to Watch for:

Thursday – Unemployment Rate data in Australia.

Friday – RBA Governor Lowe Speaks; Retail Sales numbers in the US.