U.S. Inflation Expected to Accelerate Even More in April

Even though the economic calendar for this week looks quite uneventful, all eyes will be focused on the newest inflation data in the U.S. for the month of April. These consumer price numbers will be crucial because of the widening gap between investors' opinions concerning the rising prices and FED's long term projections.

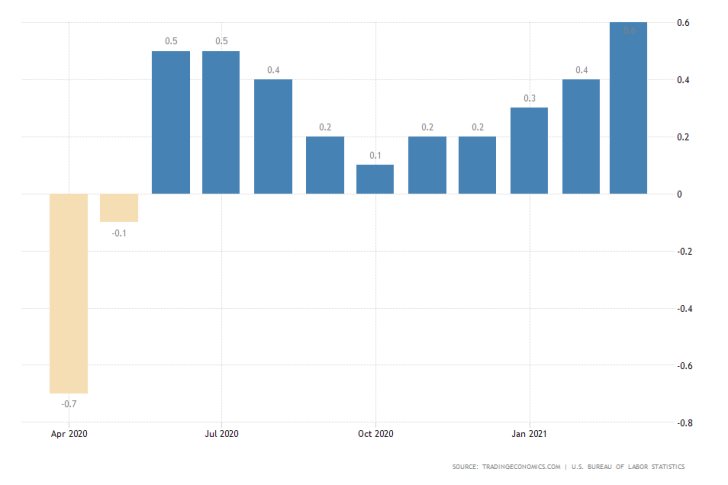

The Bureau of Labor Statistics (BLS) is scheduled to post the latest CPI data on Wednesday. According to the preliminary forecasts, the consumer prices index is projected to have grown moderately last month by 0.2 per cent.

Such a performance would strengthen further the trend of growing consumer prices in the U.S. Inflation grew by 0.6 per cent in March, which was the most since 2012. This trend is underpinned by the very sizable uptick in global demand.

Soaring energy prices contributed to this positive trend; however, the consolidating crude oil price over the past several weeks is expected to have the opposite effect. That is why the forecasts anticipate a much more moderate uptick in CPI by only 0.2 per cent.

Worsening Recovery Prospects for the British Economy

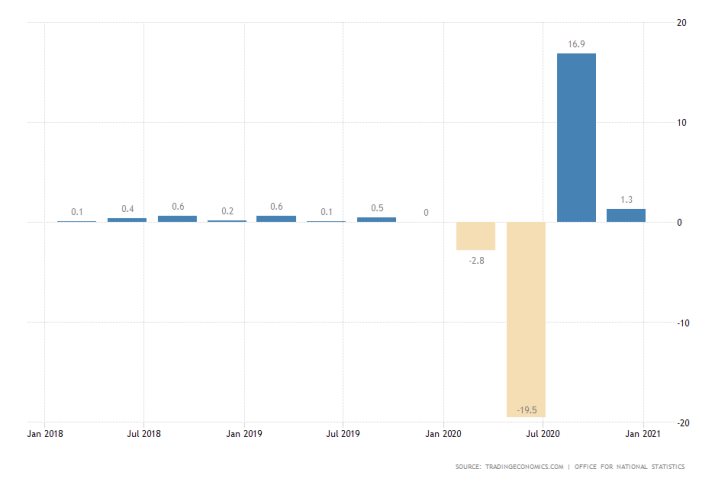

On Wednesday, the Office for National Statistics is set to post the preliminary GDP numbers in the U.K. for the first three months of 2021. These preliminary reports are published about 45 days before the final numbers, which is why they tend to garner more interest.

The British economy is expected to have shrunk by 1.6 per cent in Q1 compared to the 1.3 per cent growth that was recorded for the last three months of 2020. This would mark the first contraction since the beginning of the coronavirus crisis.

The quarterly recession is forecasted despite the better-than-expected employment numbers for last month. Even more interestingly, this negative GDP growth data is expected to be posted just days after the BOE released its slightly more hawkish-sounding policy decision.

The U.S. Retail Sector is Getting Ahead of Itself

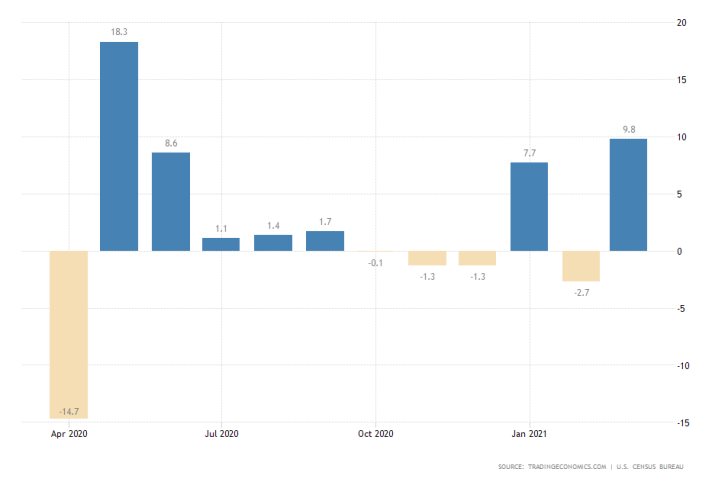

The Census Bureau is set to deliver crucial retail sales data for April on Friday. According to the preliminary forecasts, the index is expected to increase moderately by 1.0 per cent. This would be significantly less compared to the nearly 10.0 per cent growth that was recorded a month prior.

Part of the reason why such a marked drop in retail sales is forecasted has to do with the dampened employment conditions in the U.S. labour market. As was revealed on Friday, the latest Non-Farm Payrolls missed the initial forecasts by a long shot.

Therefore, the downwards pressure on the dollar is likely to be carried over the next several days. Due to the inflation data in the U.S. and the GDP numbers in the UK, the GBPUSD is likely to become the most volatile pair this week.

As can be seen on the daily chart below, the cable reached the psychologically significant resistance level at 1.40000 last Friday, following the massively disappointing employment numbers in the U.S.

Given that the price action has already rebounded from this major threshold on several occasions in the past, it seems that a potential correction from this major barrier could drive the price towards the 38.2 per cent Fibonacci retracement level at 1.36441.

Conversely, strengthening the price action above 1.40000 could allow the bullish charge to continue higher towards the next major target - 1.42000.

Other Prominent Events to Watch for:

Tuesday - BOE Gov Bailey Speaks; China y/y CPI.

Wednesday - EU Economic Forecasts.

Thursday - U.S. Unemployment Claims.

Friday - U.S. Preliminary Consumer Sentiment; U.S. Industrial Production.