U.S. Inflation Expected to Edge Higher in January

The economic calendar for the week ahead looks mostly uneventful. There are not many major releases scheduled to occur over the next five days, which means that global markets are likely to be hit by subdued volatility and diminished liquidity levels. Traders need to take this into account when planning to place any orders.

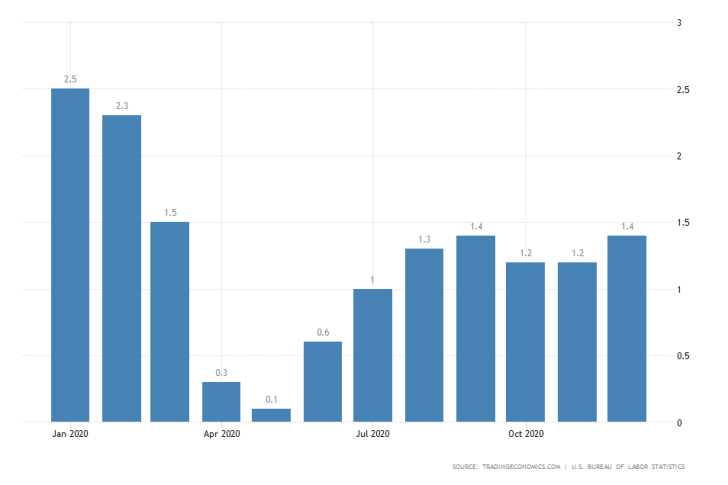

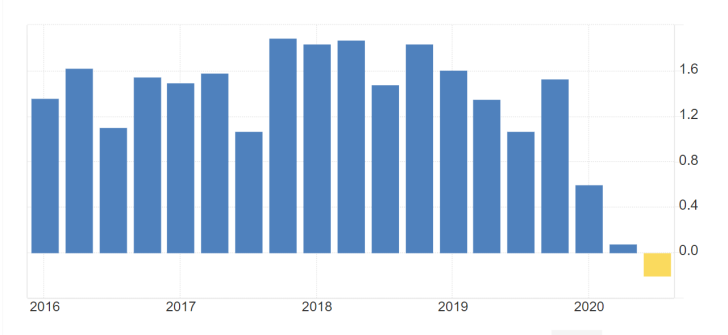

Arguably, the most impactful data this week will be the publication of U.S. inflation numbers for January, which are compiled and published by the Bureau of Labour Statistics (BLS). The latest Consumer Price Index data will be posted on Wednesday.

According to the consensus forecasts, headline inflation is projected to grow marginally by 0.1 per cent from December's 1.4 per cent. This would mean U.S. price stability is improving at a moderate pace and moving closer to FED's long-term 2 per cent symmetric target rate.

Regardless of the expectations for only a marginal improvement, rising inflation is a necessary prerequisite for inducing recovery, given the weaker-than-expected growth data for the fourth quarter.

Disney's Troubles Likely to Persist

The earnings season continues this week with Walt Disney Co. scheduled to report quarterly earnings this Thursday after the market close. The entertainment giant is the biggest company to report this week alongside the Coca-Cola company.

Disney is expected to post Earnings Per Share of -$0.47 for the three months leading to December. Such a contraction would carry on from the -$0.2 EPS that were recorded for Q3.

Disney continues to suffer under the enormous strain of the coronavirus pandemic, as its theme parks remain closed. In addition to these struggles for the company, the release dates for many of its movies are being pushed back because theatres remain closed. Thus, the Disney + streaming service remains the only stable revenue stream for the entertainment company.

Britain's Seesaw Rebound Expected to Wane in Q4

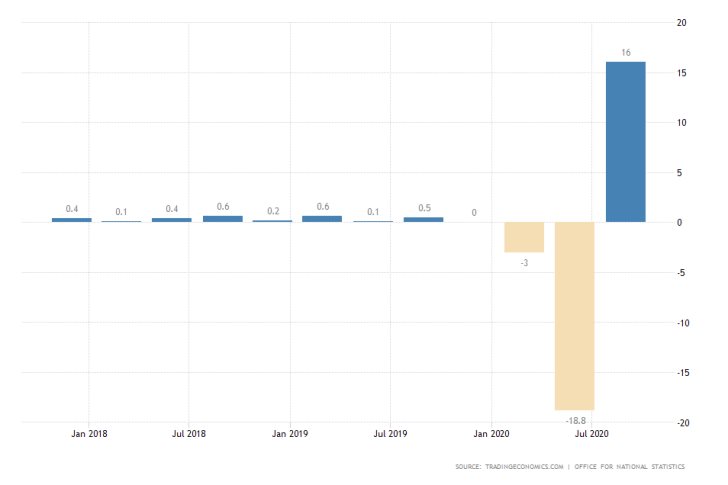

The Office for National Statistics in the UK is set to release the preliminary GDP findings for the last quarter of 2020 this Friday. According to the initial market forecasts, Britain's economy is projected to have grown marginally by 0.5 per cent.

The British economy seesawed in the third quarter by growing 16.0 per cent, which followed a drastic contraction of -18.8 per cent in the three months leading to June. The latter tumble was caused at the outset of the coronavirus pandemic.

Thus, the anticipations for a comparatively smaller expansion in Q4 are seen as a continuation of the stabilisation process now that the far-reaching coronavirus tribulations are subsiding steadily.

Unemployment rose in Q4, which is why the general economic activity is unlikely to surpass the consensus forecasts by much. Nevertheless, the Bank of England did not see this uptick in the number of unemployed persons as demanding any monetary policy interventions at the present rate.

The GDP numbers in Britain and the CPI findings in the U.S. are most likely to impact the underlying volatility levels of the GBPUSD pair, which continues to demonstrate strength as sterling bulls retain control.

As can be seen on the 4H chart below, the cable continues to consolidate in a narrow range just below the major resistance level at 1.37500. This is causing the development of a Triangle pattern, which continues to persist in spite of the recently observed false breakdown.

The underlying price action would soon have to attempt forming another breakout in either direction, depending on the findings of this week's economic reports.

Other Prominent Events to Watch for:

Tuesday - Twitter Inc. Reporting AMC.

Wednesday - U.S. Crude Oil Inventories; FED Chair Jerome Powell Speaks; BOE Governor Bailey Speaks; Spirit Airlines Inc. Reporting AMC; Coca-Cola Co. Reporting BMO; General Motors Co. Reporting BMO; Uber Technologies Inc. Reporting AMC.

Thursday - EU Economic Forecasts; U.S. Unemployment Claims; PepsiCo Inc. Reporting BMO.

Friday - U.S. Michigan Consumer Sentiment Preliminary.