The ECB Has to Grapple with Protracted Deflation Amidst Rising COVID Cases

In what looks set to be quite an eventful week ahead, the main refinancing rate decision of the European Central Bank seems bound to have the most far-reaching consequences for the global economy. The Governing Council of the ECB is meeting on Thursday to deliberate on the current economic conditions in the Euro Area.

Council members have to decide whether the recent uptick in COVID-19 cases across Europe necessitates the implementation of any major changes to the underlying monetary policy stance.

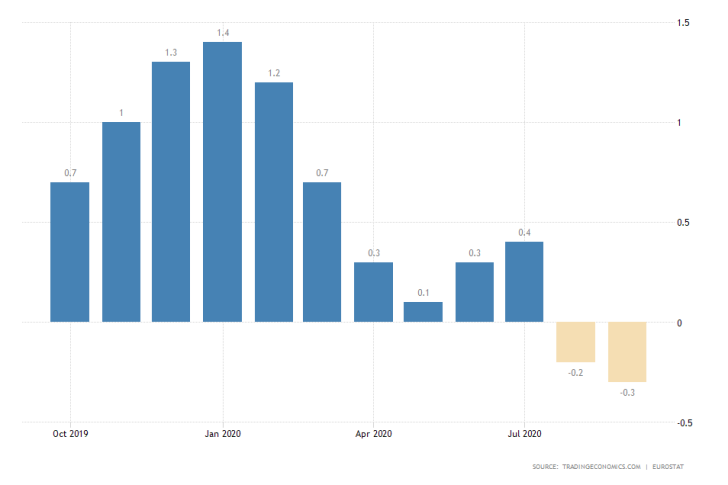

As can be seen, headline inflation in the Euro Area fell to -0.3 per cent in September, which effectively means that Council Members have figure out to a way to drive the economy out of this structural deflation.

The ECB is almost certainly going to maintain the near-negative main interest rate unchanged at 0.00 per cent. In addition to the above-mentioned subdued inflationary pressures, the Council would also have to consider the recent downbeat industry data in Germany.

The gloomy prospects for a second epidemic wave in Europe are very likely going to stave off the already fragile economic recovery, which could compel the Governing Council to scale up its Asset Purchase Facility in order to cushion the impact of the coronavirus fallout.

Traders should pay close attention to ECB's monetary policy statement, as the rhetoric of the Council is going to impact the value of the euro greatly in the near future.

As was argued in our previous analysis of the EURUSD, the recent global developments would likely cause the single currency to take a dive in the following weeks.

Last Push by the Big Four Ahead of the Presidential Election in November

The big four flagships of the technological sector – Alphabet, Apple, Microsoft, and Amazon – are scheduled to report quarterly earnings this week. The recorded performances of these four giants are likely to stir heightened trading activity on the Nasdaq this week.

The third-quarter data this year is going to be especially important given the tightening pandemic conditions worldwide and the extra uncertainty stemming from the upcoming elections in the US.

Traders and investors alike would be looking for some glimmers of hope in the four companies' reports signifying the strength of the technological sector. The latter proved to be the most resilient part of the broader stock market during the initial coronavirus crash in March.

If Big Tech's performance in Q3 lives up to the initial market expectations, traders and investors would likely perceive such a solid quarterly performance as a potential antidote to the current problems in the global context.

Conversely, a potentially disappointing performance from the four giants would likely exacerbate the coronavirus woes of a second economic downturn, coupled by the extra volatility originating from the presidential race.

Microsoft is expected to report its EPS data on Tuesday; meanwhile, Amazon, Apple, Alphabet, and Facebook are scheduled to report on Thursday.

More of the Same Expected from the Bank of Canada

The Monetary Policy Committee (MPC) of the Bank of Canada is scheduled to deliberate on its monetary policy stance this week, too. The Committee will be meeting on Wednesday.

The preliminary market expectations project no changes to the Bank's Overnight Rate, which is currently at 0.25 per cent. The MPC of the BOC has to address similar challenges to the ones faced by the ECB; however, the underlying economic conditions in Canada are somewhat better compared to the ones observed in Europe.

As was reported last week, Canadian headline inflation rose to 0.5 per cent in September, which would leave the MPC with a bit more breathing room compared to their European counterparts.

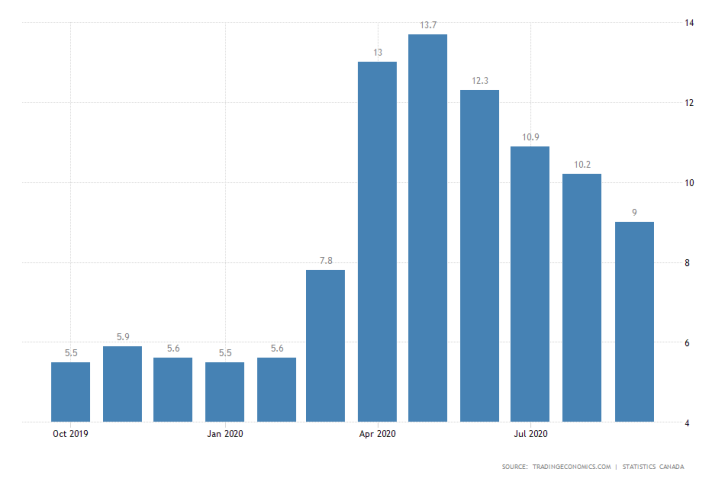

As regards the current employment conditions in the country, the Canadian labour market has enjoyed a four months-long stretch of declining unemployment.

The MPC of the BOC would most probably remain on its current course by maintaining its accommodative monetary policy stance. Meanwhile, the loonie continues to demonstrate its strength.

As can be seen on the 4H chart below, the EURCAD was recently able to break out above the major support level at 1.55500, as the pair continues to advance in an ascending channel.

The EURCAD was chosen for this week's 'Expectations' article as the two Central Bank's monetary policy decisions are likely to stir heightened volatility on the pair's price action.

The pair looks set to test the strength of the descending trend line; however, given the prospects for the weakening of the euro and strengthening of the Canadian dollar a reversal in the near future looks more than likely.

Other Prominent Events to Look Forward to:

Monday – Trade Balance data in Australia.

Tuesday – Durable Goods Orders in the US; ECB Bank Lending Survey; Caterpillar Inc. reporting TAS.

Wednesday – quarterly CPI data in Australia; Boeing Co. reporting BMO; Ford Motor reporting TAS; eBay Inc. reporting AMC; Gilead Sciences Inc. is reporting AMC; Visa Inc. is reporting AMC.

Thursday – BOJ's Interest Rate Decision; Advance quarterly GDP data in the US; Spotify Technology SA reporting BMO; Twitter Inc. is reporting AMC; Moderna Inc. is reporting BMO.

Friday – Preliminary GDP q/q in Germany; monthly GDP data in Canada; German Retail Sales; Preliminary y/y CPI data in the EU; Preliminary q/q GDP data in the EU; Exxon Mobil Corp. reporting BMO.