The US Unemployment Rate Expected to Have Jumped Five Times in Two Months

Arguably, the most important economic event to watch for this week is going to be the release of the US unemployment data for May, as the labour market in the States continues to suffer massively from the ongoing coronavirus crisis and its fallout.

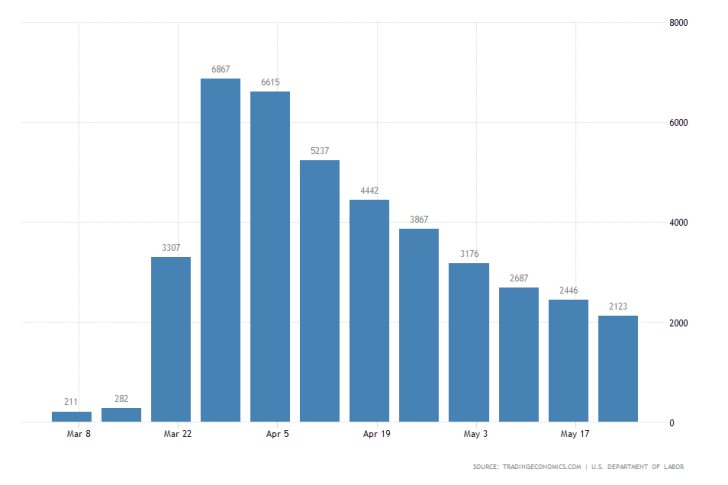

As per usual, the Non-Farm Payroll report is going to be released on the first Friday of the month. Its importance would be further boosted by the fact that last Thursday it was announced that an additional 2.12 million people have filed for unemployment benefits the previous week.

With that, the total number of laid-off persons since the beginning of the epidemic in the US has exceeded 40 million.

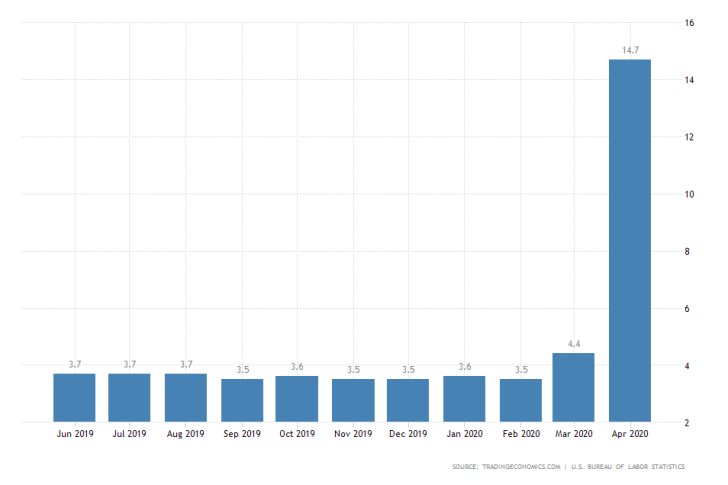

As can be seen on the chart above, the trend is falling down, and now fewer people are filing for benefits compared to the initial week of the crisis. Nevertheless, the toll on the labour market continues to be quite substantial. It is expected that in light of these recent findings, the aggregate unemployment rate would rise to 19.5 per cent.

If these projections are realised, this would not only mean that the overall unemployment rate would come close to levels last seen during the Great-Depression, but it would also measure a nearly fivefold jump in the rate from just several months prior.

The market has generally started to price in the negative impact of the coronavirus on the employment conditions in the US and elsewhere, and that is one of the reasons why the weight of the news is not likely to be devastating for the value of the dollar.

The greenback continues to be supported by the comprehensive asset-purchasing program of the FED.

On the other hand, the ongoing riots in Minneapolis following the murder of George Floyd by a police officer may offset any positive sentiment amongst investors, who were previously delighted to hear about the gradual reopening of the US economy.

Vigilant ECB to Assess the European Commission's Enormous Fiscal Relief Package

The Governing Council of the European Central Bank is scheduled to meet this Thursday, and the consensus forecasts do not project any major changes to the Bank's monetary policy.

The near-negative interest rates are expected to be maintained at their current 0.00 per cent level.

In addition to the Council's regular assessment on the effectiveness of its monetary policy, the crucial focus of the meeting is going to be placed on the Bank's remarks concerning the recent fiscal injection into the bloc's broader economy by the European Commission.

The Council is not anticipated to implement any significant changes to its asset-purchasing program either, considering the upsurge in investors' optimism in May.

Overall, the Governing Council is likely to praise the comprehensive fiscal policy of the European Commission, which is going to complement the Bank's own monetary policy. The two policies in conjunction with each other, are going to ensure quicker economic recovery.

The post-decision statement of the Council is likely going to affect the euro positively. As it was already argued in one of our latest analyses, the bullish run of the single currency is presently being supported by a number of factors, with the comprehensive fiscal and monetary policies being two of them.

The Bank of Canada Expected to Maintain a Near-Negative Interest Rate, Too

In yet another monetary policy meeting of a major central bank taking place this week, the Monetary Policy Committee (MPC) of the BOC is likely to maintain its own interest rate unchanged at 0.25 per cent, according to the consensus forecasts.

Unlike the ECB, however, the BOC is arguably going to hold its meeting while facing more uncertainties. Just last week it was announced that the Canadian economy experienced its steepest monthly contraction on record, which could compel the Committee to consider implementing an even looser monetary policy.

Depending on the underlying tone of the Committee's monetary policy statement, the Canadian dollar could potentially receive the necessary support to continue its rally.

Alternatively, the external pressures that are likely to result if the BOC implements a more pessimistic outlook on Wednesday could bring about an end to the Loonie's strong run.

Meanwhile, the USDCAD rebounded from the minor resistance level at 1.38212, which was outlined in our latest analysis.

The price action is likely to continue trading within the boundaries of the consolidation range until the pair experiences heightened volatility following the release of BOC's monetary policy decision.