Upbeat NFP Forecasts Expect Further Stabilisation of the US Labour Market

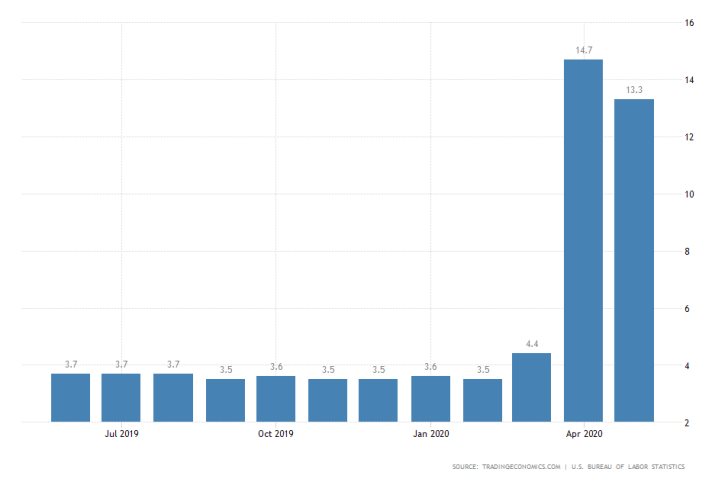

The main event this week is undoubtedly going to be the publication of the Non-Farm Payrolls. The consensus forecasts expect the positive trends in the US labour market that were established the previous month to have been continued in June.

The current market projections anticipate the headline unemployment rate to slide for the second consecutive month, from 13.3 per cent to 12.5 per cent. This would manifest the improvement of the underlying employment conditions despite the continuously rising number of unemployment claims.

The juxtaposition of falling unemployment to the simultaneously rising number of people claiming benefits highlights the diverging employment trends between the short rung and the long run.

Based on the observed data so far, it could be asserted that the coronavirus crisis is causing serious ripples in the economy. However, the number of people who have been decidedly thrown out of the labour force is significantly smaller than initially feared.

Even if the scope of the hit on the labour market is smaller than those initial estimations, many people continue to be in-between jobs, which means that the US economy would need more time to recover completely.

If the unemployment rate does indeed fall by 0.8 per cent, this is likely to strengthen the US dollar, which was jolted last week due to the rising number of newly confirmed COVID-19 cases.

The data is scheduled for release on Thursday, ahead of the July 4th celebrations in the US. Expect low liquidity and potentially erratic price action on most major assets by the end of the week due to low trading volumes.

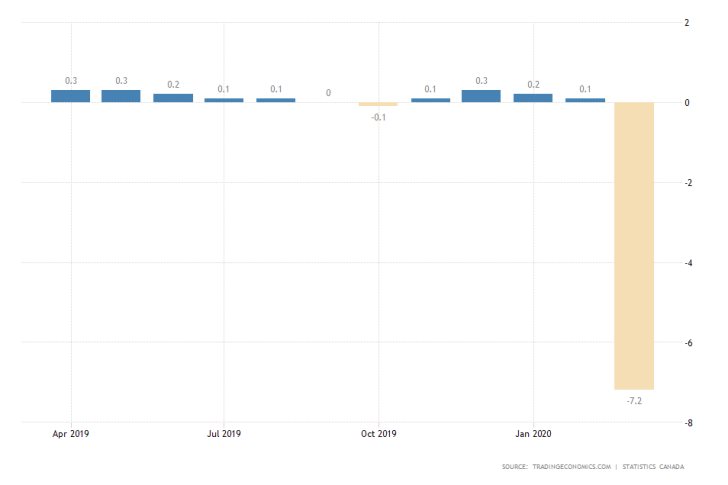

The Canadian Economy is Expected to Continue Shrinking

On Tuesday, Statistics Canada is scheduled to release the Gross Domestic Product numbers for April. The consensus forecasts expect the overall GDP to have contracted by an additional 3.3 per cent from the 7.2 per cent that was recorded in March.

The disappointing retail data coupled with the observed deflationary pressures in Canada exacerbate the size of the economic contraction. Moreover, the resurgence of COVID-19 cases globally is likely to diminish the prospects for economic stabilisation further.

If the Canadian GDP growth rate does indeed fall to negative 10.5 per cent, the Canadian dollar is more than likely to suffer as a result.

The Loonie is expected to depreciate against the Greenback in the following days, especially if the forecasts for robust NFP data in the US are met on Thursday.

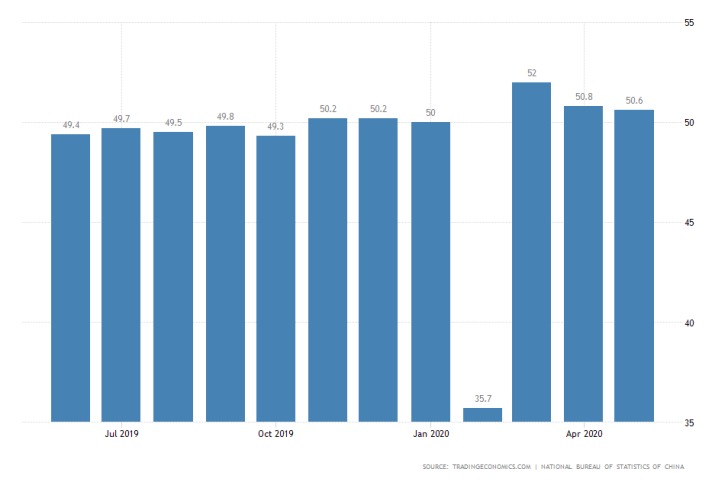

Chinese Manufacturing Likely to Slide for a Third Consecutive Month

The official NBS manufacturing PMI in China is expected to fall 0.2 per cent in June, even as the headline economic activity starts to pick up globally.

Questions over global demand continue to cast a shadow over the expected pace of economic stabilisation, which inadvertently impacts Chinese manufacturing.

The index is quite important as it serves as a prominent factor for determining the rate with which global productivity normalises now that countries are gradually lifting their restrictions.

In other words, any underlying improvements in the index are likely to underscore a pickup in global demand. This, in turn, is likely to improve investors' confidence, thereby decreasing the demand for safe-havens and low-risk securities.

Due to the significance of the first two events, we have chosen to analyse the 4H USDCAD price chart below.

Since our last analysis of the pair, the price action has managed to break out above the major resistance level at 1.36600. If the current test is successful, and the level turns into support, the bullish trend's further development is likely to resume.

Other Prominent Events to Watch For:

Tuesday – FED Chair Powell testifies.

Wednesday – ADP Non-Farm Payrolls in the US.