U.S. Unemployment Expected to Remain Unchanged for the Third Consecutive Month as Vaccination Continues

As is the case with every first Friday of the new month, the U.S. Bureau of Labour Statistics is scheduled to release the latest Non-Farm Payrolls data at the end of this week.

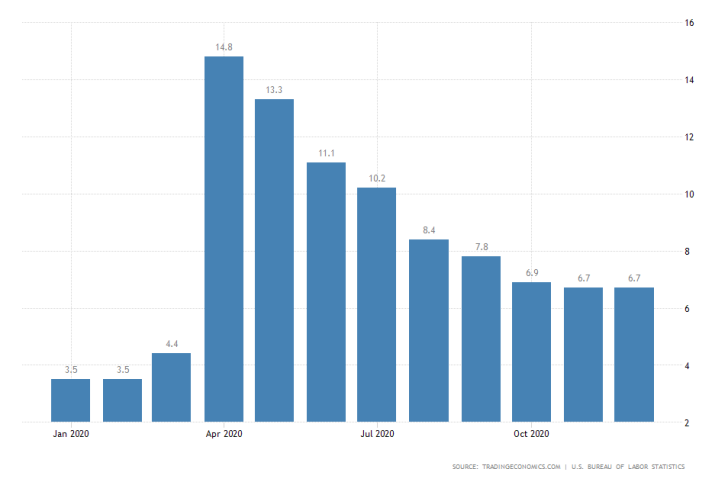

Headline unemployment in January is projected to remain unchanged at 6.7 per cent according to the preliminary market forecasts, which would mark the third consecutive month of stagnating labour market recovery.

Even though January typically tends to be a relatively quiet month in terms of jobs creation, experts expect the number of total workers to have expanded by 55 thousand people over the previous month. If realised, this would mark a welcoming, albeit muted, rebound from the 140 thousand jobs lost in December.

The pace of recovery in the U.S. has been uneven at places, weighing down on the labour market stabilisation. The GDP growth rate slowed down in the fourth quarter in contrast to improved price stability.

Google and Amazon Are Reporting Quarterly Earnings on Tuesday

The earnings season continues with full speed. After last week's prominent reports, this week Alphabet and Amazon take centre stage. Both tech giants are scheduled to deliver their Q4 earnings data on Tuesday after the market close.

Google is projected to deliver earnings per share of $15.89, which would be the Silicone Valley giant's second-best performance following Q3's $16.4. Meanwhile, Amazon is expected to report EPS of $7.05, which would exceed the $6.74 EPS recorded for the same period a year prior.

Alphabet, in particular, is likely to continue with its strong performance due to the anticipated surge in services sales. The demand for its cloud services has been quite robust since the beginning of the coronavirus pandemic owing to the fact that many people worldwide are forced to continue working from home.

As can be seen on the 4H comparison chart above, Alphabet's share price continues to outperform Amazon and the Nasdaq composite index. This is demonstrative of the company's resilience during a global economic shutdown.

BOE Unlikely to Swerve Away from its Lane

The Monetary Policy Committee (MPC) of the Bank of England is meeting this Thursday to deliberate on its current monetary policy stance. The Committee will almost certainly maintain the near-negative Official Bank Rate unchanged at 0.10 per cent, with all nine members expected to vote unanimously.

BOE is likely to make similar observations regarding the current state of the global economy to the ones made by the Federal Reserve last week. Moreover, the Committee seems unlikely to ramp up its asset purchase facility at the present rate, despite the recently recorded rise in unemployment.

BOE's monetary policy meeting and the U.S. NFP data are likely to result in heightened volatility on the GBPUSD towards the end of the week.

The cable has been consolidating below the major resistance level at 1.37400 for the last several days, as shown on the hourly chart below. Nevertheless, the underlying price action has been unable to break out above this barrier, which could prompt the establishment of a minor bearish correction.

The most significant test for such a correction is going to be at the 1.36600 minor support. This level's strength has already been tested on several previous occasions, which makes it a potential turning point for the direction of the price action.

Moreover, this support is currently converging with the 300-day MA (in orange) and the ascending trend line (the lower boundary of the emerging triangle). It also looks poised to merge with the 400-day MA (in purple) soon, which is why the GBPUSD's next test of the level is going to be so important.

The rising bearish momentum, as underpinned by the MACD indicator, should also be considered carefully.

Other Prominent Events to Watch for:

Monday - ISM Manufacturing PMI in the U.S.; Retail Sales y/y in Germany.

Tuesday - Reserve Bank of Australia Cash Rate; New Zealand Unemployment Rate; EU Preliminary GDP Q4; Alibaba Group Holding Ltd. reporting BMO; Exxon Mobil Corp. reporting TAS; Harley-Davidson Inc. reporting BMO; Pfizer Inc. reporting BMO.

Wednesday - EU Preliminary CPI y/y; ISM Services PMI in the U.S.; ADP Unemployment Change in the U.S.; Spirit Airlines Inc. reporting TAS; eBay Inc. reporting AMC; PayPal Holdings Inc. reporting AMC; Qualcomm Inc. reporting AMC; Spotify Technology SA reporting BMO.

Thursday - Merck & Co. Inc. reporting BMO; Ford Motor Co. reporting TAS.

Friday - Unemployment Rate in Canada.