The Financial Elite Gathers at Jackson Hole to Discuss the Future of the Global Economy

It is that particular time of the year again for the Jackson Hole symposium, which is held in a city with the same name in the state of Wyoming. The gathering welcomes prominent heads of central banks and other bankers, finance ministers, economists, academics, and other financial markets participants..

As per usual, the discussions held at Jackson Hole are expected to lay down a baseline roadmap for the global economy throughout the next year, as the world's financial elite deliberates on the necessary courses of action in light of the continued coronavirus fallout.

Each year, the Jackson Hole symposium garners massive interest amongst traders and investors weighing in on the ramifications for the global capital markets from the outcomes of the meetings. Consequently, the two-day symposium is typically followed by heightened volatility on the markets.

Even though most of the discussions are going to be private and therefore will not be revealed to the public, some prominent figures are expected to talk to the media, which is expected to garner the most interest.

FED Chair Jerome Powell is scheduled to deliver a speech titled " Monetary Policy Framework Review" on Thursday followed by questions from the audience. Later that day, Bank of Canada Governor Tiff Macklem is expected to participate in a panel discussion.

On Friday, the Governor of the Bank of England Andrew Bailey is scheduled to talk about Economic policy as well.

The underlying tones in the rhetoric of the three central bankers are likely to elucidate the preparedness of the global financial system to weather a potential second coronavirus wave, followed by the reintroduction of containment restrictions.

Additionally, their statements should highlight the newest adjustments to the baseline scenarios for a global recovery in light of the latest developments and arisen uncertainty.

As it is about to be seen on the 4H comparison chart below, the expected upsurge in volatility this week could affect the world's biggest stock indices.

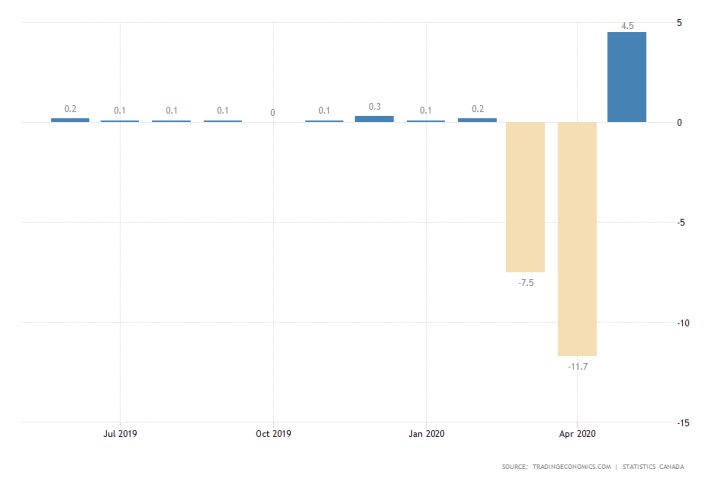

Canada's Seesawing GDP Growth Rate Expected to Have Climbed in June

The Canadian GDP Growth Rate is projected to have surged by 5.2 per cent in June, an upwardly revision of 0.7 per cent from the recorded performance in May.

The anticipations for such an improvement are based on the easing of coronavirus restrictions in Canada, followed by higher rates of consumer spending in the retail sector.

The projections for a snap rebound in headline economic activity are based on the seesaw effect in which the economy blasts off temporary from the sudden dip that was reached when most of the overall activity was suspended in the early months of the year.

These huge disparities between the recorded contractions and following expansions are anticipated to gradually diminish into 2021 when the pace of Canada's economic growth is forecasted to become more stable.

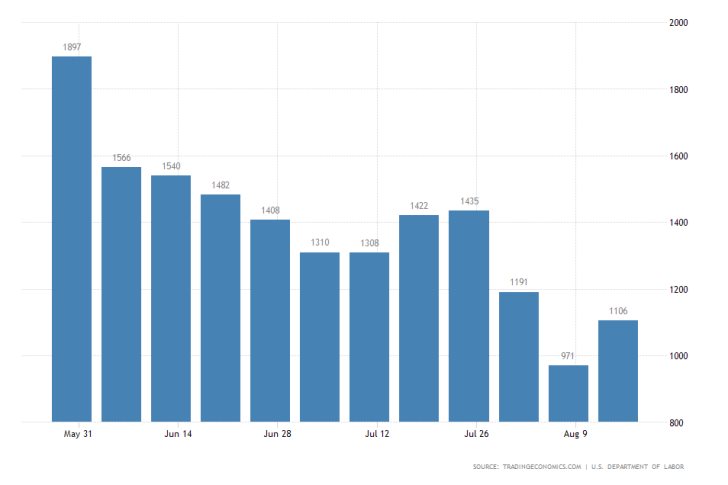

The US Labour Market is at a Crucial Turning Point

The release of this week's unemployment claims in the US is going to represent a crucially important piece of evidence as regards the rate of stabilisation of the labour market in the States.

Following last week's somewhat surprising uptick in the number of people filing for support, a potential continuation of this trend for a second consecutive week is going to jeopardise the recovery of the labour market.

The data is scheduled for publication on Thursday; however, no consensus forecasts have been released yet.

At any rate, the initial claims data coupled with Jerome Powell's speech, which is taking place around the same time, is bound to stir heightened volatility on the US dollar.

The greenback has been able to recuperate some of its losses last week and traders would be eager to see whether this is going to be a temporary blip or a complete trend reversal.

Meanwhile, the S&P 500 and the Dow Jones Industrial Average continue to advance north, albeit at a comparatively flatter angle.

The German DAX index is struggling to break out above its recent peak, which could be an early sign of a trend reversal in the making. At the same time, the British FTSE 100 remains greatly undervalued due to the coronavirus crisis and the fallout from the protracted Brexit negotiations.

Other Prominent Events to Watch for:

Tuesday – CB Consumer Confidence in the US.

Wednesday – Quarterly Construction Work Done in Australia; Monthly Durable Goods Orders in the US; Crude Oil Inventories in the US.

Thursday – Quarterly Private Capital Expenditure in Australia; Quarterly Preliminary GDP in the US.

Friday – KOF Economic Barometer in Switzerland; Monthly Personal Spending in the US; Chicago PMI in the US; Revised Consumer Sentiment in the US.