European Industry Expected to Continue Suffering Under the Pandemic

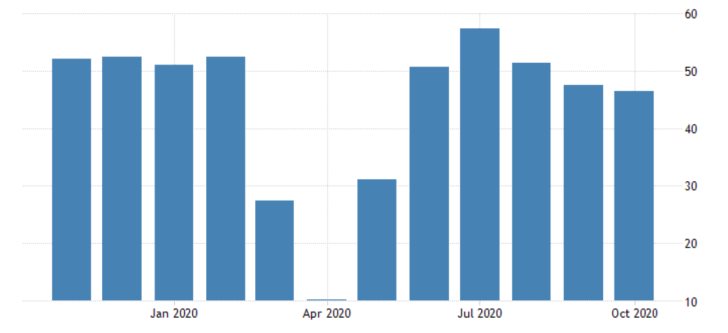

The most significant economic event taking place this week is going to be Markit's publication of the French and German industry numbers for October, which is due on Monday. According to the preliminary forecasts, both countries are expected to report sizable contractions in their overall industrial activities.

Reductions in German services and manufacturing output is likely to have the strongest impact on European markets, whereas the French services sector is expected to register the biggest slump of them all by 7.3 index points.

If the initial projections are realised, this would mark the fifth consecutive deterioration for the French services sector, and would entail deepening of the industrial crunch as a whole.

The general economic activity in the two largest economies within the Eurozone continues to be stifled by tight containment restrictions, as both France and Germany have seen massive upsurges in the confirmed coronavirus cases over the past several weeks.

There is a high probability that Monday's data is going to prompt a long-anticipated selloff of the euro, which has gained significant bullish momentum in the wake of the BioNTech and Pfizer vaccine news.

No GDP Revisions for the Third Quarter Expected in the US

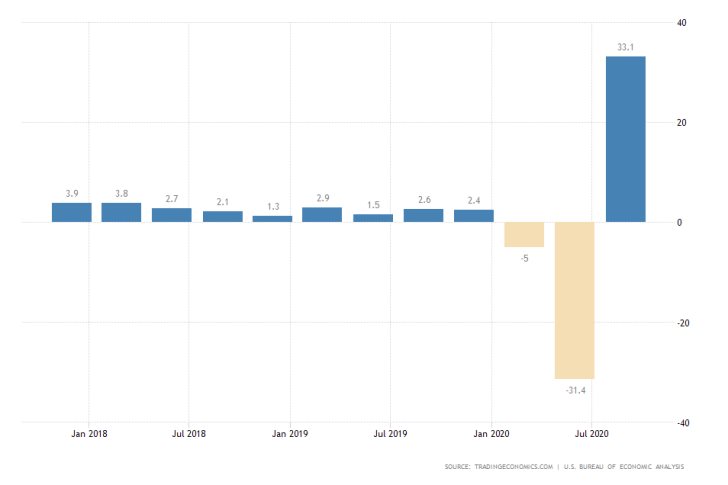

The Bureau of Economic Analysis in the US is scheduled to release the preliminary Gross Domestic Product readings for Q3 on Wednesday. The advanced GDP data already demonstrated a massive 33.1 per cent upsurge from the previous quarter's 31.4 per cent crunch.

The consensus forecasts do not project any disparities between the advanced GDP growth rate that was already recorded and the preliminary reading, which would underpin the strength of the recovery in the three months leading to September.

Moreover, such performance would strengthen investors' belief in the robustness of the US recovery following the less-than encouraging consumer data for October. The dollar is likely to benefit from reinvigorated investors' enthusiasm concerning the general economic activity in the US.

US Manufacturing Expected to Suffer Loss of New Orders

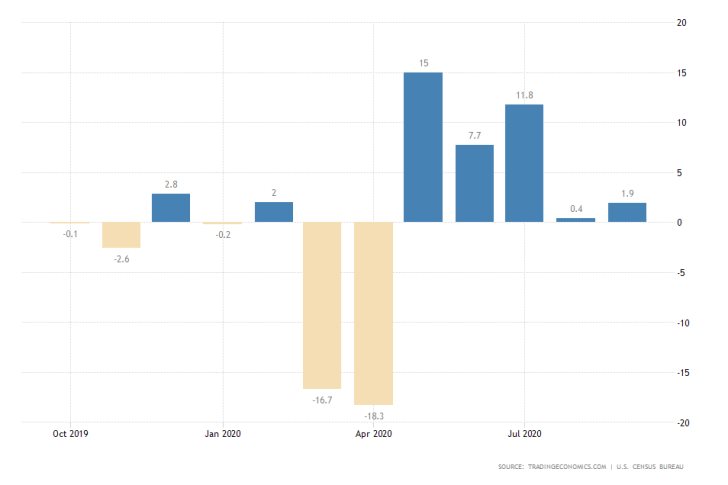

In addition to the aforementioned deterioration of consumer spending in the US, durable goods orders are anticipated to fall markedly in October from the 1.9 per cent increase that was recorded in September.

Market experts anticipate to see the new orders for manufactured durable goods falter by 0.9 per cent from a month prior. Thus, the index is expected to generate a growth of only 1 per cent. The economic report is scheduled for publication on Wednesday by the Census Bureau.

Weakened manufacturing could have an adverse impact on a number of sectors in the US economy, namely, on job creation within the labour market, which has had a remarkable run in the second portion of the year.

At any rate, the week ahead looks poised to be less action-packed compared to early-November, which would probably calm the turbulent markets. Less volatility could affect the underlying demand dynamics currently affecting the EURUSD.

As can be seen on the daily chart below, the pair continues to be range-trading, as the euro has become ostensibly 'Overbought'. This can be inferred from the Stochastic RSI indicator.

Given that the price action has been tightly concentrated just below the major resistance level at 1.18700 for the past five days, this is more than likely to prompt the bears to action.

The first target for a new downswing would be the 100-day MA (in blue); a breakdown below the moving average will clear the way for the price of the pair to head towards the 23.6 per cent Fibonacci retracement level at 1.16839 next. The latter is found just above the existing range's lower boundary.

Other Prominent Events to Watch for:

Monday – BOE Monetary Policy Report Hearings in the UK.

Tuesday – CB Consumer Confidence in the US; GBP Autumn Forecast Statement; RBNZ Financial Stability Report in New Zealand; Australia Trade Balance; BOJ Kuroda Speech.

Wednesday – ECB Financial Stability Report; Unemployment Claims in the US; Revised Consumer Sentiment in the US; FOMC Meeting Minutes;