German Industry Data in the Limelight This Week

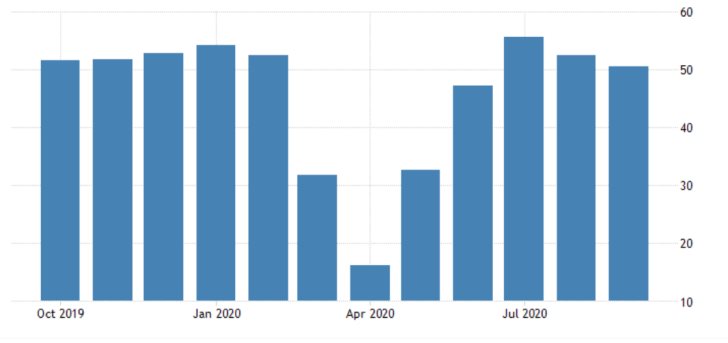

The most prominent economic event this week is going to be the publication of the Markit institute's industrial numbers in Europe; chiefly, the services and manufacturing PMI data in Germany.

The German economy comprises the biggest share of the overall economic output in the Eurozone, which is why its historical performance garners the most interest amongst investors and market experts.

Since most economies in the Eurozone are services-oriented, with manufacturing taking a smaller part of the overall industrial activity, the German services PMI represents one of the most important benchmarks for evaluating the welfare of Eurozone's economy.

According to the consensus forecasts, the German flash services PMI is expected to contract marginally to 49.6 points. This would represent the third consecutive fall of the index, which would underpin the muted growth in the third quarter.

If the initial forecasts are realised on Friday, this will highlight a protracted slump in European industrial activity, potentially threatening the tentative recovery. Such a turn of events would be especially disconcerting now, given the shaken prospects for a Brexit trade deal, and the constantly surging number of COVID-19 cases in Europe.

All of these gloomy developments are likely to spell new troubles for the euro, which is now being expected by an increasing number of traders to fall in the near future. Potentially downbeat industrial numbers on Friday could exacerbate the bearish prospects for the single currency.

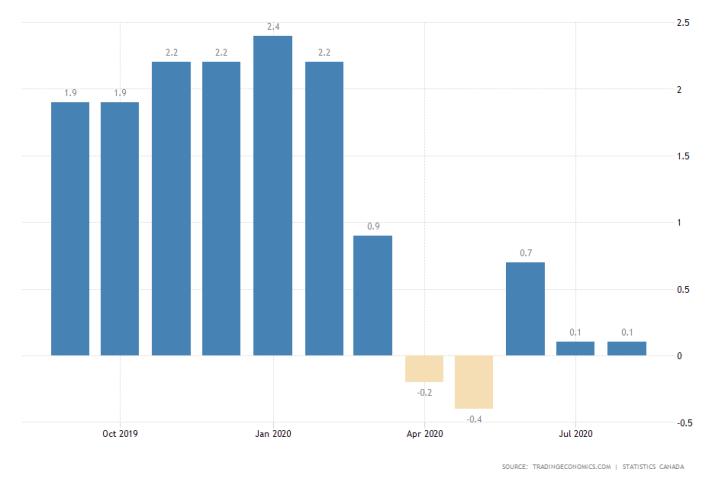

Canada's Inflation Rate Expected to Recoil Marginally in September

On Wednesday, Statistics Canada is scheduled to publish the recorded change in the Consumer Price Index for the previous month. The initial market forecasts anticipate a marginal improvement from the 0.1 per cent growth that was observed in August.

According to their projections, the Canadian CPI is anticipated to rise by 0.4 per cent, which would drive the country's inflation rate marginally away from the 0.00 per cent stagnation threshold.

This slightly optimistic scenario is based on the already registered stabilisation of US consumer prices. Due to the interconnectedness of the two economies, market experts expect to see a positive spillover effect across the border.

Even still, such a marginal improvement of the Canadian price stability is unlikely to set a new recovery trend as the Bank of Canada had already stated that it expects to see an uneven recovery in the following quarters.

The US Tech Sector Next in Line to Report Quarterly Earnings

The earnings season continues with prominent reports of some of the tech sector's flagships scheduled to take place this week.

Netflix is expected to report its Q3 EPS findings on Tuesday; Tesla, which garnered especially high interest amongst small retail traders during the lockdowns, is expected to report on Wednesday; whereas Intel would take the limelight the next day.

These three companies rank amongst the most influential blue-chip stocks in the Nasdaq Composite Index, which is why this week's earnings data should elucidate the next likely direction for the tech industry.

The Nasdaq recently rebounded from a bearish correction's dip, which was reached in late-September on coronavirus-related worries. The index, however, did not manage to recuperate past the all-time high that was reached prior to the correction, which could represent an early signal of diminishing bullish pressure in the market.

Returning to the primary topic of today's analysis, the following daily chart examines the current state of the EURUSD. As can be seen, the price action is currently nearing the Distribution range's lower boundary – the 23.6 per cent Fibonacci retracement level at 1.16839.

The market is technically range-trading at present, as demonstrated by the ADX indicator. Even still, given the aforementioned developments, the new woes for the euro stemming from the expectations for subdued industrial numbers in September could prompt a new attempt at a breakdown below this level.

Other Prominent Events to Watch for This Week:

Tuesday – RBA Monetary Policy Minutes in Australia.

Wednesday –UK CPI Data; Nasdaq Inc. TAS.

Thursday – CPI NZD Data; American Airlines Group Inc. Reporting BMO; AT&T Inc. Reporting BMO; Coca-Cola Co. Reporting BMO; DOW Inc. Reporting BMO.

Friday –French Manufacturing and Services PMI; British Manufacturing and Services PMI;