Muted Industrial Numbers in Germany and France Could Spell Trouble for European Stocks

The most important economic event to watch for this week would be the release of Services PMI and Manufacturing PMI data from Germany and France on Friday.

Being respectively the largest and second-largest economies in the Eurozone, the industrial activity in Germany and France is a keystone determinant for the wellbeing of the bloc's broader economy.

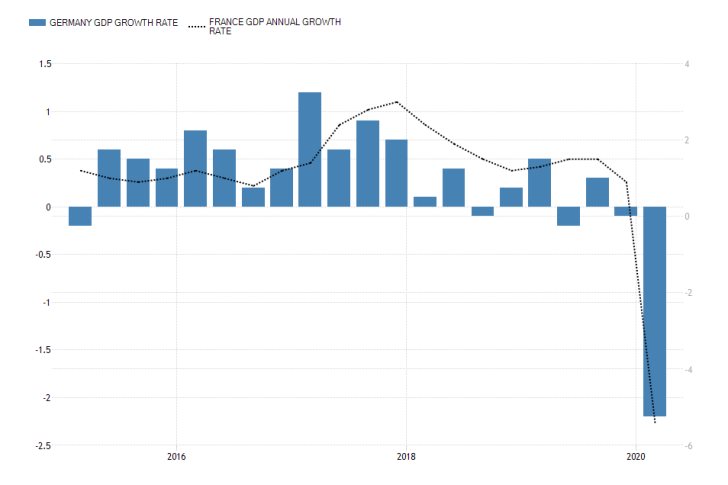

Last week, it was revealed that both countries have entered into structural recessions, which was vastly anticipated by the market.

The significant economic contraction that was observed would increase the importance of Friday's data releases even more, as investors and policymakers would be hoping for early signs of marginal improvement in the two industries.

The simultaneous release of the two countries' industrial numbers is prone to increase the volatility levels on all Euro-based assets during Friday's trading session, especially the underlying volatility in the European stock market.

The market has already started to price in the impact of the fallout from the coronavirus on the underlying GDPs, and economists are going to weigh in on whether the initial steps in Germany for gradually reopening the economy would have paved the way for even marginal industrial stabilisation.

In case that the reported data on Friday misses the initial forecasts, investors' muted outlook would likely persist, underlying the deteriorating economic slump in the Eurozone.

Such a scenario would be most detrimental for the European stock market. It is already rattled by uncertainty and fears over the fragile rally of EU stocks following the initial market crash. The current bullish correction in the stock market is driven mostly by the accommodative monetary policy stance of the ECB and its vast relief package.

As it can be seen on the comparison chart below, European stocks are already underperforming compared to the British and the US stock markets, so disappointing performance on Friday could propel the EU50 into further disarray.

Jerome Powell is Testifying on the Size and Scope of the Coronavirus Relief Package on Tuesday

The Chairman of the Federal Reserve Jerome Powell is scheduled to testify alongside US Treasury Secretary Steven Mnuchin on the most recent coronavirus developments and their impact on the economy before the Senate Banking, Housing, and Urban Affairs Committee in Washington.

The two men are expected to evaluate the efficiency of the fiscal aid relief that has been extended by the government so far in conjunction with the accommodative monetary policy of the FED, in mitigating the adverse impact of the pandemic on the economy.

Traders will be on the lookout for hints in the two men's commentaries possibly underpinning deficiencies in the overall relief package, which would necessitate further help by the Bank and the government.

Powell's overall tone could have a profound impact on the stock market, seeing as how his remarks from last week jolted the price action on some US indices.

Strong emphasis on the uncertainty that is stemming from the continually evolving coronavirus situation could scare investors even more, which could potentially disrupt the current stock market rally.

The Collapse of British Retail Sales is Anticipated to be Exacerbated in April

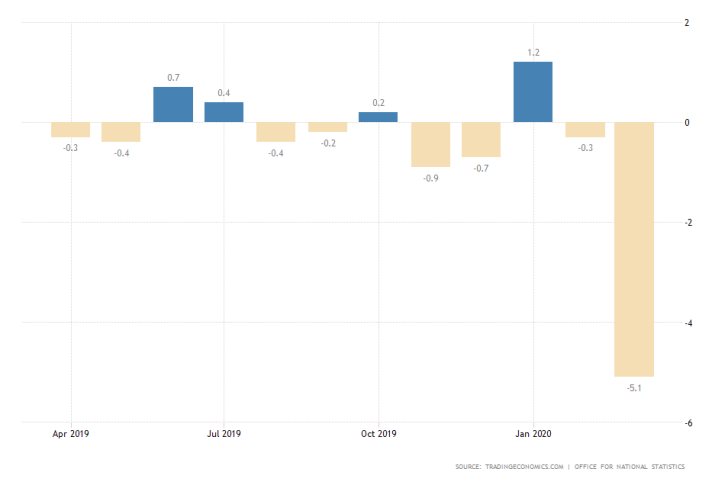

The lockdown in the United Kingdom was in full swing in April, which saw a drastic upsurge in both new cases and casualties of the epidemic. That is why the most stringent policies of social distancing were conducted last month.

Consequently, this is expected to result in yet another massive dropdown in the number of net retail sales. Such projections are also based on the turmoil that was observed in the energy market last month, and the crash of crude oil' price.

Friday's data release is going to underpin the extent of the economic hit on the British industrial activity, similarly to what was observed in the US last week.

This, in turn, is going to affect the British stock market. The FTSE100 is currently struggling above the 0.00 per cent level, as can be seen on the chart below.

If Friday's report delivers potentially crushing numbers, this could propel British stocks into negative territory.

Other Prominent Events to Watch for This Week:

Wednesday – BOE's Governor Bailey Speaks.

Thursday – RBA's Governor Lowe Speaks; Flash Services PMI in the UK; Flash Manufacturing PMI in the US; FED Chairman Powell Speaks.