The Consensus Forecasts Project Mixed Industrial Numbers in the Eurozone for August

The most impactful economic release this week is going to be the publication of crucial industry data in Germany and France, which is going to take place on Friday.

The significance of the simultaneous releases of Services PMI and Manufacturing PMI data in the two countries is bolstered by the fact that the recorded performance of the largest and second-largest economies in the Eurozone typically sets the tone for the entire industrial sector in the region.

The consensus forecasts expect marginal deteriorations in France and Germany's services sectors, while manufacturing in the two countries is expected to edge higher in August.

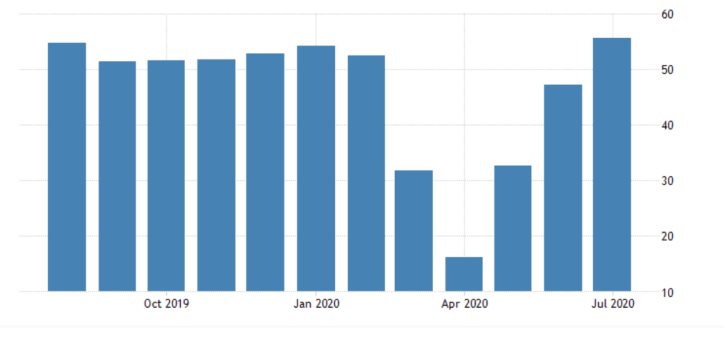

German Services PMI is anticipated to fall from the downwardly revised 55.6 in July to 55.3 index points in August. The suddenness with which the coronavirus crisis hit markets in the first quarter of the year exposed the weak links in Germany's economy, and also underlined the significance of the services sector.

If the country is forced to reintroduce new lockdowns to prevent a second epidemic wave, most of the sustained economic activity would depend on services as technology allows for most workers in the sector to continue working from home.

Christine Lagarde, the Chair of the ECB, had previously underlined the need for the European economy to become even more services-oriented as opposed to relying on manufacturing, which is extremely vulnerable to economic closedowns.

That is why services data of the biggest-economy in the Eurozone represents such a crucial indicator for the overall well-being of the EU's broader economy.

The marginal deterioration of 0.3 index points, as underlined by the initial market forecasts, could, therefore, exacerbate the bearish pressure that is currently exerted on most European indices.

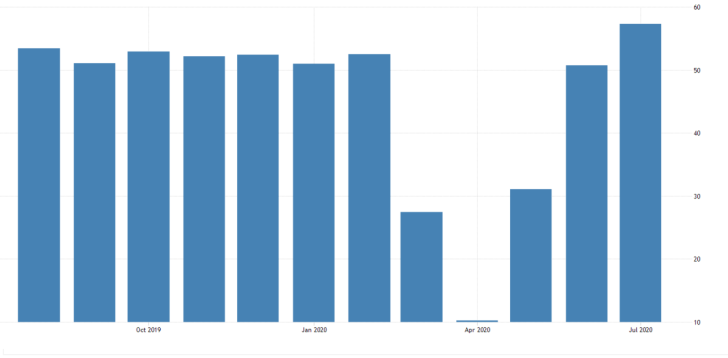

Meanwhile, the French Services PMI index is expected to register an even bigger monthly contraction. The consensus forecasts project an index point depreciation from July's 57.3 to 56.3 index points.

The marginal improvements in manufacturing that are anticipated to be recorded in the two countries are unlikely to compensate for the more impactful slumps in the services sector, which could hurt the German DAX and the French CAC, as well as the euro.

The single currency has enjoyed a solid bullish run in the last month, as its global appeal rose amidst falling demand for the greenback, but Friday's data could serve as the catalyst for a new correction.

JMMC of the OPEC Set to Hold Two Meetings This Week, Likely Impacting the Price of Crude Oil

The 21st Meeting of the Joint Ministerial Monitoring Committee (JMMC) of OPEC is scheduled for this week. Two videoconferences are expected to take place on Monday and Tuesday, respectively.

The meetings of the Committee are usually prompting heightened volatility on the price action of crude oil, which continues to consolidate in a tight range around a psychologically-significant support level.

This week, the anticipated surge in volatility could be further bolstered by the escalating tensions between Greece and Turkey. The brewing conflict in the Mediterranean could impede trade in the Aegean region, thereby indirectly affecting the supply and demand for crude.

In light of the alarming prospects of a second coronavirus wave in Q3 and Q4 of 2020, the most important outcome of the meeting would be the new projections of the Committee concerning the recovery of global oil demand. At its previous meeting, the JMMC stated that:

" The Committee observed that there were encouraging signs of improvement as economies around the world open up. While there could be localized or partial lockdowns re-imposed in some places, the recovery signs are clear, both in physical and futures markets. It noted that, moving to the next phase of the agreement, the extra supply resulting from the scheduled easing of the production adjustment will be consumed as demand recovers."

The JMMC has to determine whether the increased likelihood of new economic closedowns poses a correspondingly more considerable threat to the still-recovering global demand from a month prior. If so, then the aforementioned 'extra supply' would not be entirely consumed by muted global demand as more stringent restrictions are re-imposed.

Consequently, the Committee could allude to worse prospects for the stabilization of the energy market in Q3. Such projections would, in turn, harm the price of oil, causing it to develop a more significant bearish correction.

The British Industry is Expected Pick Up Slowly After Historic Slump

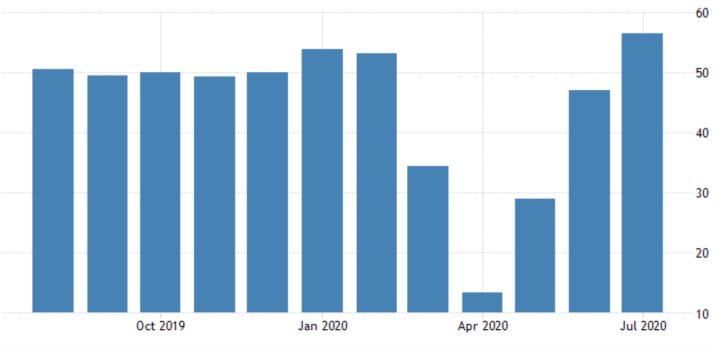

This Friday, the Markit institute is scheduled to release pivotal Services and Manufacturing PMI data for the UK as well. The consensus forecasts project minor improvements in both sectors from the recorded performance in July.

Services, in particular, is expected to edge higher by 0.5 points in August, driving the index to 57.0. This would be welcoming development from the historic economic slump that was recorded in the second quarter.

Nevertheless, British industry continues to suffer under the weight of the protracted Brexit negotiations, and the uncertainty that stems from this gridlock.

Even as the economic activity is expected to recoup as containment restrictions in Britain eased over the last several weeks, this is unlikely to revitalize the overall pessimistic investors' sentiment.

Consequently, the FTSE100 is likely to continue depreciating as the number of COVID-19 cases in the country and elsewhere continues to rise.

British stocks are underperforming compared to French and German stocks, as can be seen on the 4H chart below, which is partially caused by the aforementioned economic contraction.

As a whole, the German DAX, the French CAC 40, and the British FTSE 100 appear to have reached a plateau – being unable to break out above the previous peaks – which signifies rising selling pressure.

The expectations for muted industry numbers in the three countries this week could, therefore, catalyze this increasingly bearish outlook, and prompt the development of a new and more significant bearish correction.

Other Prominent Events to Watch for:

Tuesday – the release of Monetary Policy Meeting Minutes in Australia.

Wednesday – Crude Oil Inventories in the US.

Thursday – Unemployment Claims in the US.

Friday – Retail Sales in Canada; Flash Manufacturing and Services PMI data in the US.