Forward-Looking ECB Unlikely to Divert from its Current Course

In a week filled with monetary policy meetings of prominent central banks, Thursday's gathering of the European Central Bank's Governing Council steals the spotlight.

The ECB is expected to maintain its near-negative interest rate unchanged from its current 0.00 per cent level.

The better-than-expected industrial numbers in France and Germany for the previous month have signalled policymakers and investors that the European economy has withstood the initial turmoil from the coronavirus fallout.

While the accommodative monetary policy stance of the ECB has paved the way for the Eurozone economy's gradual recovery; there is still a lot to be done. Weakened price stability in the Euro Area remains a crucial impediment to sustained stabilisation.

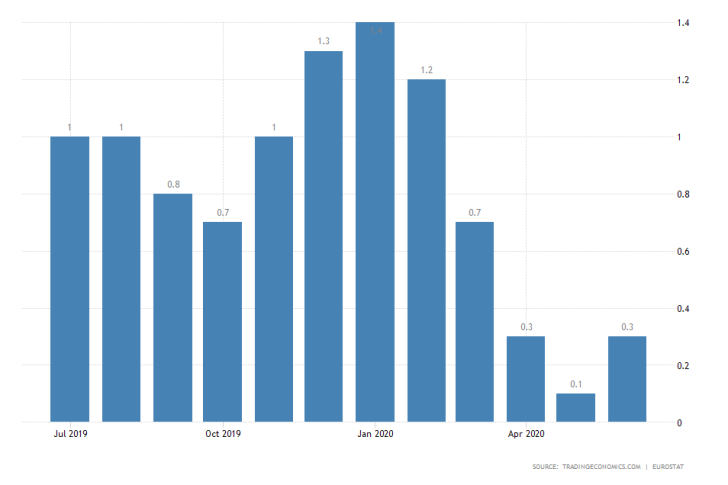

As can be seen on the graph below, the inflationary pressures in the Eurozone are still far-off from ECB's desired target level of two per cent. That is why the Council is expected to refrain from altering its underlying policy too much.

The loose monetary stance supplemented by ECB's comprehensive asset purchase programs is going to be preserved until there are definite signs of inflation starting to climb towards the desired level. In that sense, ECB's Main Refinancing Rate is going to remain at 0.00 per cent for as long as it is needed to foster a 2 per cent inflation rate.

Overall, ECB's Governing Council has reasons to be optimistic as the Eurozone economy is currently at a better place compared to the observed situation prior to the Council's previous meeting.

The BOC Has to Reconcile Its Past Mistakes, as Tiff Macklem Takes the Helm at the Bank

The new Governor of the Bank of Canada Tiff Macklem, who took over the role from Stephen Poloz in early June, has to reinvigorate the Bank's partially misplaced monetary policy.

The Bank of Canada's Governing Council is scheduled to gather this Wednesday, in yet another crucially important meeting of a major central bank. The consensus forecasts do not expect changes to the Overnight Rate, which is currently at 0.25 per cent.

During its previous meeting on the 3rd of June, the Council somewhat prematurely decided to scale back it's market operations, as it saw an improvement in the underlying financial conditions.

" Massive policy responses in advanced economies have helped to replace lost income and cushion the effect of economic shutdowns. Financial conditions have improved, and commodity prices have risen in recent weeks after falling sharply earlier this year. "

The Bank of Canada was the first central Bank of an advanced economy to make such a decision, even as the impact of the initial blow from the coronavirus crisis was not entirely cushioned at that time.

Canada's industry was subsequently hit by the pandemic fallout as commodity prices plummeted in mid-March, which contributed to Canada's largest GDP contraction on record.

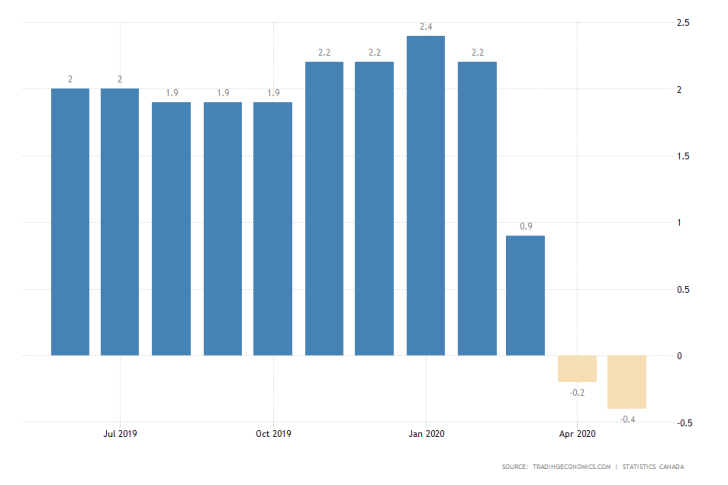

The subsequent stabilisation of the energy market coupled with a minor improvement in Canada's labour market conditions, encompass the only welcoming news for BOC's policymakers. Meanwhile, crunching inflationary pressures continue to weigh heavily on Canada's price stability.

The economy is currently suffering from deflation, which represents a major impediment for the ongoing recovery process.

Given that crude oil's bullish run is now jeopardised by the growing shale industry in the US, the looming threat from a new turmoil in the energy market could compel Tiff Macklem and the rest of the Governing Council to broaden BOC's asset purchase facility once again.

An accommodative monetary policy stance is needed to foster increased investments and consumer spending in Canada so that the inflation rate could start rising towards the desired 2 per cent target level.

US Retail Sales Are Expected to Grow for the Second Consecutive Time

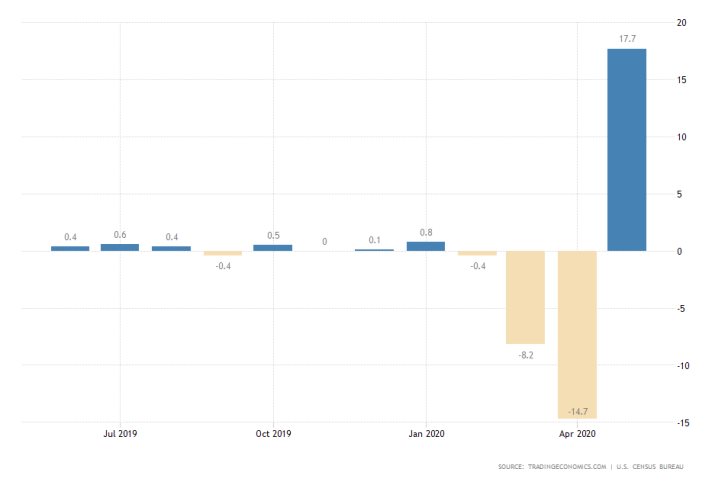

The Census Bureau in the US is scheduled to release the newest retail sales data on Thursday. The consensus forecasts anticipate a potential growth of 4.6 per cent, which would mean that the trend of improving underlying conditions in the retail industry would be resumed.

Even though the June projections of a 4.6 per cent growth are dwarfed by the 17.7 per cent surge that was recorded a month prior, such data would still manage to bolster investors' sentiment. Heightened consumer spending is a necessary prerequisite for continued economic recovery in the US.

If Thursday's data meets the initial expectations, this would likely strengthen the dollar, which continues to seesaw due to protracted global uncertainty. The shifting tones in the aggregate demand for safe-havens fuels the greenback's rollercoaster ride.

Due to the significance of the monetary policy meetings of the ECB and the BOC, heightened volatility is expected to impact the price action of the EURCAD currency pair.

As can be seen on the 4H chart below, the pair is nearing the major resistance level at 1.54200, which serves as the upper boundary of a significant consolidation range.

The range-trading conditions in the market are likely to be preserved, which creates favourable conditions for the implementation of swing trading strategies as the price action is expected to continue bouncing between the limits of the range.

Other Prominent Events to Watch for:

Monday – BOE's Governor Bailey Speaks.

Tuesday – m/m CPI in the US.

Wednesday – BOJ Interest Rate Decision; y/y CPI in the UK.

Thursday – q/q CPI in New Zealand; Unemployment Rate in Australia; q/y GDP in China.

Friday – BOE's Governor Bailey speaks.