Time for Jerome Powell and His Colleagues from the FOMC to Commit to What They Started

The highlight this week is undoubtedly going to be FED's monetary policy meeting, which is scheduled for Wednesday. The Federal Open Market Committee is expected to maintain the near-negative Federal Funds Rate unchanged at 0.25 per cent.

Jerome Powell and his colleagues are also anticipated to ramp up FED's various quantitative easing programs, similar to what the ECB did last week. This is partly due to the fact that the Committee did not implement any changes during their previous meeting in early-November, and the Bank's overall liquidity levels remained the same.

Back then, the FOMC had to grapple with the uncertain political landscape in the US, which was the case amidst the Presidential elections. The current situation is, however, quite different, which would allow the Committee to bolster the scope of its underlying QE programs.

The reeling greenback desperately needs support from the central bank in order to alleviate its pains in the short run.

Germany's Industrial Woes Likely to be Further Exacerbated in November

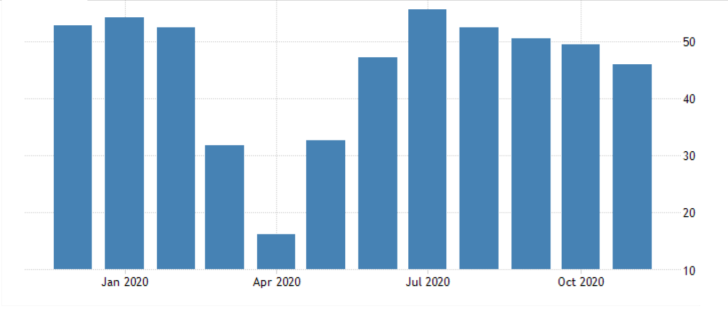

Also taking place on Wednesday, the Markit institute is going to publish the latest industrial numbers that have been recorded in Germany and France over the previous month.

According to the initial market forecasts, the biggest slump is expected to be observed in the German Services PMI data. The index is projected to plunge by 1.9 points from a month prior, which would elucidate worsening industrial circumstances in Germany.

Moreover, such a recorded performance would mark the fifth consecutive month of deteriorating services numbers. The overall impact is made worse by the shaken consumer confidence in the country.

BOE Has to Reconcile the Likelihood of a No-Deal Brexit

In the other monetary policy meeting of a top central bank that is scheduled to take place this week, the Bank of England has to deliberate on its underlying stance amidst the latest Brexit tribulations.

The Monetary Policy Committee (MPC) of the BOE is meeting this Thursday, and the preliminary market forecasts do not project any changes to the Official Bank Rate. The latter is currently sitting at the near-negative 0.10 per cent.

In addition to the latest economic developments, the Committee would also have to take into account the possibility of a no-deal Brexit at the end of the month when deliberating on the appropriate scope of the underlying Asset Purchase Facility.

The meetings of the BOE and FED this week are bound to bolster the underlying volatility of the GBPUSD. The reeling greenback continues to be affected negatively by the global vaccine optimism, whereas Brexit fears and hopes are driving the pound.

As can be seen on the hourly chart below, the pair jumped following this week's open and is currently about to have a crucial test. The price action reached the major resistance level at 1.34000, which represents a prominent turning point.

The latter coincides with the upper boundary of the descending channel, which makes it an even more significant make-it-or-break-it point.

Other Prominent Events to Look Forward to:

Tuesday – RBA Monetary Policy Minutes in Australia; Chinese Retail Sales m/m; UK Unemployment Rate Q3; BOC Governor Macklem Speech.

Wednesday – OPEC-JMMC Meetings; Canada CPI m/m; US Retail Sales; US Flash Manufacturing PMI; New Zealand GDP q/q.

Thursday – Australia Unemployment Rate.

Friday – BOJ Rate Decision; Canada Retail Sales m/m.