U.S. Labour Market Expected to Rebound in October

This week's most important events, including the monetary policy decisions of the FED and BOE, and the U.S. non-farm payrolls, are poised to cause an upsurge in volatility on the GBPUSD. This would likely hasten the anticipated trend reversal that was forecasted by our latest analysis of the pair.

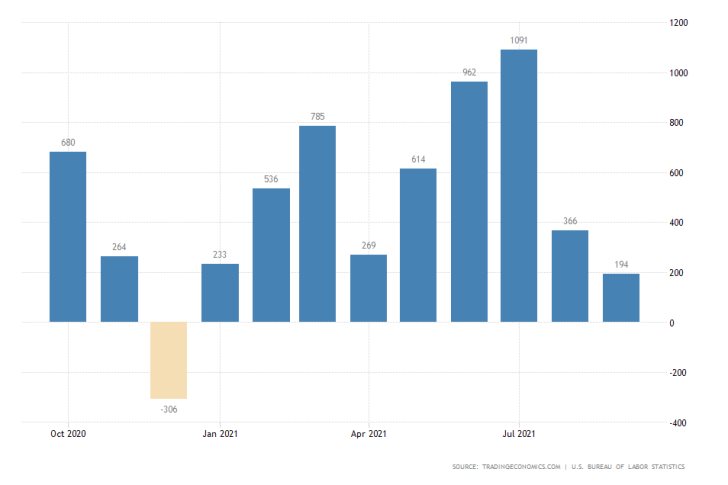

As is always the case on the first Friday of the new month, the U.S. Bureau of Labour Statistics (BLS) is scheduled to publish the non-farm payrolls for the month before. According to the preliminary forecasts, the U.S. labour market is expected to have added 397 thousand new jobs in October.

If these projections are realised, this will mark a sizable rebound in the pace of jobs creation from September when only 194 thousand new jobs were created.

Meanwhile, headline unemployment is expected to drop marginally to 4.7 per cent from September's 4.8 per cent. This would mark the fourth consecutive month of declining unemployment.

Industrial activity in the U.S. has been on the rise over the short term, as underpinned by a sizable uptick in producer prices, which represents a likely catalyst for robust jobs creation.

FED's Take on Inflation Will Be Crucial

The Federal Open Market Committee (FOMC), chaired by Jerome Powell, is meeting on Wednesday. The Committee will deliberate on its current monetary policy stance. Markets weigh in on whether the Federal Reserve would adopt a slightly more hawkish stance, similarly to what the ECB did last week.

The Committee is expected to maintain the near-negative Federal Funds rate unchanged at 0.25 per cent. But the central point of the meeting would be FOMC's take on inflation growth in light of the global energy squeeze and the robust earnings season.

Now available: Weekly data on the Assets and Liabilities of Commercial Banks in the United States: https://t.co/NSim8zRsNg #FedData

— Federal Reserve (@federalreserve) October 29, 2021

The marked increase in the prices of higher-yield assets as of late would likely be the key reference point for Jerome Powell and his colleagues.

BOE Could Deliver Another Surprise

In yet another highly-anticipated policy decision, the Monetary Policy Committee (MPC) of the Bank of England is meeting on Thursday. The BOE has been the most hawkish-sounding of the major central banks, which is why it could surprise the markets yet again. Two of the Committee's nine members are forecasted to vote in favour of decreasing BOE's stock of asset purchases.

Silvana Tenreyro talks about global supply chains. She sets out how they work, how they can benefit trade, and what the current disruptions could mean for inflation and interest rates in the UK. https://t.co/UFlrDz0d9y pic.twitter.com/3znYgyZTsR

— Bank of England (@bankofengland) October 25, 2021

The global energy crisis has had an especially adverse fallout on the British economy, which the Committee's ultimate decision would likely reflect. According to the preliminary forecasts, the MPC is expected to keep the Official Bank Rate unchanged at 0.10 per cent.

The Thursday meeting is likely to weaken the British pound, whose recovery has been showing early signs of climaxing as of late. Given the expected strengthening of the greenback, this would likely bolster the trend reversal on the GBPUSD.

As can be seen on the 4H chart below, the price action has already started developing a new downtrend. This happened following the decisive breakdown below the ascending channel's lower boundary.

A subsequent rebound from the 23.6 per cent Fibonacci retracement level at 1.37347 was then followed by a throwback to the same boundary from below. Subsequently, the price action dropped to the 38.2 per cent Fibonacci at 1.36727, which represents the next crucial test for the mounting bearish sentiment.

Notice that the latter converges with the 200-day MA (in orange), making it an even more prominent turning point. The price action is testing the two as the underlying bearish momentum grows, as underpinned by the MACD indicator.

If it manages to penetrate below this threshold, the downtrend would then likely head towards the 61.8 per cent Fibonacci at 1.35724. Conversely, a rebound from the 38.2 per cent Fibonacci, and the 200-day MA, would likely be followed by a throwback to the 23.6 per cent Fibonacci before the downtrend can be extended lower.

Other Prominent Events to Watch Out for:

Monday - U.S. MoM ISM Manufacturing PMI; Germany MoM Retail Sales.

Tuesday - Australia RBA Policy Decision; New Zealand MoM Unemployment Rate.

Wednesday - U.S. MoM ISM Services PMI; Eurozone MoM Unemployment Rate; Eurozone ECB President Lagarde Speaks.

Thursday - OPEC - JMMC Meetings; Australia MoM Trade Balance.

Friday - Canada MoM Unemployment Rate; Eurozone MoM Retail Sales.