Powell Needs to Reassure the Anxious Markets

The economic calendar for next week is filled with top-tier events, chiefly the monetary policy decisions of the three most prominent central banks. This is sure to cause volatility upsurges on an already volatile EURUSD. You can read more about the pair's ongoing trend reversal from our latest comprehensive analysis.

First up, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve, chaired by Jerome Powell, is set to deliberate on its current monetary policy stance on Wednesday. The Committee is expected to maintain the near-negative Federal Funds Rate unchanged at 0.25 per cent and dial back the pace of its asset purchases.

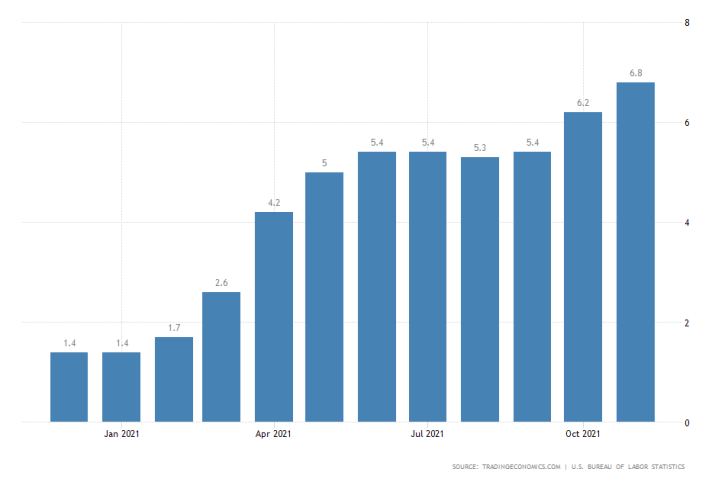

The most widely discussed topic over the last several weeks has been the rising consumer and producer prices. In November, headline inflation topped 6.8 per cent, the highest level since June 1982.

The threat of overheating recovery is what is expected to prompt Jerome Powell and his colleagues to dial back the scope of FED's quantitative easing. Especially since persisting supply bottlenecks are likely to continue contributing to soaring inflation.

No Alterations of ECB's PEPP Expected

The European Central Bank with Chair Christine Lagarde is next in line, scheduled to meet on Thursday. The Governing Council of the ECB, too, is expected to refrain from lifting the 0.00 per cent Main Refinancing Rate at the present moment.

Given that no major headway was made since the Council's previous meeting, purchases under ECB's Pandemic Emergency Purchase Programme (PEPP), with a total envelope of 1850 billion Euros, would likely continue unaltered.

Monthly net issuances of debt securities in the euro area averaged €93 billion from January to October 2021. This is more than in 2019, but significantly lower than what we had over the same period in 2020. Read the press release https://t.co/kSVRCKqBZU pic.twitter.com/NXx4u394xY

— European Central Bank (@ecb) December 10, 2021

Overall economic sentiment in the Eurozone was hit less than initially expected, though it remains quite fragile compared to the levels observed over the same period before the pandemic. Consumption also remains massively subdued in spite of rising inflation.

More Discord Anticipated Among BOE's MPC

Again on Thursday, the Monetary Policy Committee (MPC) of the Bank of England will meet. Andrew Bailey and his colleagues are expected to keep the Official Bank Rate and asset purchase facility at 0.10 per cent and £875 billion, respectively. However, market forecasts do not anticipate unanimous decisions to be reached by the nine-member Committee.

Two members are expected to vote in favour of lifting the Bank Rate, an ostensibly hawkish stance in light of recent developments, while three members are expected to decrease the scope of BOE's asset purchase facility. These forecasts are significant enough to potentially cause a rebound on the struggling pound.

As can be seen on the daily chart below, the GBPUSD has been developing a massive downtrend over the last several weeks. Nevertheless, there are ample reasons to anticipate the emergence of a bullish pullback in the near term.

Primarily, the price action appears to have just completed a major 1-5 impulse wave cycle, as postulated by the Elliott Wave Theory. It happened just above the 38.2 per cent Fibonacci retracement level at 1.31676. Not only that, but the price action also appears to have rebounded from the 600-day MA (in red).

If it manages to break out above the major resistance level at 1.33000, underpinned by the 500-day MA (in green), the pullback's next target would be the previous swing low at 1.34000.

Other Prominent Events to Watch Out for:

Tuesday - UK MoM Unemployment Rate; U.S. MoM PPI.

Wednesday - China MoM Retail Sales; UK MoM CPI; Canada MoM CPI; U.S. MoM Retail Sales.

Thursday - Australia MoM Unemployment Rate; Germany MoM Flash Manufacturing and Services PMI; UK MoM Flash Manufacturing and Services PMI; Eurozone MoM Flash Manufacturing and Services PMI.

Friday - Japan BOJ Policy Rate Decision; UK MoM Retail Sales; Germany MoM ifo Business Climate.