July Employment Numbers Due for Release in the US and Canada

The most significant event this week would be the simultaneous publication of pivotal employment data in the US and Canada. Both releases are scheduled to take place on the first Friday of the new month, as per usual.

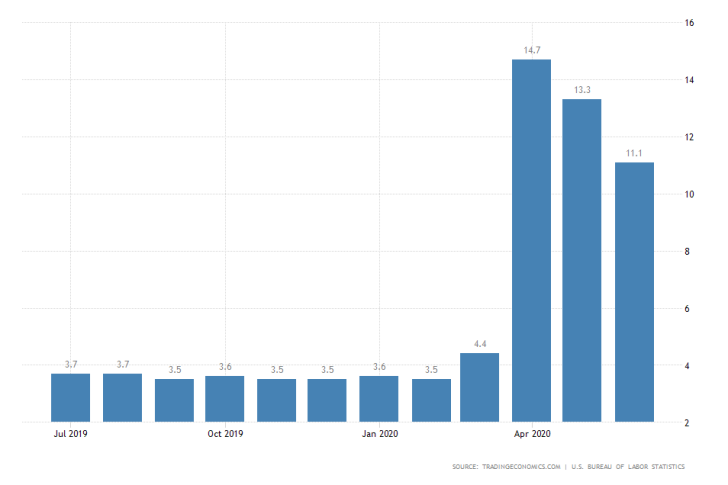

As regards the July Non-Farm Payrolls in the US, the labour market is expected to continue recuperating on a monthly basis. Thus, the consensus forecasts project a depreciation in headline unemployment to occur for the fourth consecutive month.

The unemployment rate is thereby anticipated to fall from the 11.1 per cent that were registered a month prior, to 10.5 per cent in July.

Though only a marginal improvement, such a performance would cushion the hit on the strained dollar, as it would provide investors and traders with some positive data.

The downturn of the greenback, which began as an indirect consequence of the soaring euro, was exacerbated last week, following the release of the disappointing GDP numbers for Q2 coupled with the somewhat dovish-sounding monetary policy statement of the FOMC.

That is why robust NFP data for July could potentially induce at least a temporary respite for the freefalling dollar. Thereby, Friday's jobs report could be the catalyst needed for the development of a short-term correction on most major pairs involving the dollar.

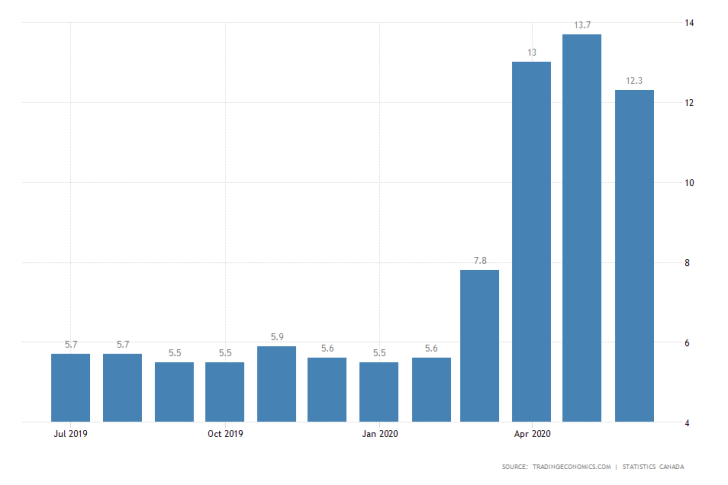

As regards the current state of the Canadian labour market, there are no prevailing forecasts for the July jobs report as of yet.

Similarly to the US labour market, the Canadian unemployment rate seems to have already reached a peak, which would mean that signs of stabilisation could be observed on Friday.

Nevertheless, the recovery process of the Canadian labour market is less pronounced compared to the steadily depreciating unemployment in the US. This is why it is harder to project what would be announced on Friday.

BOE Likely to Maintain the Official Bank Rate Unchanged

The Monetary Policy Committee (MPC) of the Bank of England is gathering this Thursday to deliberate on its monetary policy stance.

The meeting of the FED from last week already set the tone for the major central banks, which is why no significant changes to the current course of the BOE are anticipated to be announced.

All nine members of the MPC are expected to vote in favour of maintaining the Official Bank Rate unchanged at 0.10 per cent. Moreover, the Asset Purchase Facility is projected to remain at £ 750 billion, the same as in June.

With no likely adjustments to the Bank's current monetary policy stance, no significant volatility spikes are expected to affect the pairs involving the pound, following the release of BOE's statement.

Vigilant RBA is Expected to Remain on its Current Course, Too

The Governing Council of the Reserve Bank of Australia is holding its monetary policy meeting on Tuesday. Similarly to the MPC of the BOE, the Governing Council of the RBA is expected to refrain from implementing any significant changes to the underlying monetary policy at the present rate.

The consensus forecasts anticipate the Council to keep the near-negative Cash Rate unchanged at 0.25 per cent, seeing as how the situation in Australia hasn't changed drastically from the previous gathering of the Council in early July.

The Australian dollar is likely to run into some difficulties this week as the number of confirmed COVID-19 cases continues to rise in some Australian states.

Earlier today, the Victoria state declared a state of emergency following the announcement of new epidemic spikes, which could threaten the overall recovery process in the country.

Meanwhile, we have selected the GBPUSD as the most interesting pair this week, due to the significance of the NFP data and the meeting of the BOE. The currency pair has generated a remarkable, bullish trend over the past several weeks, but due to the aforementioned factors, a new bearish correction might be due.

However, traders should keep in mind that the prevailing market sentiment remains ostensibly bullish, as can be discerned by the Ichimoku Cloud indicator on the 4H chart below.

Other Prominent Events to Watch for This Week:

Monday – ISM Manufacturing PMI in the US.

Tuesday – Walt Disney Co. reporting after the market close.

Wednesday – Unemployment Data in New Zealand; ISM Non-Manufacturing PMI Data.

Thursday – 22nd Century Group Inc. reporting time not specified; Uber Technologies Inc. reporting after the market close.