U.S. Inflation Expected to Slow Down in July

Given the top-tier events in the calendar this week, the GBPUSD looks like the pair that is most likely to experience heightened price fluctuations. This is especially interesting given the expectations for a decisive reversal. Check out our last analysis of the pair for more information on the current bearish setup.

The Bureau of Labour Statistics (BLS) in the U.S. is scheduled to post the latest inflation data on Wednesday. The consumer price numbers for July will be the most important economic release this week.

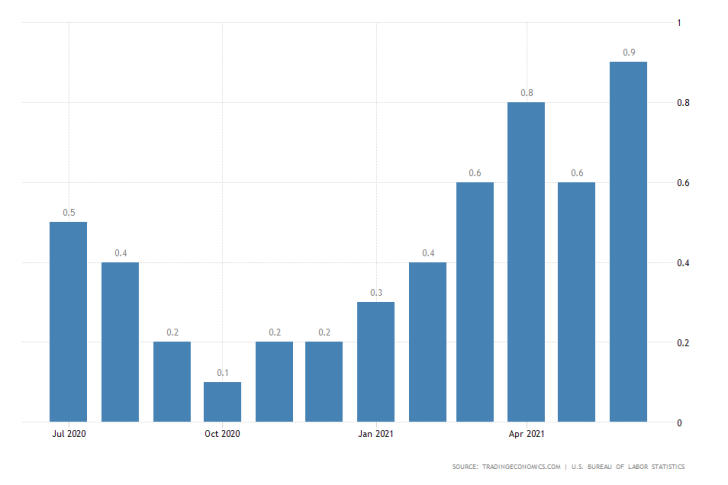

According to the preliminary forecasts, the Consumer Price Index (CPI) is expected to slow down by 0.4 per cent from a month prior. Headline inflation is projected to appreciate by 0.5 per cent, taking a sizable U-turn compared to the 0.9 per cent uptick that was recorded in June.

If these projections are realised, this will mark only the second instance of easing price pressures since October 2020. Furthermore, it would confirm the expectations of Jerome Powell and the FED regarding short term inflation behaviour.

This would also justify FOMC's somewhat laidback stance on short term inflation, despite notable increases in consumer prices over the last several months. In particular, a doubling down in inflation from a month prior would confirm the Committee's assertion that prices have been growing recently owing to temporary supply bottlenecks.

Wednesday's data is thus likely to strengthen the U.S. dollar because, if it meets the initial forecasts, it will signify FED's recovery projections. This would reassure traders and allow for the greenback to continue strengthening.

Germany's Economic Sentiment to Continue Worsening

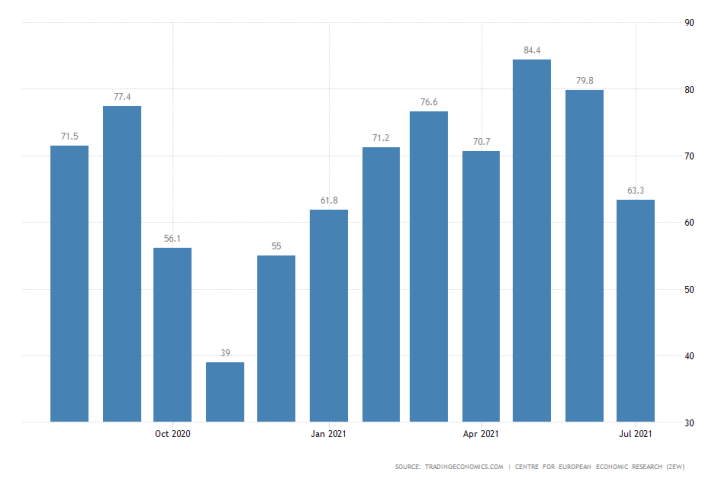

The ZEW economic sentiment index in Germany is anticipated to continue diving for the third consecutive time in August amidst rising coronavirus cases and uneven vaccine rollout in the Eurozone. The ZEW will publish the numbers on Tuesday.

The market forecasts anticipate the index to depreciate from the 63.3 index points that were recorded in July to 54.9 points in August. Even though this would still underline positive expectations for economic expansion - being above the 50.0 benchmark - it would be the weakest reading since November 2020.

Investors' s sentiment is expected to wane in spite of the positive factory numbers that were recently recorded in the Eurozone's manufacturing sector. Once again, this divergence is ascribed to the persisting supply chain disruptions globally.

The euro is most likely to be affected negatively by Tuesday's release.

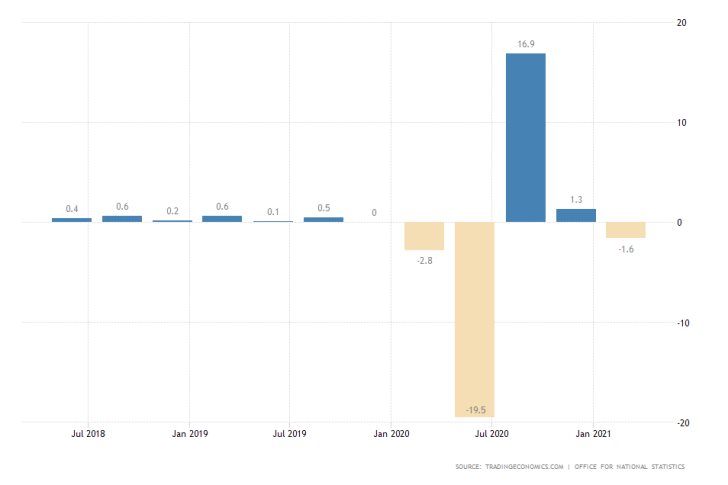

UK's Economy to Rebound in the Second Quarter

On Thursday, the Office for National Statistics in the UK is scheduled to release the preliminary GDP numbers for the three months ending in June. The initial forecasts expect the British economy to grow by 4.8 per cent, a sizable rebound from Q1's contraction of 1.6 per cent.

These optimistic forecasts are inlined with BOE's forward-looking economic forecasts. At its August meeting, the Monetary Policy Committee (MPC) of the Bank showed more hawkishness than before, which is congruent with the forecasts for economic expansion.

This is likely to bolster the pound in the short term following the publication of the report. However, as can be seen on the 4H chart below, bearish pressure on the GBPUSD continues to increase.

As of late, the price action has been depreciating within a descending channel (FLAG) pattern, which typically entails probable bullish rebounds. However, the GBPUSD looks more likely to continue depreciating over the next several days under the current circumstances.

This is owing to the fact that before the close of last week's trading session on Friday, the price action reversed from the 300-day MA (in purple), the 50-day MA (in green), and penetrated below the 23.6 per cent Fibonacci retracement level at 1.38864.

Given the rising bearish momentum, as underpinned by the MACD indicator, the price is now likely to test the channel's lower boundary. The latter is currently converging with the 38.2 per cent Fibonacci at 1.38259, the 100-day MA (in blue) and the 200-day MA (in orange).

Other Prominent Events to Watch for:

Wednesday - Germany MoM CPI.

Thursday - U.S. MoM PPI.

Friday - U.S. MoM Preliminary Michigan Consumer Sentiment Index.