The Discrepancies in the U.S. Labour Market Expected to Deepen

The most important economic event taking place this week is going to be the publication of the April Non-Farm Payrolls in the U.S on Friday. According to the preliminary forecasts, the unemployment rate is projected to fall by 0.3 per cent on a monthly basis.

This means that headline unemployment is expected to depreciate to 5.7 per cent from the 6.0 per cent that was recorded in March. The labour market is also likely to have added 975 thousand jobs in April, more than the 916 thousand jobs that were created a month prior.

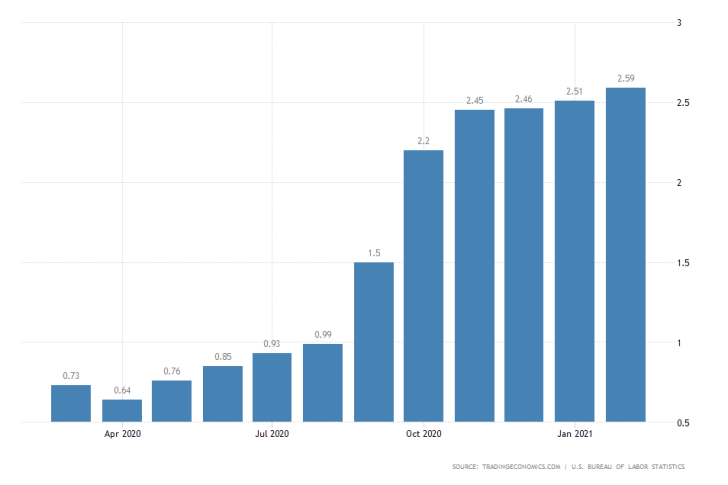

Despite the overall robust performance of the U.S. economy, however, not all trends in the labour market are favourable. The number of people that have been left out of the labour force has been growing moderately over the past months.

This is owing to the fact that more and more people prefer to live off coronavirus benefits rather than work, which represents a potential threat for the long term recovery goals of the FED.

This discrepancy between headline unemployment and persisting unemployment could jeopardise the overall recovery process, which, in turn, could necessitate the preservation of FED's accommodative monetary policy for longer than initially planned.

The timing of FED's policy interventions will likely have a profound impact on the value of the dollar, as traders and investors weigh in on the likelihood of sustained recovery. This can be observed on the changing demand trends in the bonds market.

BOE Expected to Shy Away from Raising the Asset Purchase Facility

The Monetary Policy Committee (MPC) of the Bank of England is meeting on Thursday to deliberate on its current policy stance. The consensus forecasts expect the Committee to maintain the near-negative Official Bank Rate unchanged at 0.10 per cent.

The MPC, consisting of nine members, is also anticipated to vote unanimously to preserve the Asset Purchase Facility at the same rate of 895 billion pounds.

No changes are required given the strengthening labour market conditions in the U.K. and the recently observed uptick in economic activity. Meanwhile, the overbought pound is expected to continue sliding into the new week.

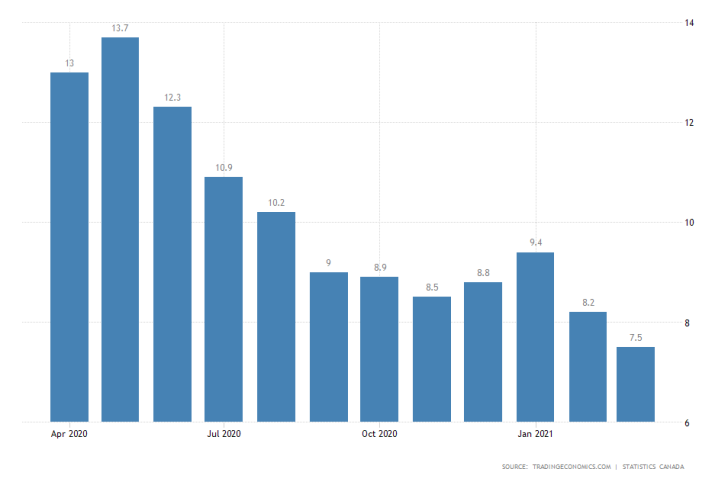

Canadian Unemployment Could Rise in April

Also on Friday, Statistics Canada is scheduled to post the latest employment numbers in the country. The initial forecasts are less optimistic than the ones concerning the U.S. labour market.

The unemployment rate is projected to seesaw to 8.0 per cent from the 7.5 per cent that was recorded in March. The dip represented the lowest rate of unemployment since the beginning of the coronavirus crisis, but the labour market is currently not in a position to continue recuperating.

These downbeat forecasts are advanced in spite of the improved business sentiment in Canada and the strong economic activity that was observed there since the beginning of the year.

This could temporarily ease off some of the strong bearish bias on the USDCAD. As can be seen on the monthly chart below, the pair has been depreciating since the beginning of 2020, and the selling pressure has been growing steadily over the past several months.

Nevertheless, the ADX has been threading below the 25-point benchmark for quite a while now, and the Stochastic RSI is in its oversold extreme. Both of these factors imply a potential bottoming out of the correction near the major support level at 1.21000.

That is further substantiated by the fact that the support level is currently being crossed by the ascending trend line. However, it is also worth mentioning that the price action has crossed below the 100-day MA (in blue), which is yet another indication of the rising bearish bias.

Other Prominent Events to Watch for:

Monday - U.S. ISM Manufacturing PMI; FED Chair Jerome Powell with a Speech; German y/y Retail Sales.

Tuesday - RBA Cash Rate Decision; New Zealand q/q Unemployment Rate; RBNZ Governor Orr with a Speech; Pfizer Inc. Reporting BMO.

Wednesday - BOC Governor Macklem with a Speech; U.S. ISM Services PMI; ADP Employment Change; General Motors Reporting BMO.

Thursday - BOJ Monetary Policy Meeting Minutes; EU y/y Retail Sales.

Friday - RBA Monetary Policy Statement.