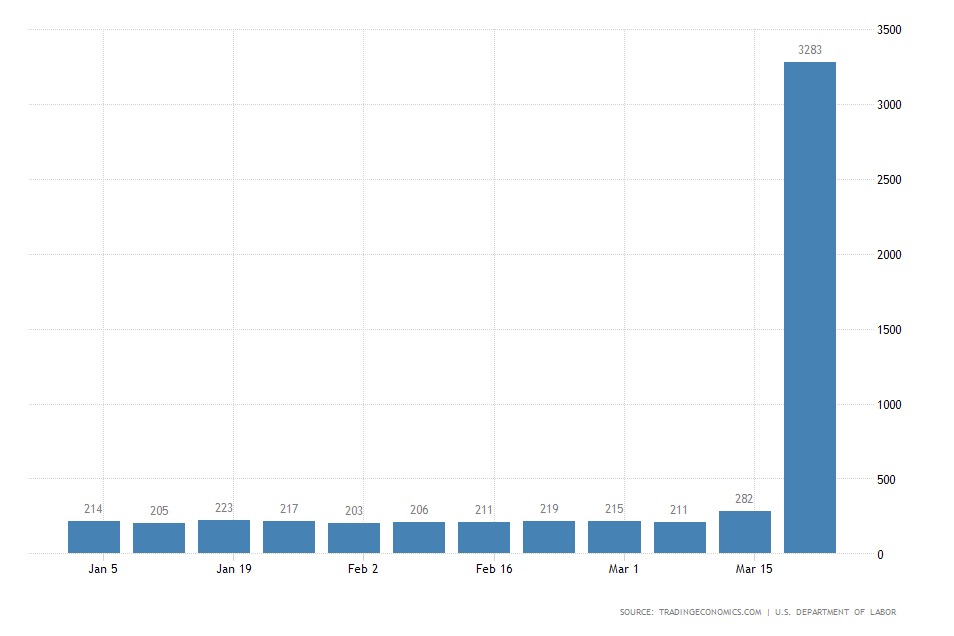

The US Department of Labor reported 3.28 million jobless claims in March yesterday, which is an unprecedented monthly surge in the number of people seeking unemployment benefits.

The findings of the Department’s labour survey from yesterday dwarf all of the previous highs that have been recorded to-date in the survey’s 53 years of jobless claims data gathering.

The various initial forecasts were projecting widely diverging predictions prior to yesterday’s release due to the ambiguity of the recent developments in the US labour market. Overall, the consensus projections were converging towards 1.64 million new claims.

These expectations fell massively short of the eventually reported 3.28 million claims, which underpins the severity of the coronavirus' impact on the US economy and its labour market. In comparison, the jobless claims for February were 282 thousand.

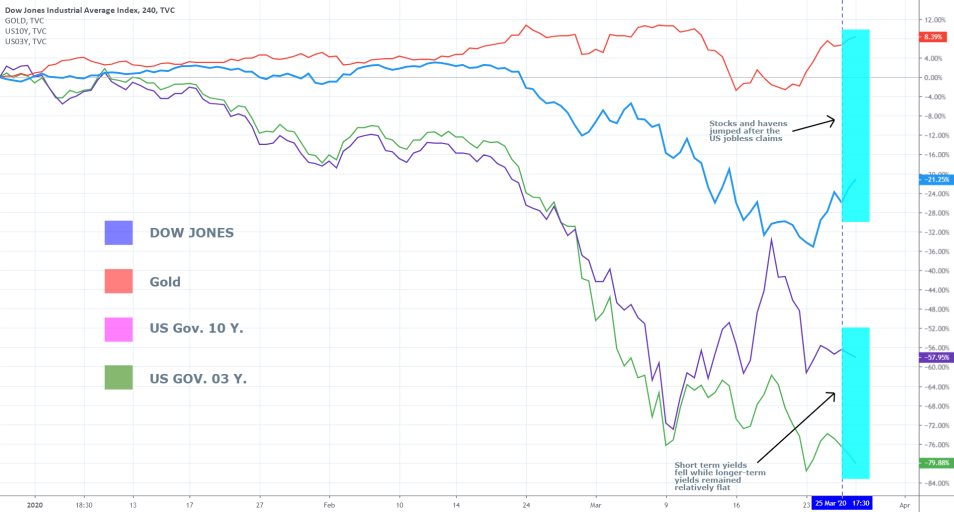

The markets sent mixed massages after the report was released, signifying different reactions amongst traders, investors and policymakers. Demand for short term treasuries surged while their yields tanked.

Meanwhile, the yield of the 10-year US Government bond remained relatively flat, which illustrates a discrepancy in the bonds market. Investors are fleeting to securities with short-term maturities as they perceive the threat of the immediate uncertainty as being more detrimental than the risks in the long run.

The market is already pricing in the immediate danger from rising unemployment, but it is, for the time being, downplaying the longer-term risks, as investors seem to be anticipating the economy to normalize by the end of the year.

That is so because the almost astronomical surge in jobless claims is not perceived as being proportionate to a likely rise in the overall unemployment. The market does not believe that the outbreak of the coronavirus has caused an increase in structural unemployment of more than 3 million people in less than two months.

The majority of those claims have most likely been filed by workers who have been laid off from work due to the economic strain resulting from social distancing.

However, at least a portion of the 3.28 million claimants is going to be comprised of workers in-between jobs, which would lessen the negative impact on the labour market once they find new occupations.

Another portion of the claimants could have voluntarily chosen to leave work while the pandemic lasts and isolate themselves. Such actions could be prompted by the government’s pledge to support individuals and families with a direct line of credit that is being extended to the American public.

At present, the majority of those people are expected to quickly re-join the labour force once the virus outbreak is dealt with. All of these assertions anticipate the reported number of jobless claims to be partially misleading in practice, as the true extent of the economic hit on the US labour market remains uncertain.

Meanwhile, stocks and commodities rose yesterday on the announced stimulus package and the bolstered liquidity circulating the economy.

Traders have already started to question whether the recent rally is going to turn out to be the beginning of a new bullish market, or it is a temporary correction before the previous rout is resumed.