U.S. Inflation Growth Projected to Slow Down in June

This week's inflation numbers are very likely to catalyse another big price swing on the greenback following its recent tribulations. Check out our last GBPUSD analysis to get a better understanding of the current struggles of the dollar.

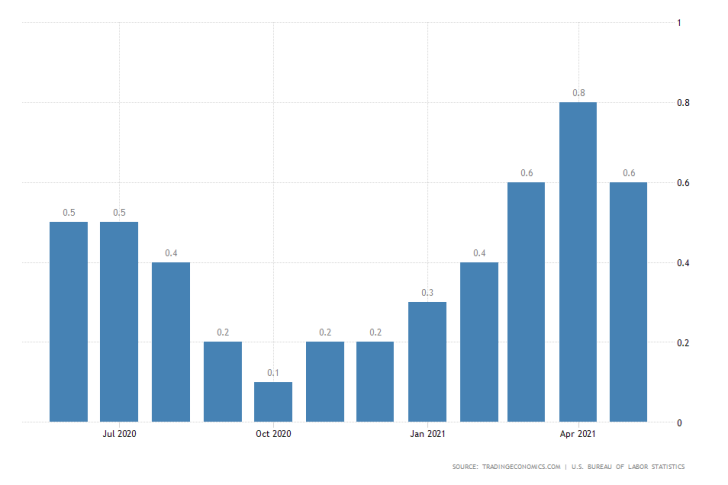

All eyes this week would be focused on the crucially important inflation growth data in the U.S. According to the preliminary forecasts, the Consumer Price Index (CPI) is expected to slow down in June, as per FED's headline price stability projections.

The market was becoming increasingly more concerned with the possibility of inflation soaring well above FED's 2.0 per cent symmetric target level. However, Jerome Powell and his colleagues from the FOMC managed to reassure traders and investors that prices would converge towards the target by the end of the year.

FED's overall outlook on inflation seems to be in lined with current global trends.

The latest CPI numbers are scheduled for publication on Tuesday. If the preliminary forecasts are indeed realised, and headline inflation is shown to have contracted for the second month in a row, this would calm the market even more.

This is why the greenback is likely to continue strengthening as inflation growth slows down.

No Reason for the BOC to Become More Hawkish Prematurely

On Wednesday, the Monetary Policy Committee (MPC) of the Bank of Canada is set to deliberate on its current policy stance. The Committee would almost certainly maintain the Overnight Rate unchanged at 0.25 per cent.

The Canadian dollar managed to rally last week on the shaken energy market. The Loonie advanced as the price of crude oil started establishing the first major bearish correction in a while.

We’ll be publishing our Monetary Policy Report on July 14. Don’t miss our analysis of the impact of #COVID19 on Canada’s #economy and the outlook for recovery. #cdnecon https://t.co/8F6BT9QcA8

— Bank of Canada (@bankofcanada) July 9, 2021

The meeting of the BOC is unlikely to catalyse much bigger gains for the Loonie than that, as the market is already pricing in these recent developments. Once the dropdown of the WTI bottoms out, USDCAD is likely to continue establishing the broader uptrend.

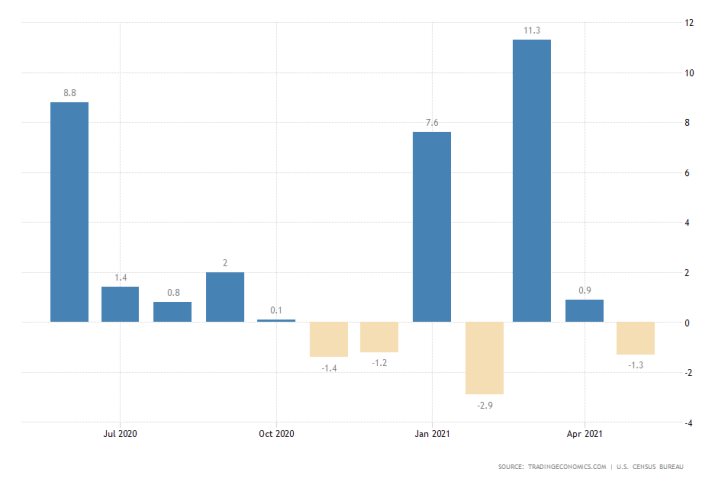

U.S. Retail Sector to Remain Subdued as Demand Remains Weak

In the other major economic release in the U.S. this week, the Census Bureau will post the newest retails sales numbers on Friday. The initial market expectations envision sustained weakness in the industry.

In particular, the index is anticipated to contract by 0.5 per cent in June, following a 1.3 per cent drop a month prior. Such a performance would solidify the weak performance of the sector over the second quarter.

Such retail numbers would potentially exacerbate the short term woes for the greenback, while the broader sentiment remains mostly bullish.

The prevalence of selling pressure in the short term could potentially catalyse a deeper dropdown on the USDCAD, which looks like the most interesting pair for next week. This is owing to the aforementioned events.

The pair appears to be developing a massive 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. The current correction could potentially bottom out around the 38.2 per cent Fibonacci retracement level at 1.23670 before the bullish momentum is resumed.

Other Prominent Events to Watch Out for:

Wednesday - New Zealand RBNZ Official Rate Decision; U.S. MoM PPI; U.S. FED Chair Powell Testifies; UK YoY CPI.

Thursday - Australia MoM Unemployment Rate; China QoQ GDP; U.S. FED Chair Powell Testifies; New Zealand QoQ CPI; UK 3M Unemployment Rate.

Friday - Japan BOJ Policy Rate Decision; U.S. MoM Preliminary Michigan Consumer Sentiment Index.