U.S. Inflation Expected to Remain Unchanged in September

The GBPUSD is the most likely currency pair to register big price swings over the next several days. That is owing to the CPI, consumption and unemployment numbers in the U.S. and UK that are scheduled for release throughout the week. Check out our newest comprehensive analysis of the pair to understand the current market sentiment.

Recently, Wall Street and Main Street have been concerned with the rising consumer prices in the U.S. and elsewhere, which is why this week's headline inflation numbers in the States will garner the most interest amongst traders and investors.

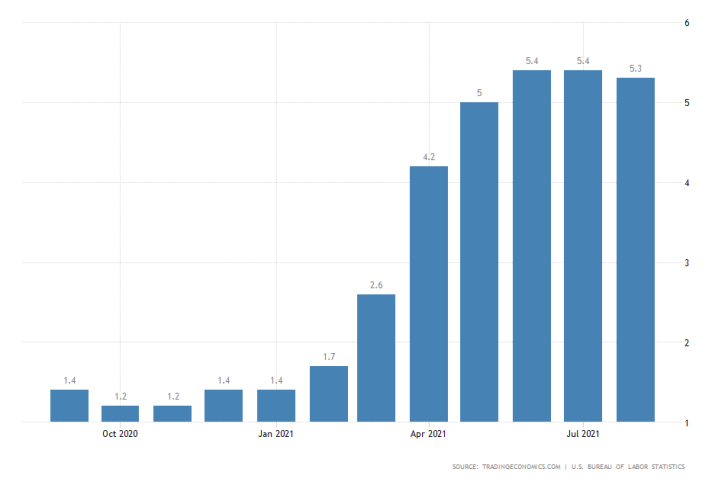

The Census Bureau will post the September Consumer Price Index (CPI) data on Wednesday. According to the consensus forecasts, headline inflation is expected to remain unchanged at 5.3 per cent from a month prior.

The main CPI is projected to increase moderately by 0.3 per cent, the same growth rate that was observed in August. Overall, consumer prices remain at a multi-year high, though the pace of inflation growth is easing. Part of the reason is the reduced speed with which jobs are being created.

British Unemployment to Fall to Its Lowest Level in Over a Year

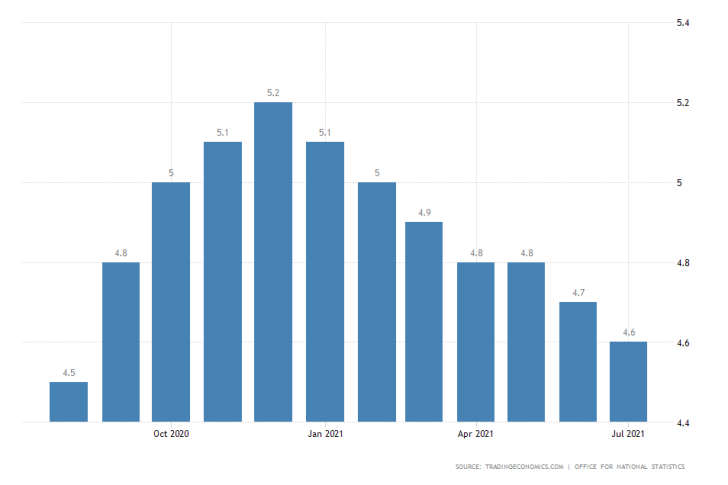

The Office for National Statistics in the UK will release the newest labour market survey on Tuesday. The unemployment rate is anticipated to drop to 4.5 per cent in September from the 4.6 per cent that were recorded a month prior.

This would mean that the British labour market would be at its strongest since August last year.

Such news would be a welcoming development given the recently observed construction squeeze and petrol crisis, which stirred heightened volatility on the pound.

U.S. Consumption to Continue Seesawing in September

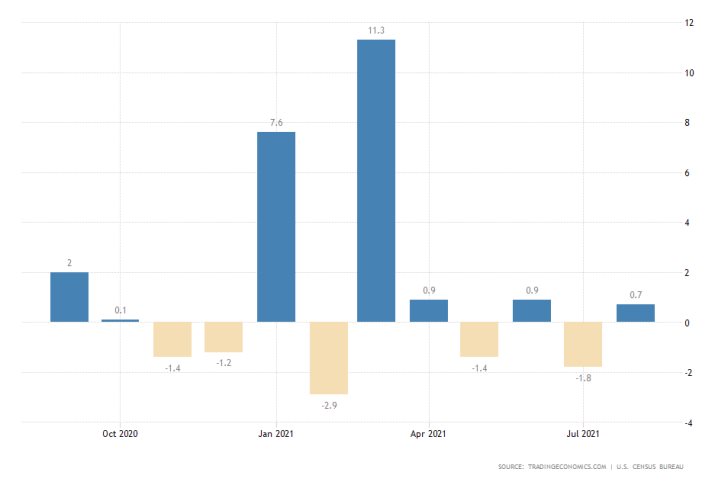

Retail sales in the U.S. are likely to falter yet again, as overall consumption continues to seesaw on a monthly basis. According to the preliminary forecasts, the index is expected to contract by 0.3 per cent in September, coming off from the 0.7 per cent gains that were achieved in August.

The Census Bureau will release the latest consumption numbers on Friday, which would complement the findings of the earlier inflationary reports for the same period.

Global consumption continues to be weak despite material improvements in labour markets, as production remains stymied by persisting supply squeezes and distortions to the global supply chains.

As was mentioned above, the key consumer and employment numbers in the U.S. and UK for September are likely to catalyse another directional price swing on the GBPUSD.

As can be seen on the daily chart below, the price action appears to be developing a major 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. The broader downtrend is represented as a descending channel.

Notice that the price action appears to have completed the second retracement leg (3-4), though it could be extended past the 38.2 per cent Fibonacci retracement level at 1.36473 and towards the upper limit of the channel. This would allow for the development of the last impulse leg (4-5) towards the 61.8 per cent Fibonacci at 1.32765.

The likelihood of a potential reversal from the current spot price is additionally corroborated by the fact that the latest bullish pullback is currently consolidating below the aforementioned 38.2 per cent Fibonacci and the 300-day MA (in purple).

The convergence of the two makes them an even more prominent resistance, and therefore a very probable turning point for the direction of the price action.

Other Prominent Events to Watch Out for:

Tuesday - Germany MoM Economic Sentiment.

Wednesday - U.S. FOMC Meeting Minutes; Germany MoM Consumer Price Index.

Thursday - Australia MoM Unemployment Rate; U.S. MoM PPI; China MoM Consumer Price Index; Japan MoM Industrial Production.

Friday - U.S. MoM Preliminary Consumer Sentiment; EU European Council Meeting.