U.S. Labour Market Likely Headed for Another Solid Month

In the first week of 2022, markets remain volatile because of the generally diminished liquidity. More conviction is expected to be observed by the end of the week, as trading activity starts to pick up. Still, traders should remain extra cautious of potential volatility spikes during those initial trading days.

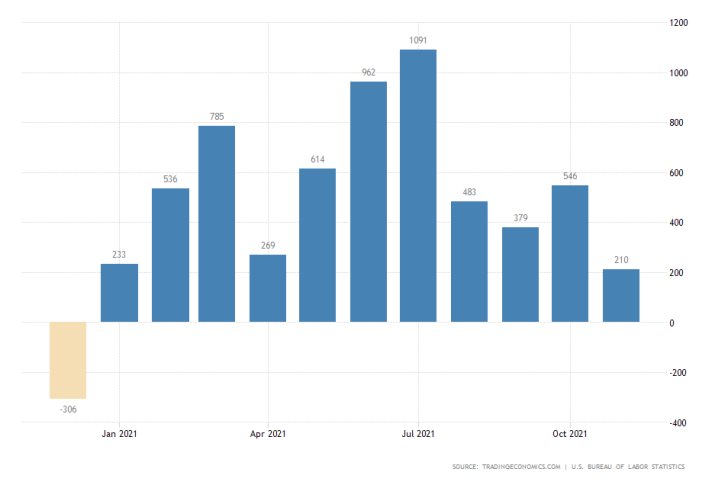

The most important trading event taking place this week will be the release of the U.S. December non-farm payrolls by the Bureau of Labour Statistics (BLS). As per usual, this will take place on the first Friday of the new month.

According to the preliminary forecasts, the U.S. labour market is expected to have added an additional 410 thousand new jobs in December. If these forecasts are realised, this would mark a sizable rebound from the 210 thousand job openings that were recorded a month prior.

Meanwhile, headline unemployment is expected to fall marginally by 0.1 per cent to 4.1 per cent. This would be the lowest level in over two years, signifying the robust recovery pace of the U.S. economy.

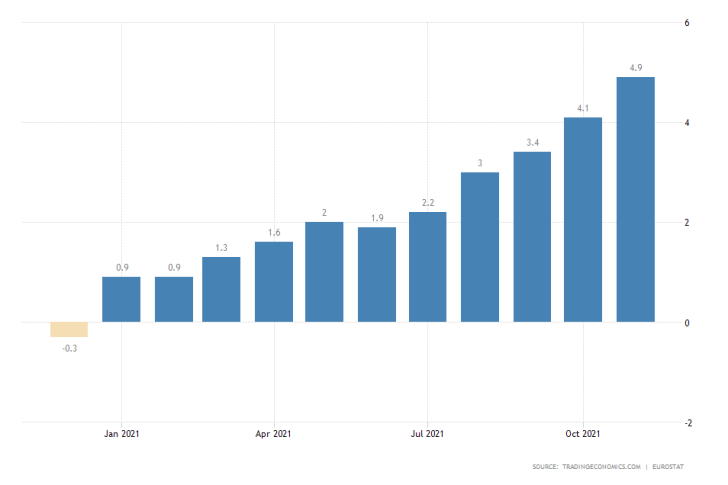

Marginal Drop in Eurozone Inflation Expected Following ECB's Revised Policy Stance

On Friday, Eurostat will post the latest change in the Eurozone's headline inflation. The Consumer Price Index (CPI) is expected to drop by 0.2 per cent from the 4.9 per cent peak that was recorded last month.

If these expectations are fulfilled, this would represent the first time inflation contracted since July of last year; a welcoming development in light of ECB's newly-adopted hawkish policy stance. Eurostat's CPI findings for December are therefore likely to bolster the recuperating euro in the short term.

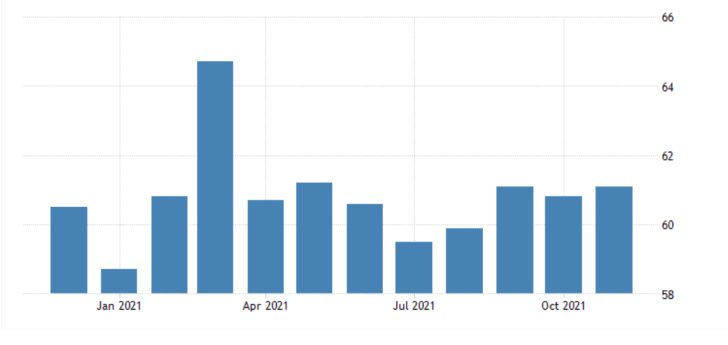

U.S. Factory Activity Set to Depreciate in December

Manufacturing activity in the U.S. is expected to have depreciated marginally over the last month of 2021. On Tuesday, the Institute for Supply Management (ISM) will likely revise the manufacturing PMI downwards to 60.4 index points from the 61.1 growth that was recorded in November.

This could potentially exacerbate the struggles of the greenback in the very short term, having the most significant impact on the EURUSD pair. As can be seen on the 3H chart below, the price action is already advancing within the boundaries of an ascending channel.

The uptrend appears to be taking the form of a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Despite the seemingly erratic behaviour of the price action, the pair looks poised to complete the final impulse leg (4-5) towards the upper limit of the channel. This follows the crucial rebound from the 23.6 per cent Fibonacci retracement level at 1.13389.

The completion of the latest pullback is made even more significant by the fact that the rebound occurred from the middle line of the channel as well.

Other Prominent Events to Watch Out for:

Tuesday - OPEC-JMMC Meetings; U.S. JOLTS Job Openings; Germany MoM Retail Sales; Germany MoM Unemployment Rate; UK MoM Manufacturing PMI.

Wednesday - U.S. FOMC Meeting Minutes; U.S. MoM ADP Unemployment Change.

Thursday - U.S. MoM Services PMI; Germany MoM CPI Change.

Friday - Canada MoM Unemployment Rate; Eurozone MoM Retail Sales.