A Moderate Decline in U.S. Inflation Forecasted for August

Due to the major economic releases in the U.S. and UK, the GBPUSD is likely to register the most substantial price fluctuations this week. Check out our previous analysis of the pair to understand the currently unfolding bearish reversal on the pair.

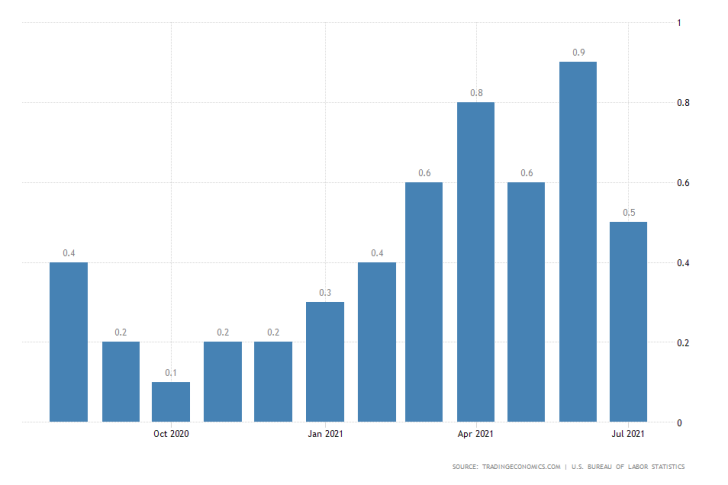

On Tuesday, the U.S. Bureau of Labour Statistics (BLS) will post the inflation rate numbers for September. According to the preliminary forecasts, the Consumer Price Index (CPI) is expected to grow by 0.4 per cent, a moderate decrease from the 0.5 per cent increase that was recorded a month prior.

If these projections are realised, this will mark the third consecutive month of waning inflationary pressures. This would be good news for the recuperating dollar because it would mean that FED's projections for an eventual decrease in price pressures are being met.

In the medium term, headline inflation is expected to converge around 2.0 per cent, which would be illustrative of the waning impact of global supply squeezes and stabilisation of the economy.

China's Retail Sector to Remain on the Current Path

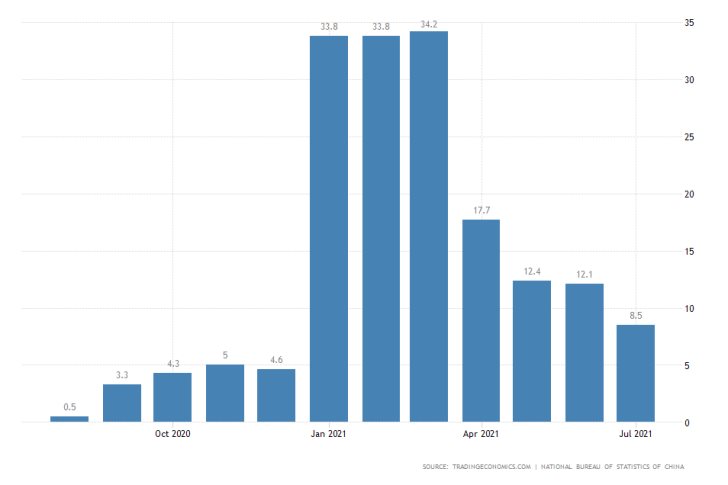

The National Bureau of Statistics of China (NBSC) is scheduled to publish the latest retail sales numbers on Wednesday. The sector is expected to have expanded by 6.9 per cent in August.

If realised, this would represent the slowest monthly expansion since the beginning of the year and the fifth monthly reduction in retail pressures.

Such a performance would be demonstrative of the pace of the global recovery stabilising around the medium-term projections, following a stretch of bumpy and uneven fluctuations.

Despite the weaker performance on a month over month basis, such a result would generally represent good news for the global economy, as it would entail a certain degree of normalisation of demand pressures.

British Unemployment to Fall to its Lowest Level in a Year

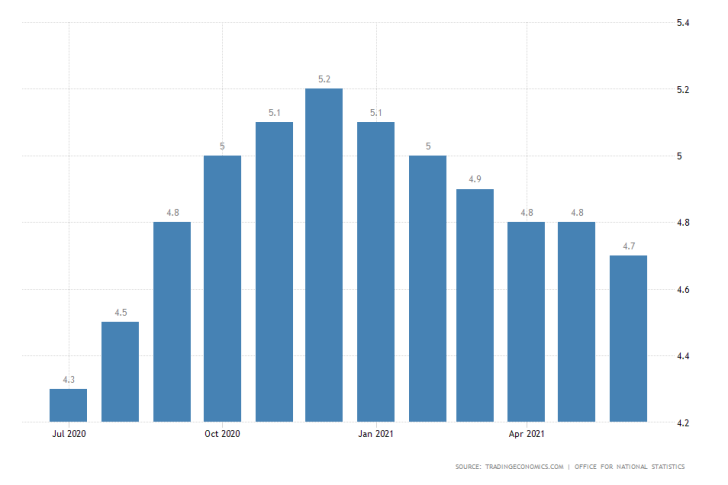

The unemployment rate in the UK is forecasted to fall to 4.6 per cent in August, marking a moderate decrease of 0.1 per cent from a month prior. The latest labour force survey will be published on Tuesday.

Moreover, this would be the lowest level of headline unemployment since August 2020, which would underpin the robustness of the UK recovery despite the continued spread of the Delta variant.

As was mentioned at the beginning of the article, the pair that is most likely to experience heightened price action this week is the GBPUSD, owing to the U.S. inflation numbers and the British unemployment data.

As can be seen on the 4H chart below, the pair has recently completed a bullish 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Following its completion, the price action went on to establish a Double Top pattern, which is a classic reversal pattern.

The rising bearish sentiment in the market is underpinned by the fact that the price action managed to penetrate below the 23.6 per cent Fibonacci retracement level at 1.3823 and the 50-day MA (in green). This results in a bearish crossover on the histogram of the MACD indicator.

Presently, the price action is headed towards the 38.2 per cent Fibonacci at 1.3780, which is about to be crossed by the 100-day MA (in blue). This appears to be part of the second impulse leg (2-3) of a newly emerging bearish 1-5 impulse wave pattern.

Other Prominent Events to Watch for:

Tuesday - Japan MoM Industrial Production.

Wednesday - UK YoY CPI; Canada MoM CPI; U.S. MoM Industrial Production; New Zealand QoQ GDP; U.S. Crude Oil Inventories.

Thursday - Australia MoM Unemployment Rate; U.S. MoM Retail Sales.

Friday - UK MoM Retail Sales; U.S. MoM Preliminary Consumer Sentiment.