No Need to be Overly Optimistic Over FOMC's April Meeting

The Federal Open Market Committee (FOMC) of the Federal Reserve is convening this Wednesday for the third time this year. The Committee is expected to leave the near-negative Federal Funds Rate unchanged at 0.25 per cent, similar to what the ECB did last week.

Jerome Powell and his colleagues are also unlikely to scale up FED's massively accommodative Quantitative Easing (QE) programmes. Consumer prices are already picking up as retail demand increases.

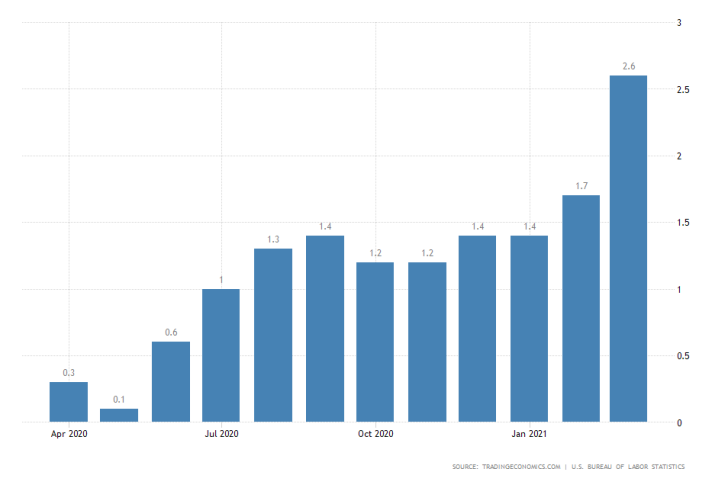

Headline inflation thus rose sharply to 2.6 per cent in March, which is inlined with FOMC's short term projections regarding inflation getting moderately above 2.0 per cent in the medium term:

"With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer term inflation expectations remain well anchored at 2 percent."

FED's preparedness to seek short-term inflationary pressures exceeding its longer-term goals is precisely why investors should not hope for the FOMC to adopt a more hawkish stance on Wednesday. Instead, the Committee is likely to comment on these developments as a step in the right direction, likely strengthening the dollar as a consequence.

U.S. Growth Rate Expected to Accelerate in Q1

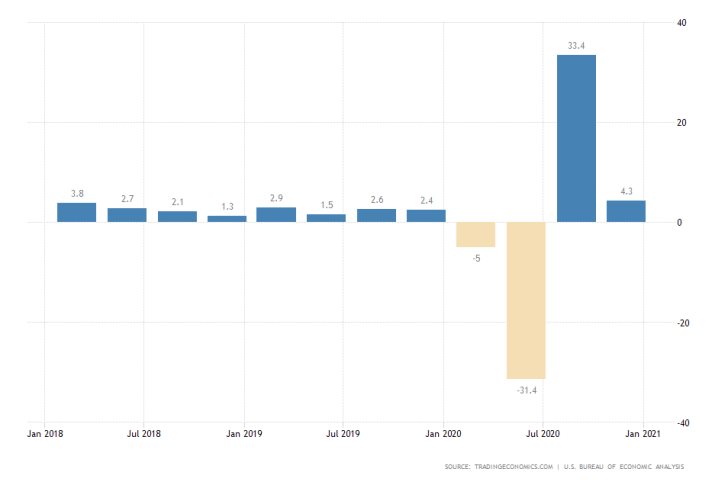

On Thursday, the U.S. Bureau of Economic Analysis is scheduled to publish the advance Gross Domestic Product (GDP) growth data for the three months to March. The preliminary forecasts anticipate the rate of economic expansion to have reached 6.5 per cent in the first quarter of 2021.

Such a recorded performance would mean that U.S. growth would have sped up from Q4's expansion of 4.3 per cent, underpinning the solid uptick in demand.

The advanced GDP report represents the first reading of underlying economic activity recorded over a single quarter, which is why it tends to cause the most sizable market reactions. In contrast, the preliminary and final GDP reports only revise the advanced data.

That is why Thursday's numbers are likely to boost further the underlying volatility that is currently affecting the greenback.

The Earnings Season Reaches a Climax with Big Tech Releases

Last but not least, Silicon Valley's earnings season is about to reach boiling temperature this week with releases from some of the most renowned technological giants in the world.

First up, Tesla is scheduled to post its earnings for Q1 on Monday after the market close. On Tuesday, Google's parent company Alphabet and Microsoft both report after the market close. Apple and Facebook follow suit on Wednesday, whereas Amazon closes the pivotal week on Thursday.

The quarter is thus far proving to be one filled with hits-and-misses for most companies owing to the uneven impact of the pandemic on different sectors. Even though restrictions have been gradually eased over the first few months of the year, the risk to recovery continues to be subject to changing health conditions.

These volatile conditions are likely to cause even higher adverse fluctuations on most related assets, particularly on the greenback. A key pair to focus on this week will be the USDJPY because of BOJ's policy decision adding up extra pressure in addition to the other events.

As can be seen on the daily chart below, the pair is currently establishing a Falling Wedge pattern, which typically entails likely bullish trend continuation. What is even more interesting is the fact that the price action is currently consolidating around the 38.2 per cent Fibonacci retracement level at 107.676 and the 50-day MA (in green).

The aforementioned volatility outbursts this week could cause more price fluctuations between the 38.2 per cent Fibonacci and the 23.6 per cent Fibonacci retracement level at 108.847 before the price eventually breaks out above the Wedge's upper boundary.

Other Prominent Events to Watch for:

Monday - German ifo Business Climate; US Durable Goods Orders.

Tuesday - BOJ Policy Rate Decision; US CB Consumer Confidence; Starbucks Corp. reporting AMC; Visa Inc. reporting AMC.

Wednesday - Australia CPI q/q; OPEC-JMMC Meetings; Canada m/m Retail Sales; Boeing CO. reporting BMO; Ford Motor Co. reporting TAS; Qualcomm Inc. reporting AMC.

Thursday - Twitter Inc. reporting AMC; Mastercard Inc. reporting BMO.