The FED Expected to Recalibrate it's Economic Projections Markedly

Undoubtedly, the most widely anticipated event this week will be the monetary policy meeting of the Federal Reserve. The FOMC is scheduled to gather on Wednesday, and the Committee is expected to maintain the 0.25 per cent Federal Funds Rate unchanged under the current global trends.

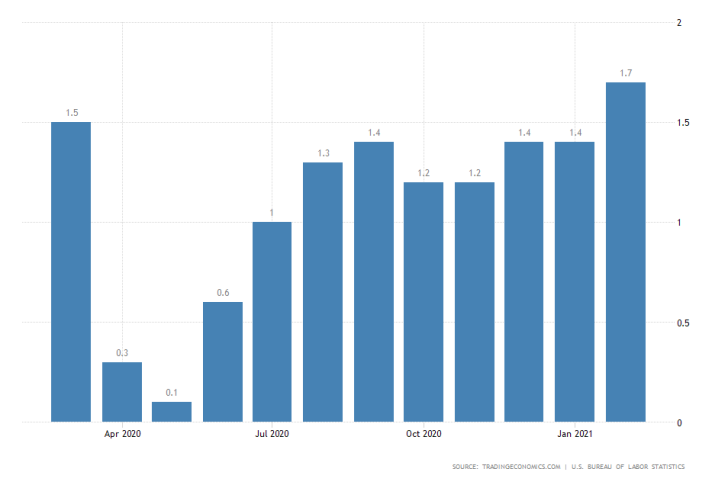

Market participants will be keen to see whether the Committee will adopt a more hawkish-sounding policy stance in light of the recent economic developments. Namely, the faster-than-expected labour market expansion and growing inflation.

Even though headline inflation remains below FED's longer-term goals, it is growing fast, which could potentially compel the FOMC to recalibrate its projections. This trend of rapidly rising prices is now likely to be accelerated even further, following the recently bolstered fiscal policy in the U.S.

The Committee could thus express readiness to tighten its policy sooner than what was initially thought. Such a turn of events would likely affect the stock market, whose rally has been bolstered by FED's accommodative monetary policy stance.

Overall, the FED is unlikely to scale up its underlying asset-purchasing programmes at the present rate; however, any hints at possible rate hikes before the end of 2022 are likely to jolt stocks and other higher-risk assets on Wednesday.

U.S. Retail Sales Projected to Fall Marginally in February

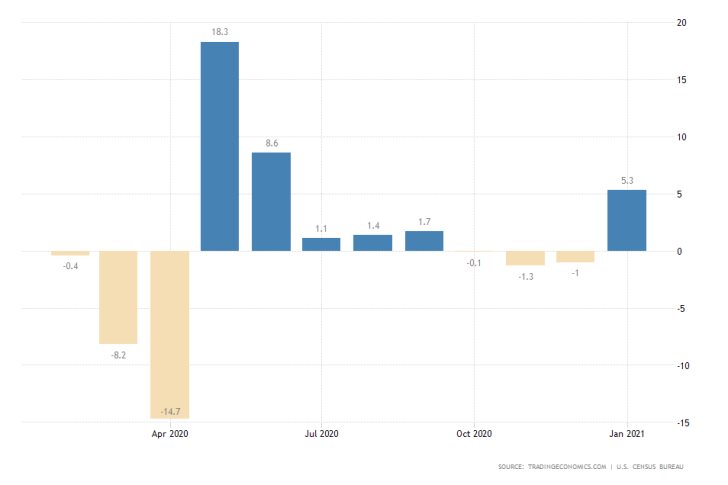

The Census Bureau in the U.S. is scheduled to publish the latest retail sales findings on Tuesday. According to the preliminary forecasts, a marginal contraction of 0.5 per cent is expected to be registered for the month of February.

This will follow the considerable uptick of 5.3 per cent that was recorded in January. The retail sector is growing steadily because of the stimulus checks that the government extended in a bid to stimulate consumption.

Given the recently signed 'American Rescue Plan' by Joe Biden, this trend is very likely to be extended over the next quarter, thereby continuing to drive sales even higher. Meanwhile, the expectations for a marginal fall in February are unlikely to jolt the recuperating dollar drastically.

BOE Expected to Vote Unanimously to Keep Current Policy Stance

In yet another central bank meeting taking place this week, the Monetary Policy Committee (MPC) of the Bank of England is scheduled to deliberate on its current policy stance on Thursday.

All nine members of the Committee are anticipated to vote unanimously in favour of maintaining the near-negative Official Bank Rate unchanged at 0.10 per cent. Meanwhile, the scope of BOE's asset purchase facility is expected to remain at £895 billion.

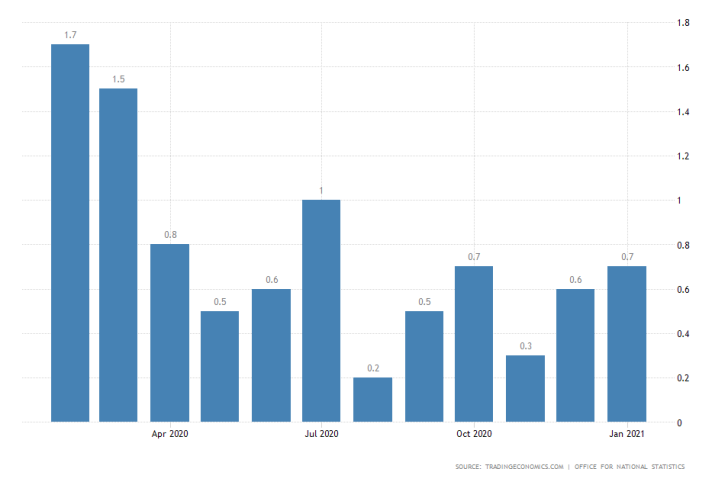

Despite improving economic conditions in the United Kingdom, headline inflation remains subdued, which is why the BOE has much fewer reasons to adopt a more hawkish policy stance.

Given that both the BOE and the FED are scheduled to meet this week, their respective policy decisions are likely to have the greatest impact on the GBPUSD pair.

As can be seen on the 4H chart below, the cable appears to have started to range-trade as of late, following the development of a major Elliott Cycle - the completion of a 1-5 impulse wave pattern being followed by an ABC correction. This can be further asserted from the recent rebound of the price from the psychological resistance at 1.40000.

While the price action looks poised to test the lower boundary of the newly emerging trend at 1.38500 soon, the Stochastic RSI indicator demonstrates that the GBPUSD is promptly becoming oversold. This is likely to result in yet another bullish rebound towards the range's upper boundary.

Other Prominent Events to Watch for:

Monday - China y/y Retail Sales.

Tuesday - BOJ Governor Kuroda Speaks; RBA Meeting Minutes.

Wednesday - Canada m/m CPI; New Zealand q/q GDP; US Crude Oil Inventories.

Thursday - Australia Unemployment Rate.

Friday - BOJ Policy Rate Decision; Canada m/m Retail Sales; Australia m/m Retail Sales.