The Monetary Policy Committee (MPC) of the Reserve Bank of New Zealand is scheduled to meet on Wednesday and deliberate on the current economic conditions in the country.

Market analysts expect the central bank to reduce the rate by 25 basis points from the current 1.00 per cent level to 0.75 per cent.

If the consensus forecasts are met, that would mean that the MPC would have reduced the headline interest rate in the country for the third time this year.

In its previous monetary policy statement from September, the MPC observed that:

“The Committee noted that, while GDP growth had slowed over the first half of 2019, impetus to domestic demand is expected to increase. Household spending and construction activity are supported by low interest rates, while business investment should lift in response to demand pressures. The Committee expected increasing demand to keep employment near its maximum sustainable level. Rising capacity pressures and increasing import costs, higher wages, and pressure on margins are expected to lift inflation gradually to 2 percent.”

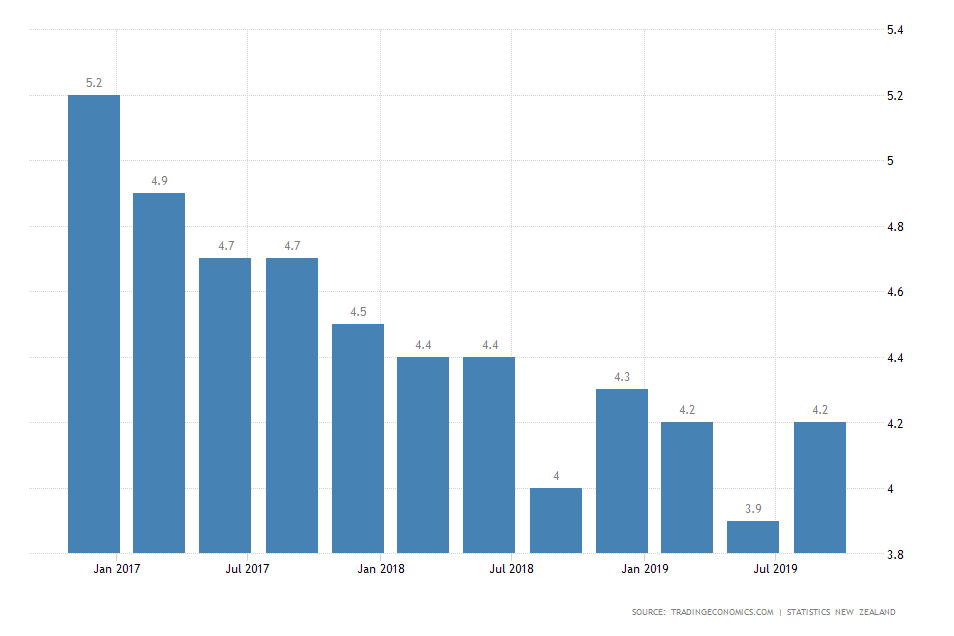

Since then, unemployment has appreciated by 0.3 percentage points to an overall 4.2 per cent, which is close to, but above maximum sustainable employment.

This apparent deterioration of the local labour market in Q3, which was examined in greater details here, could potentially compel the MPC to reduce the interest rate on Wednesday further.

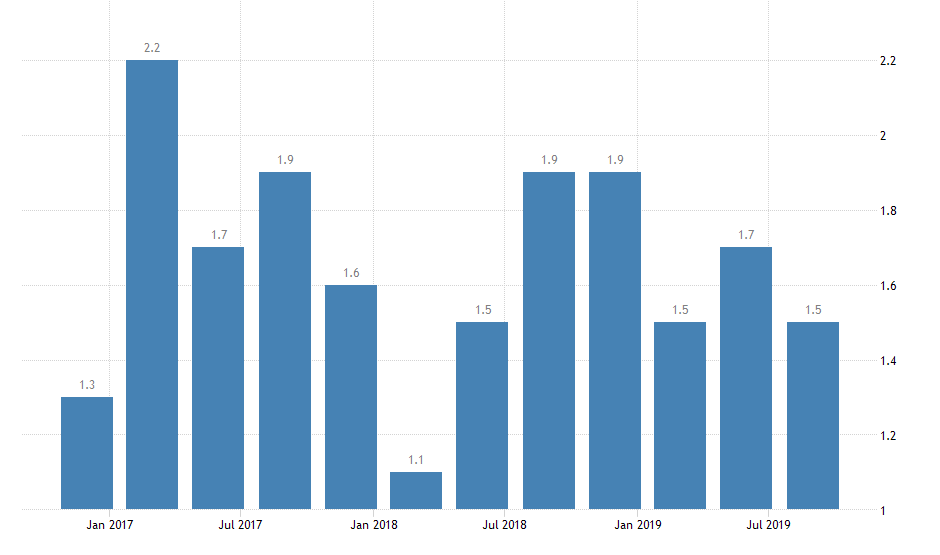

Annualised headline inflation in New Zealand, too, fell during Q3, which is yet another potential determinant for a reduction of the underlying interest rate.

Inflation tumbled by 0.2 percentage points from 1.7 to 1.5 per cent in the same quarter, signifying waning price stability.

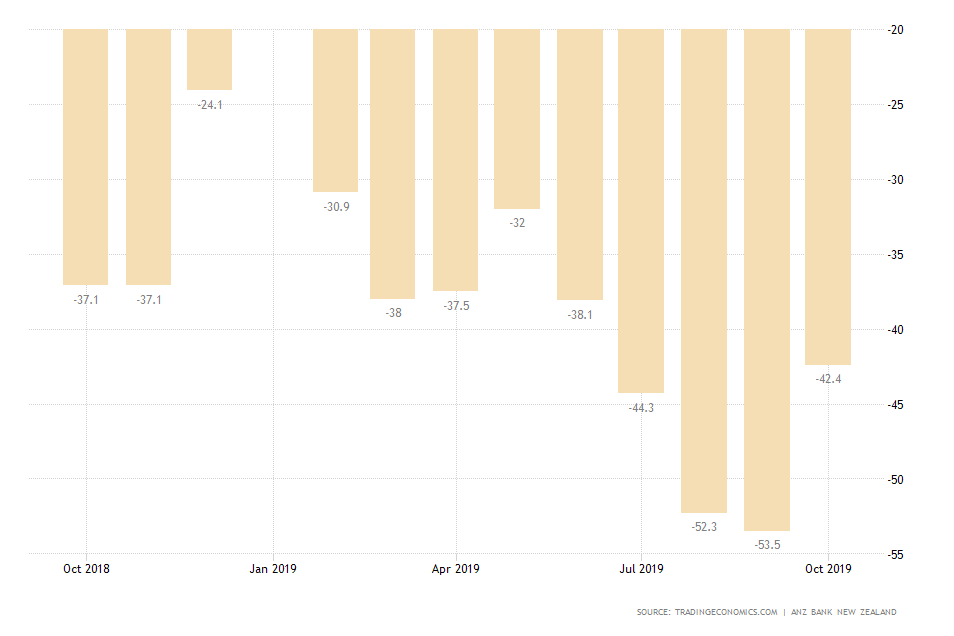

In contrast, the business confidence index in New Zealand has bounced off in October from the 11-year low that was registered in the previous month.

The index increased from -53.5 per cent to -42.4, which indicates that investors are regaining their confidence, following the last interest rate reduction in August.

As the business sentiment continues to improve, monetary policymakers can expect the business activity to pick up in Q4, resulting in the normalisation of the growth rate, stabilisation of inflation and falling unemployment.

Even though the majority of market experts weigh in on a reduction of the rate on Wednesday, there are also reasons to expect precisely the opposite.

A more favourable business outlook is likely to prompt heightened business activity, which could prove sufficient for the MPC of the RBNZ to postpone any reductions until 2020.

Meanwhile, the NZDUSD is currently trading in a narrow range within 0.64260 and 0.63300.

Wednesday’s decision is likely to prompt heightened trading activity, which could subsequently cause the price to break out of the range’s boundaries.

The direction of the price action is going to be dependent on the monetary policy decision itself.