The Board of Directors of the Reserve Bank of Australia is expected to gather on Tuesday to deliberate on the current Australian monetary policy and potentially on adjusting the interest rate in the country.

The consensus forecasts project no changes, which means that the interest rate is most likely to be maintained at its current level of 0.75 per cent.

Marginal improvements in unemployment and inflation support these expectations since RBA's previous interest rate decision.

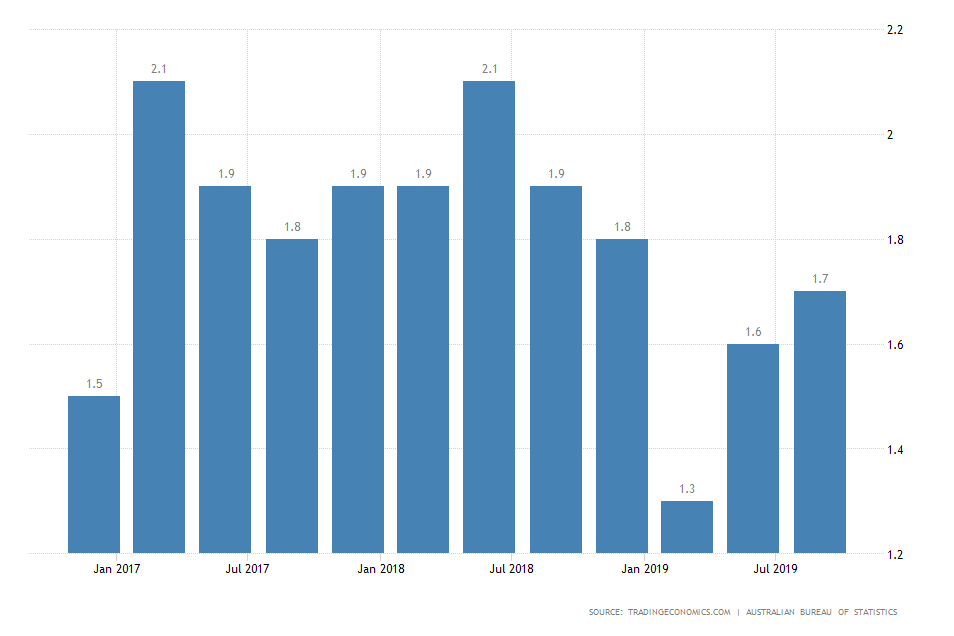

The inflation rate has increased by 0.1 percentage point in September and is currently at 1.7 per cent.

This marginal improvement in inflationary pressures is inlined with the RBA’s mid-term projections, even though net inflation remains close to, but below, the central bank’s target rate.

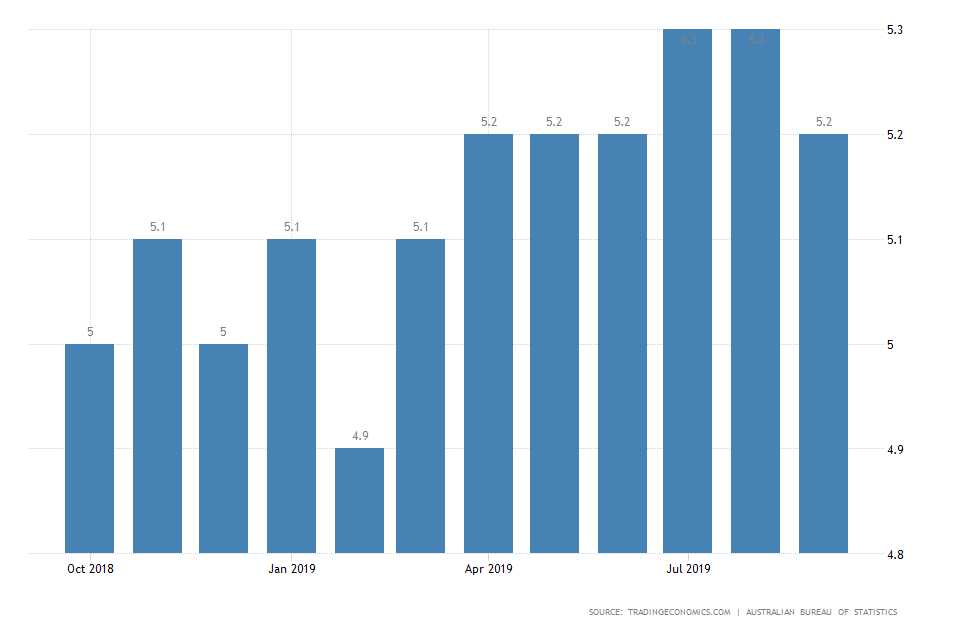

Noticeable improvement in labour market conditions has also been registered since the previous monetary policy meeting, as net unemployment has decreased by 0.1 percentage point in September.

Therefore, the seasonally adjusted unemployment rate has fallen back to 5.2 per cent and is currently within RBA’s mid-term forecasts.

In the previous monetary policy statement, the Board of Directors expressed optimism that the low-interest rates in Australia are going to accommodate sustained economic growth and price stability in the mid-term.

“The Board took the decision to lower interest rates further today to support employment and income growth and to provide greater confidence that inflation will be consistent with the medium-term target. The economy still has spare capacity and lower interest rates will help make inroads into that.”

The observed marginal improvements in employment and inflation over the last quarter signify the central bank's initial expectations for further growth; however, not everybody is entirely convinced of the monetary policy’s potential.

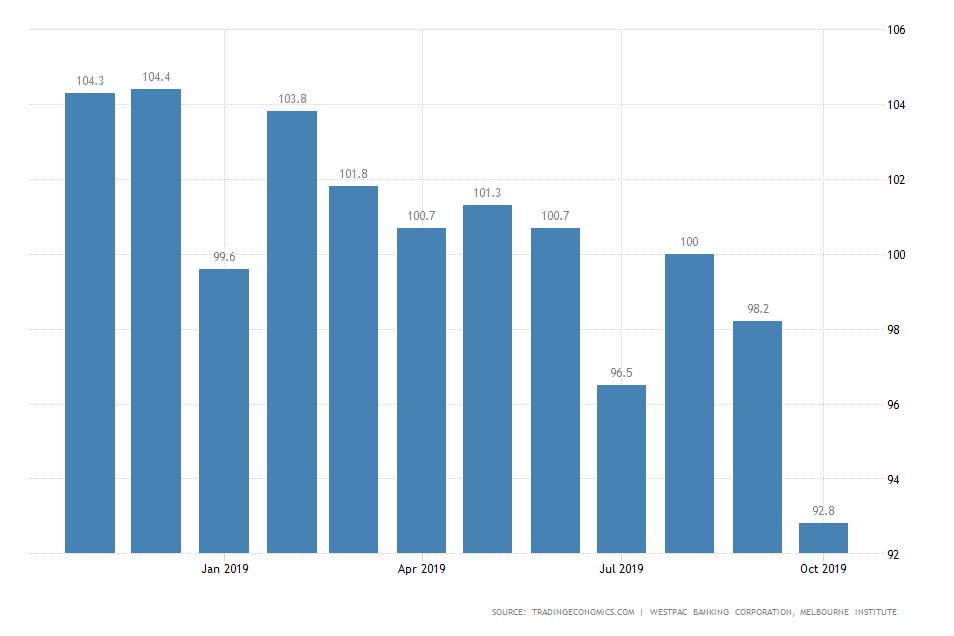

The consumer sentiment index tumbled by 5.5 per cent in October on a month-over-month basis and is currently on its lowest levels since July 2015.

Waning consumer confidence could potentially signify a deterioration in consumer spending, which, in turn, could impede the price stability in the country.

Overall, the RBA is most likely to abstain from lowering the interest rate further at the beginning of November; however, additional reductions by the end of the year are not completely out of the question given the observed plunge consumer confidence and the prolonged trade impasse globally.

Meanwhile, the bullish trend on the AUDUSD continues to develop in accordance with our earlier projections from the 14th of October, as the price moves closer to the significant level of 0.69362 which is the 61.8 per cent Fibonacci retracement.

A minor correction in the price to the 0.68800 support is likely to occur before the pair resumes trading higher.