Earlier today, the Bank of Japan expectedly decided to maintain its Policy Rate unchanged. Thus, the negative interest rate of -0.10 per cent was preserved in July due to fears of a second coronavirus wave.

Immediately following the release of BOJ's policy statement, the Yen started rising against the dollar, as per our earlier projections. So far during today's trading session, the USDJPY has moved by more than 30 pips.

Even though Haruhiko Kuroda, the Governor of the Bank of Japan, and the rest of his colleagues expressed certain optimism concerning Japan's prospects for growth and future recovery, the undertones of the monetary policy statement inspired the heightened demand for the Yen.

The Bank anticipates inflation to remain subdued for the immediate future due to the coronavirus fallout, which continues to be felt across the world even though the impact from the initial hit is now mostly offset.

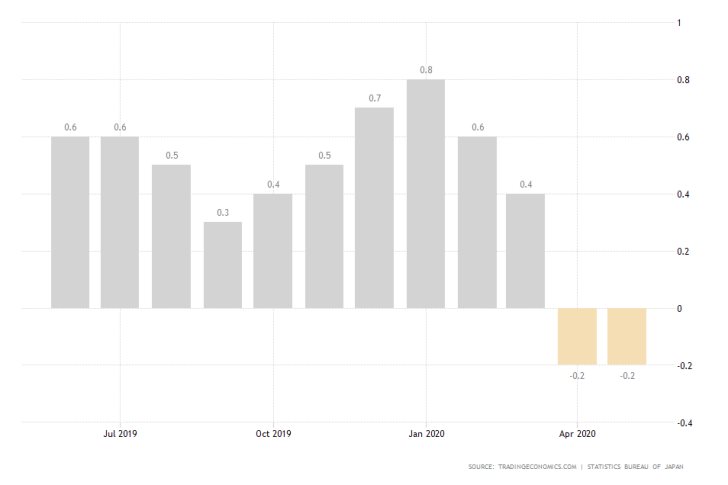

Additionally, the BOJ cited the crash in the oil market as a contributing factor to the currently negative inflation rate of -0.2 per cent.

As we argued in our comprehensive analysis from yesterday, the price action of crude oil may be due for another dropdown, which would have a negative impact on the fragile price stability in Japan, and likely prolong the current state of effective deflation.

The reinvigorated interest for the Japanese yen, as a globally recognised safe-haven asset, was prompted by the BOJ's cautionary rhetoric.

"The outlook for economic activity and prices […] is extremely unclear, since it could change depending on the consequences of COVID-19 and the magnitude of their impact on domestic and overseas economies. It is based mainly on the assumptions that a second wave of COVID-19 will not occur on a large scale […] these assumptions entail high uncertainties. With regard to the risk balance, risks to both economic activity and prices are skewed to the downside, mainly due to the impact of COVID-19. "

What the BOJ did was to underline the protracted uncertainty that continues to loom over the recovery process, and to stress that the tentative economic conditions could change at any moment as the crisis evolves.

Consequently, the demand for the Yen surged, as traders and investors started to weigh in on the possibility of a protracted recovery process in Japan and elsewhere, that exceeds the initial forecasts.

As can be seen on the 4H chart below, the USDJPY rebounded from the retracement peak at point 4, which is completely inlined with our earlier expectations.

The price action would now likely remain trading within the boundaries of the downwards sloping channel, as it heads further south.

If it manages to break down below the crucial test level at 106.700, which is encompassed by the minor support level there, the next target level would be point 5.

The latter would probably be positioned somewhere close to the channel's lower boundary, and also near the major support level at 106.000. The crossover on the MACD confirms the currently rising bearish momentum in the market.