The highly anticipated ADP report was released on Wednesday, and it highlighted some concerning trends in the American labour market, as well as some unexpected developments.

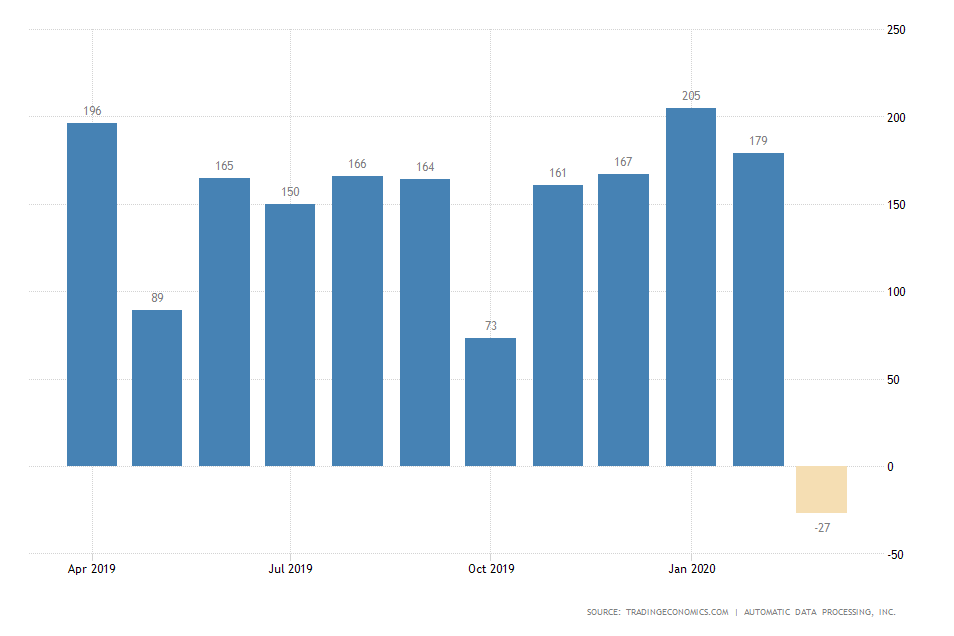

Overall, private-sector employment decreased by 27 000 in February, a downwards revision from the 179 thousand jobs that were created in January. Nevertheless, the deterioration is sizably smaller than the initial forecasts, which projected as much as 150 thousand lost jobs.

The most recent trends in employment underscore a significant loss of jobs in small business amounting to 90 thousand, but medium and large-scale business gained a combined 63 thousand new workers. Even still, the final results highlight a net loss of 27 thousand jobs in the labour market in March.

This contraction in employment underpins the vulnerability of the services sector in the US, which suffered a loss of 18 thousand jobs. This is exactly twice as much as the loss of labour that was recorded in the goods-producing sector.

In that regard, the findings of the ADP report highlight a global trend in labour market conditions everywhere. Primarily, that national lockdowns, which are intended to curb the spread of the virus, leave the services-providing sector especially vulnerable to external pressures and economic contractions.

The most jobs that were lost in the services sector are in trade, transportation & utilities, and in leisure and hospitality – 37 thousand and 11 thousand respectively. This was mostly anticipated given the virtual halt in operations in air travel and tourism.

Conversely, 48 thousand jobs were added in health and education. This transition underscores America’s increasing effort to combat the outbreak by employing more healthcare workers.

As regards the goods-producing sector, 16 thousand jobs in construction were lost, but manufacturing added 6 thousand new workers. If this trend is preserved in the midterm, it would likely impact the housing market in the states due to diminished construction activity.

Meanwhile, Donald Trump shifts to Keynesian economics by pledging a 2-trillion-dollar Infrastructure Bill, which he intends to propose to Congress as a new relief package for the reeling economy.

With interest rates for the United States being at ZERO, this is the time to do our decades long awaited Infrastructure Bill. It should be VERY BIG & BOLD, Two Trillion Dollars, and be focused solely on jobs and rebuilding the once great infrastructure of our Country! Phase 4

— Donald J. Trump (@realDonaldTrump) March 31, 2020

Given the near-negative federal funds rate, bolstered spending in infrastructure could accommodate the struggling construction sector by creating new jobs and a lasting upgrade in US infrastructure as a whole.

The stock market reacted negatively to the revised outlook for employment, even though the findings of the ADP report were not as detrimental as the consensus forecasts projected.

The Dow Jones Industrial Average plunged by 4.40 per cent during yesterday’s trading session to 20943.0 index points. The swing low was held above the crucial support level at 20900.0, which is the 23.6 per cent Fibonacci Retracement level.

Futures today are more optimistic, with the DJI trading at +1.30 per cent during the pre-market open.