On Thursday the Monetary Policy Committee (MPC) of the Bank of England decided to keep the Bank Rate in the country unchanged at 0.75 per cent in December, by a majority vote of 0-2-7.

The most significant excerpt from the monetary policy meeting was that for the second consecutive time two of the Committee’s nine members voted for the reduction of the rate, attesting to the need for a somewhat more accommodative policy.

As it was argued in our ‘Weekly Expectations’ article from Monday, the most crucial indicator that could swing the ultimate decision of the MPC in either direction was and remains to be, inflation.

In the monetary policy statement from yesterday, it was alleged that:

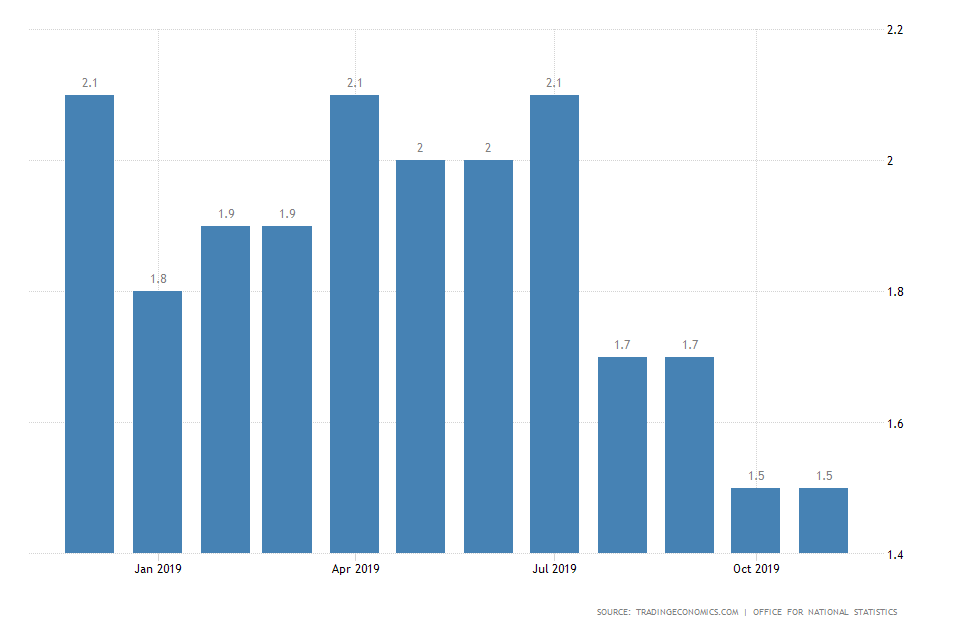

“CPI inflation remained at 1.5% in November, and core CPI inflation remained at 1.7%, broadly as expected. The headline rate is still expected to fall to around 1¼% by the spring, owing to the temporary effects of falls in regulated energy and water prices.”

The admission that inflation in the United Kingdom is expected to continue deteriorating away from the Bank of England’s 2 per cent target means that the MPC might have to loosen the monetary policy further in order to accommodate price stability.

The apparent waning of aggregate spending in the economy can be attributed mostly to uncertainties connected to impeded global trade and long-term Brexit ambiguities.

Another crucial indicator is the fact that despite the robust employment in the United Kingdom, wage growth has been somewhat subdued, which, in turn, curbs sustained consumer spending and leads to lessened inflation.

Thus, a reduction of the interest rate in Q1 of 2020 might be needed to support higher rates of customer and investor spending, in addition to acting as an insurance against heightened uncertainties, resulting from a likely no-deal divorce of the UK from the EU.

The words of the Committee members further confirmed this in the monetary policy statement:

“Monetary policy could respond in either direction to changes in the economic outlook in order to ensure a sustainable return of inflation to the 2% target. The Committee will, among other factors, continue to monitor closely the responses of companies and households to Brexit developments as well as the prospects for a recovery in global growth. If global growth fails to stabilise or if Brexit uncertainties remain entrenched, monetary policy may need to reinforce the expected recovery in UK GDP growth and inflation.”

Such changes, however, might be left to be implemented by Andrew Bailey, who was named earlier today as the 121st governor of the Bank of England.

Bailey will succeed Mark Carney in February, which would most likely happen immediately after Britain finally withdraws from the European bloc, which is scheduled to occur on the 31st of February.

One of the most pressing tasks ahead of BOE’s future new governor would be to promote price stability and support the recent strengthening of the pound, which has lost a lot of its power since the Brexit vote in 2016.

Meanwhile, the GBPUSD has expectedly fallen to the major support level at 1.29800, as we argued in our previous market update.

The price of the pair is likely to consolidate in a narrow range ahead of the anticipated low-liquidity market environment next week, which is expected to be prompted by the diminished trading activity around the Christmas holidays.