The Monetary Policy Committee (MPC) of the BOE is scheduled to deliberate on its monetary policy this Thursday.

Market analysts do not anticipate a likely change in the British interest rate by the MPC, with the consensus forecasts expecting the rate to be maintained at its current level, which is at 0.75 per cent.

However, the market braces for potential disagreements between the nine members of the committee.

On the last monetary policy meeting, which took place on the 7th of November, two members of the committees voted for a reduction of the interest rate.

The last time that the MPC was nearly as dovish was on the 14th of July 2016 –immediately after the Brexit vote – when Gertjan Vlieghe had voted for a reduction of the Bank Rate.

This time, it seems, that the surrounding Brexit tribulations might once again compel some of the MPC members to consider lowering the rate, as the general market expectations project the same 0-2-7 vote to be realised as the one that was observed in November.

Economic activity in the United Kingdom is currently being heavily influenced by Boris Johnson’s victory in last week’s general elections, which removed some of the overall uncertainty surrounding the country’s future.

Nevertheless, the MPC of the BOE has to think of what would happen with the business activity in the country once the initial excitement from the Tory victory settles down.

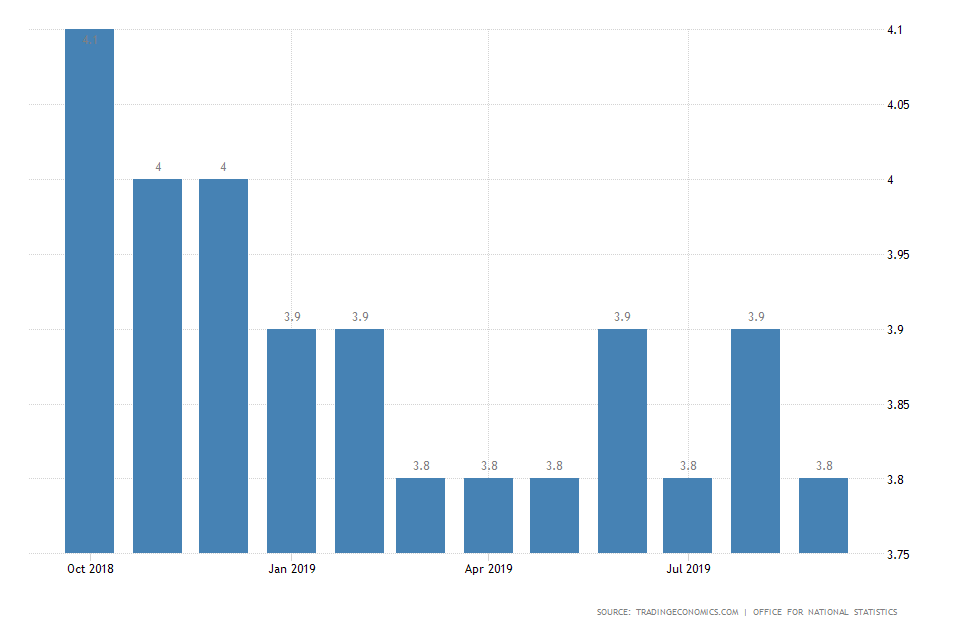

In terms of employment, the British labour market is currently performing exceptionally well.

Unemployment is currently at 3.8 per cent, which is the lowest level on record in nearly 45 years.

Nevertheless, other economic indicators are not as encouraging.

In terms of inflationary pressures, in mid-November, it was recorded that the inflation rate in Britain had decreased to 1.5 per cent in October, which is the lowest level on record since November 2016.

The trend of waning inflation is worrisome, as it exhibits signs of curbed price stability and weakening business activity.

This is the key factor that might compel even more members of the MPC to consider reducing the interest rate, which would make the monetary policy more accommodative.

In the last monetary policy meeting of the BOE, it was stated that:

“If global growth fails to stabilise or if Brexit uncertainties remain entrenched, monetary policy may need to reinforce the expected recovery in UK GDP growth and inflation. Further ahead, provided these risks do not materialise and the economy recovers broadly in line with the MPC’s latest projections, some modest tightening of policy, at a gradual pace and to a limited extent, may be needed to maintain inflation sustainably at the target.”

Meanwhile, the FTSE100 has surged by more than 3.70 per cent in the two since the announcement of Boris Johnson’s victory last Friday.

The price is currently reaching the major resistance level at 7558, as the aforementioned fundamentals bolstered the index.

Nevertheless, the bullish momentum could be exhausted soon, as indicated by the RSI indicator, which is nearing 'Overbought' territory.

This is especially true if the BOE adopts a more accommodative monetary policy on Thursday.