The GBPUSD is currently experiencing heightened volatility due to varied factors, both internal and external. Meanwhile, the broader market sentiment remains ostensibly range-trading, as was detailed by our last follow-up analysis of the pair.

The Office for National Statistics in the UK posted better-than-expected employment numbers for May, which bolstered the pound momentarily. Nevertheless, the trend of resurging coronavirus cases of the new delta variant has compelled the British government to extend the deadline of the lockdown measures yet again.

These starkly opposed developments have increased the underlying volatility of the GBUSD in the short term.

The cable broke out above the 38.2 per cent Fibonacci retracement level (from the latest downswing, represented on the 30 Min chart above) and is currently headed towards the 61.8 per cent mark. This represents a minor bullish pullback in an otherwise increasingly more bearish-looking market.

The widening Bollinger Bands underpin the aforementioned upsurge in adverse volatility, while the uptick in bullish momentum, as seen on the MACD, elucidates this minor bullish pullback.

The emergence of a Morning Star structure at the lower end of the range (spanning between 1.40800 and 1.41800) indicates the possibility for the pullback to extend as far as the range's upper boundary.

However, before the pair could do so, the price action would have the break out above several key resistances. The 200-day MA (in orange) and the 300-day MA (in purple), both of which serve as floating resistances, and the aforementioned 61.8 per cent Fibonacci retracement level at 1.41412.

A decisive reversal could occur from either of the four, allowing bears to add to their selling orders in anticipation of further price depreciation.

Temporary encouraging labour data amidst resurging cases

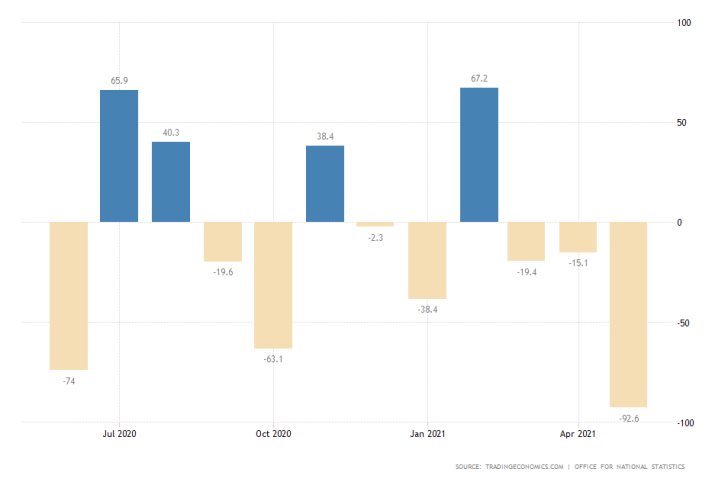

According to today's labour force survey, the number of people claiming unemployment benefits fell by 92.6 thousand in May, compared to the much smaller decrease of 15.1 thousand that was recorded a month prior.

This performance exceeded by far the consensus forecasts, which were anticipating the total claimant count to increase by 25.0 thousand. Despite these massively positive numbers, headline unemployment remained virtually unchanged at 4.7 per cent.

Meanwhile, Boris Johnson's cabinet announced that the national lockdown would be extended by four weeks due to a massive uptick in Covid-19 cases of the new Delta variant. The restrictions were initially supposed to be lifted on the 21st of June.

WATCH LIVE: An update on coronavirus (14 June 2021) https://t.co/jqGvXyJU2i

— Boris Johnson (@BorisJohnson) June 14, 2021

The deadline extension is likely to jolt investors' optimism, as the decision could have a fallout impact on the recuperating economic activity in Britain. This could also weigh down on the labour market over the next month.