Microsoft is the latest major U.S. company to post better-than-expected quarterly results during the current earnings season. Even so, the stock market continues to be in turmoil due to a massive stocks selloff. You can learn more about it from our Nasdaq Composite analysis.

After the market close yesterday, the tech giant released its earnings numbers for the three months ending in December, beating Wall Street's forecasts across the board. Meanwhile, the share price appears to be attempting to consolidate above the previous swing low.

MSFT's selloff is taking the shape of a descending wedge pattern, as can be seen on the 4H chart above. This is a type of structure that typically entails potential bullish rebounds, which gives investors a reason to expect the end of the correction soon. This is further bolstered by the fact that the bottleneck of the wedge looks poised to take place at the previous swing low at 280.00.

Not only that, but the 500-day MA (in green) has recently crossed above this major support level, making it an even more prominent turning point. This is elucidated by the fact that its first test took the shape of a Hammer candlestick, further substantiating the expectations for a rebound.

The first obstacle for the eventual rebound would be the 23.6 per cent Fibonacci retracement level at 293.39, which is currently converging with the 400-day MA (in purple). The next target would be the 38.2 per cent Fibonacci at 304.17.

In addition to the fact that it was recently crossed by the 300-day MA (in red), the resistance is positioned just above the psychologically significant threshold at 300.00. All of this implies the probable accumulation of strong selling pressure just above the 38.2 per cent Fibonacci.

Microsoft Posted Record-Breaking Quarterly Results

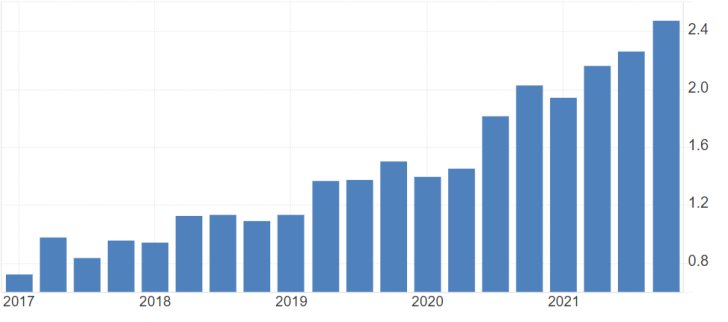

The company posted earnings per share (EPS) of $2.48 vs $2.31 expected. Its revenue reached $51.73 billion, well above the $50.88 billion projected by Wall Street analysts. Microsoft's robust quarterly results thus continued the trend of very solid earnings data being posted by some of the biggest U.S. companies.

Satya Nadella, chairman and chief executive officer of Microsoft, had this to say about the company's quarterly performance:

"Digital technology is the most malleable resource at the world’s disposal to overcome constraints and reimagine everyday work and life. As tech as a percentage of global GDP continues to increase, we are innovating and investing across diverse and growing markets, with a common underlying technology stack and an operating model that reinforces a common strategy, culture, and sense of purpose."

💻 Business Highlights: More Personal Computing 🎮

— Microsoft (@Microsoft) January 25, 2022

Windows OEM revenue ⬆️ 25%

Windows commercial products and cloud services revenue ⬆️ 13%

Xbox content and services revenue ⬆️ 10%

Search advertising revenue excluding traffic acquisition costs ⬆️ 32%

Surface revenue ⬆️ 8%