The Federal Open Markets Committee of the Federal Reserve has its sixth monetary policy meeting scheduled for Wednesday and the prevailing market forecasts project a likely cut in the interest rate from the current 2.25 per cent level to 2.00 per cent. The Committee has a lot of economic indicators to consider, with notable recent changes in inflation and major developments on the international stage.

The FED had already cut the rate once this year, which happened during the previous meeting, when the Committee decided to reduce the interest rate with 25 basis points to the current level of 2.25 per cent. Investors weigh in on the possibility for a new reduction this week based on the Committee's statements from the last meeting, which was held on the 31st of July.

“On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.” [source]

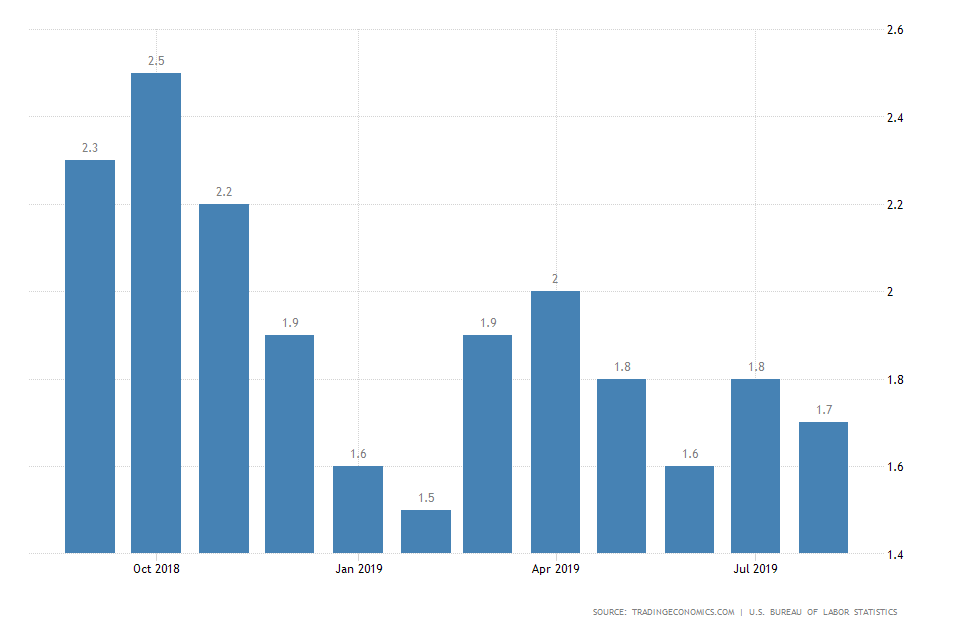

The price setting in the US deteriorated in August as the inflation rate fell with one basis point to 1.7 per cent. Thus, subdued inflationary pressures have become a serious reason for apprehension amongst FOMC members, because the recent trend of deteriorating performance is driving inflation away from the Committee's 2 per cent symmetric objective. Arguably, this could turn into the most significant reason for a rate cut later during the week.

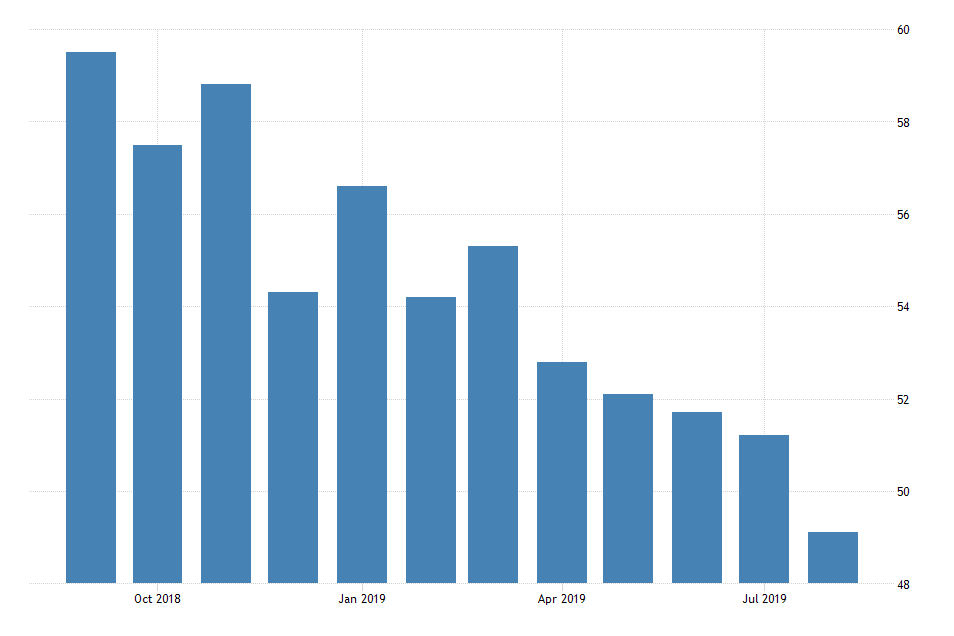

Meanwhile, the labour market continues to be resilient to both internal and external pressures. The overall unemployment rate has remained steady at 3.7 per cent for the previous three months and average earnings have risen on each occasion. Despite that strong performance, however, business confidence has been continuously decreasing for the last six months and with that the business fixed investments have deteriorated as well.

Finally, the prolongation of the trade war between the US and China continues to exert pressure on global trade and the recent hair strikes of Saudi oil facilities by Yemeni rebels are undoubtedly going to increase the global uncertainty, which in turn is already weighing heavily on international markets (you can read more about the impact of the attacks in Saudi Arabia on the oil market here).

Overall, the previous rate cut has not been enough to offset the trend of deteriorating growth and the FED would be justified in adopting an even more accommodative stance. However, there is still a possibility that the Monetary Committee might decide to maintain the interest rates unchanged in order to keep monitoring the situation as it develops, which might disappoint investors but ultimately could be understandable in this unpredictable environment.

The EURUSD pair has recently managed to break above the fundamentally important resistance level at 1.10700, which is positioned just above the upper boundary of the major bearish channel. Thus, the pair is currently building on bullish momentum and Wednesday's decision is certain to have a significant impact on the price action for the next quarter.