FED Has to Address the Issue of High Inflation

The sharp uptick in consumer prices in May caused additional volatility outbursts for the U.S. dollar. The EURUSD is yet to establish a bearish reversal as the greenback strengthens. FED's meeting this week is likely to speed up this process.

The most decisive event in the economic calendar for this week will undoubtedly be the June meeting of the FED, which is scheduled to take place on Wednesday. Jerome Powell and his colleagues from the Federal Open Market Committee (FOMC) should deliberate on the latest economic developments in the U.S. and elsewhere.

The Committee is expected to maintain the near-negative Federal Funds Rate unchanged at 0.25 per cent, similarly to the policy stance that was adopted by the ECB last week.

However, some worried market participants would like to hear hints in FOMC's statement suggesting the potential tightening of the policy by the end of the year. This is so due to steadily rising inflationary pressures, driven by heightened consumers sentiment and soaring energy demand.

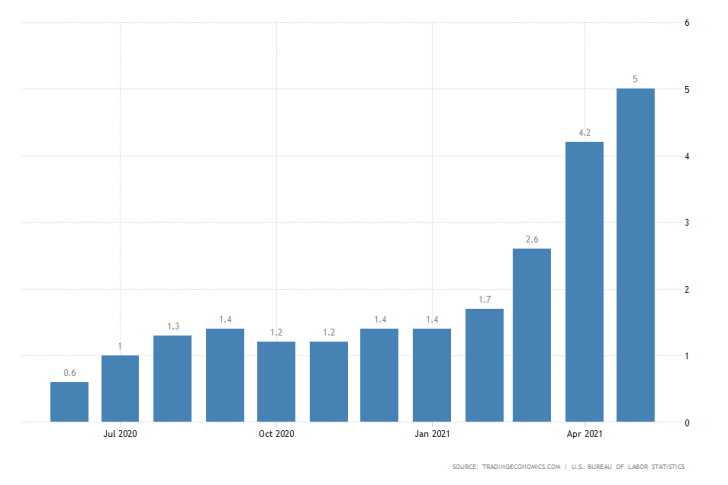

Headline inflation in the U.S. peaked at 5.0 per cent in May, above market forecasts.

While Jerome Powell and his colleagues had previously stated that they expect inflation to increase moderately above the 2.0 per cent symmetric rate in the near future before eventually converging back closer to the target, the rising pace of consumer prices growth may compel the FOMC to recalibrate its baseline forecasts.

The adoption of a more hawkish policy stance by the FED would likely strengthen the greenback as this would ease tensions and calm investors. The central focus on Wednesday would therefore be placed on FOMC's current take on inflation and whether it sees the need to tighten its policy sooner than initially planned.

Consumer Prices in Canada Likely to Continue Increasing at the Same Pace

Also on Wednesday, Statistics Canada is supposed to release the latest CPI data for the previous month.

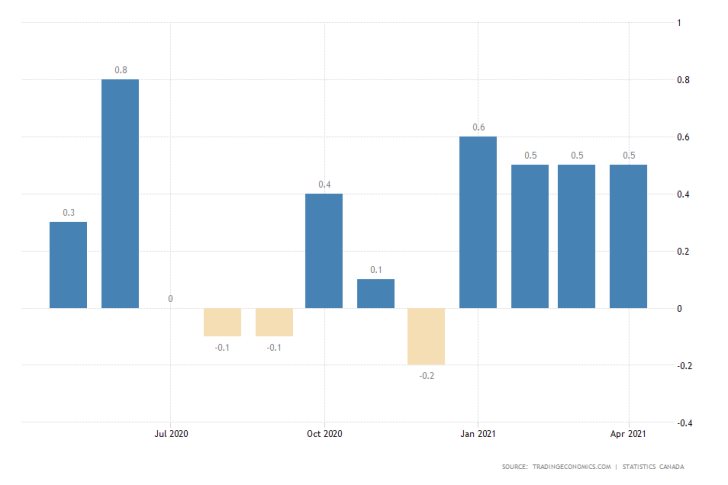

Inflation in Canada has been growing at the same 0.5 per cent pace over the last three months, and the consensus forecasts anticipate this to be the case in May yet again.

Global demand eased marginally last month, which is likely to be reflected in Canadian consumption for the same period. Moreover, this also coincided with a minor stretch of corrective price action for crude oil, which is also likely to contribute to a smaller rise in CPI.

With inflation rising at a slower pace, the Canadian dollar is likely to continue giving way to the strengthening greenback.

U.S. Retail Sales Expected to Stall in May

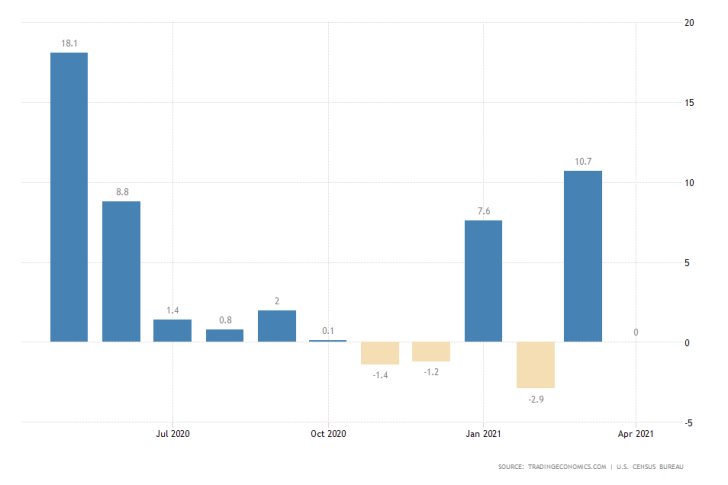

The U.S. retail sector is projected to have contracted marginally in May as the initial impact of Joe Biden's "American Rescue Plan", which began in March, is starting to diminish as enthusiasm drops.

Retail sales are forecasted to drop by 0.6 per cent in May, following a downwards revision to 0.0 per cent the previous month. The Census Bureau is set to post the data on Tuesday.

The consensus forecasts for muted retail sales data represents the only conceivable hurdle that could impede the strengthening of the U.S. dollar over the next five days. Yet, the greenback seems poised to continue appreciating against the Loonie in the longer run.

Last week, the USDCAD was finally able to break out above the upper boundary of a massive Accumulation range, as presented on the 4H chart below. This happened after a prolonged period of consolidation above the 100-day MA (in blue), underpinning the steadily rising bullish bias.

The breakout above 1.21350 and the 200-day MA (in orange) implies that the USDCAD may finally commence establishing a new Markup. This transition from the preceding Accumulation into a new Markup occurs as per the expectations of the Wyckoff theory.

The price may yet drop to the upper end of the Accumulation from above before rebounding and continuing to head north. The first major target for the new uptrend is underscored by the 200-day MA (in green). This is the resistance at 1.22700.

Other Prominent Events to Watch for:

Tuesday - BOE Governor Bailey Speaks; U.S. m/m PPI; U.S. m/m Industrial Production; RBA Meeting Minutes; UK m/m Unemployment Rate; Germany Harmonized Index of Consumer Prices.

Wednesday - UK y/y CPI; BOC Governor Macklem Speaks; New Zealand q/q GDP; China y/y Retail Sales.

Thursday - RBA Governor Lowe Speaks; Australia Unemployment Rate; Switzerland SNB Policy Decision.

Friday - BOJ Policy Decision; UK m/m Retail Sales.