FED to Reaffirm its Stance on Inflation on Wednesday

Finally, Big Tech is on the line to report quarterly earnings, which will undoubtedly stir heightened volatility on tech stocks. This is happening just as the Nasdaq Composite is trying to re-establish itself. Check out our detailed analysis of the index to prepare yourself ahead of the Apple, Alphabet and Microsoft earnings this week.

In what looks poised to be one of the most eventful weeks for markets this year, the July meeting of the FED, which is scheduled to occur on Wednesday, will take centre stage.

Jerome and his colleagues from the FOMC are expected to expound upon their inflationary goals. The dollar has been rallying ever since the June meeting of the FED when the Committee laid out its plans for a future hike.

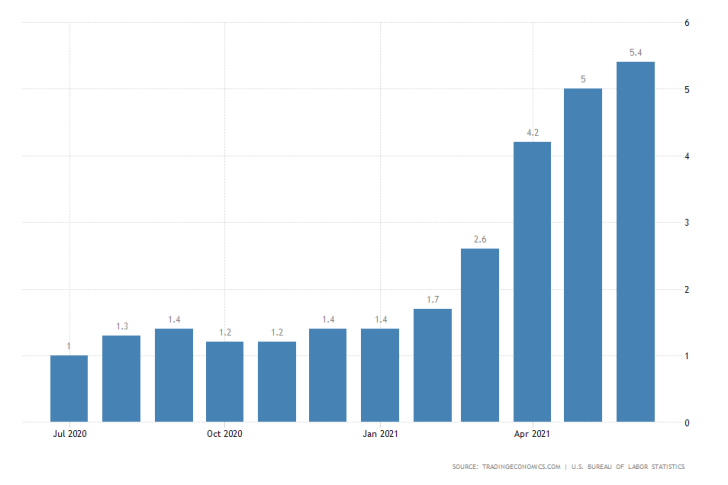

The FOMC expects headline inflation to remain marginally above the 2.0 per cent level over the near future before prices converge lower by the end of the year. That is why the FED adopted a new strategy that allows for inflation to temporarily exceed this benchmark.

The Committee is highly unlikely to deviate from this new path to recovery it took so recently, which is why the greenback is likely to be bolstered even more on Wednesday. The near-negative Federal Funds Rate is expected to be maintained at 0.25 per cent.

U.S. GDP Growth Rate Forecasted to Expand Massively in Q2

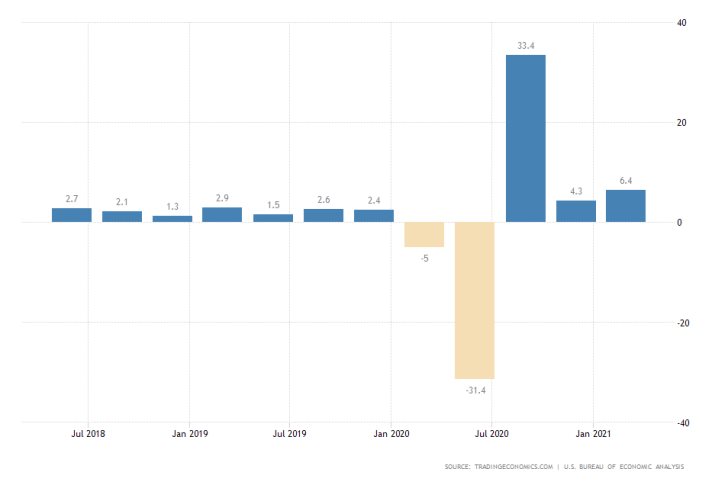

On Thursday, the U.S. Bureau of Economic Analysis is scheduled to publish the GDP growth rate numbers for the second quarter of 2021. Since this will be the advance report for the three months leading up to June, the market reaction to its release will likely be strong.

According to the preliminary forecasts, the rate of economic expansion is projected to reach 8.5 per cent, marking a considerable increase compared to the 6.4 per cent growth that was recorded in Q1.

If these projections are realised, this would confirm Jerome Powell's recent comments regarding the robust economic data that has been recorded over the first portion of the year.

Big Tech is Next in Line to Report Quarterly Earnings

This week will be the most significant one from the current earnings season, with prominent releases from some of the biggest blue-chip companies in the U.S. First, on Monday, Tesla will kick-start the whole thing with its report after the market close.

Alphabet, Apple, and Microsoft are next in line, all reporting on Tuesday after the market close. Facebook will keep things interesting on Wednesday, while Amazon will close off the week with its highly anticipated report on Thursday.

“Add to cart” is definitely a mood.

— Amazon (@amazon) July 23, 2021

That last report is of particular interest, given the current technical outlook on Amazon's share price. As can be seen on the 4H chart below, the price action is currently attempting to consolidate above the major resistance-turned-support level at 3562.78.

The latter's prominence also stems from the fact that it underpins the 23.6 per cent Fibonacci retracement level from the last upswing, which was commenced in the form of a Pennant.

A potentially robust earnings report on Thursday could strengthen Amazon's stock price above this critical barrier and send it soaring higher into uncharted territory.

Other Prominent Events to Watch for:

Monday - Tesla Inc. Reporting AMC.

Tuesday - U.S. CB Consumer Confidence; Japan BOJ Chair Kuroda Speaks; U.S. MoM Durable Goods Orders; Alphabet Inc. Reporting AMC; Apple Inc. Reporting AMC; General Electric Co. Reporting BMO; Starbucks Corp. Reporting AMC; Microsoft Corp. Reporting AMC; Visa Inc. Reporting AMC.

Wednesday - Australia QoQ CPI; Canada MoM CPI; U.S. Crude Oil Inventories; U.S.; Boeing Co. Reporting BMO; Ford Motor Co. Reporting TAS; Mcdonald's Corp. Reporting BMO; Facebook Inc. Reporting AMC; Qualcomm Inc. Reporting AMC; Pfizer Inc. Reporting BMO.

Thursday - Amazon.com Inc. Reporting AMC.

Friday - Canada MoM GDP; Germany QoQ GDP; Exxon Mobil Corp. Reporting BMO;