U.S. GDP Growth in Q2 with a Likely Upward Revision

The most important currency pair to keep an eye on this week will be the EURUSD. The U.S. GDP data coupled with the latest inflation numbers in the Eurozone are likely to cause heightened volatility on the pair. Have a look at our newest EURUSD analysis to get a comprehensive picture of the broader market sentiment.

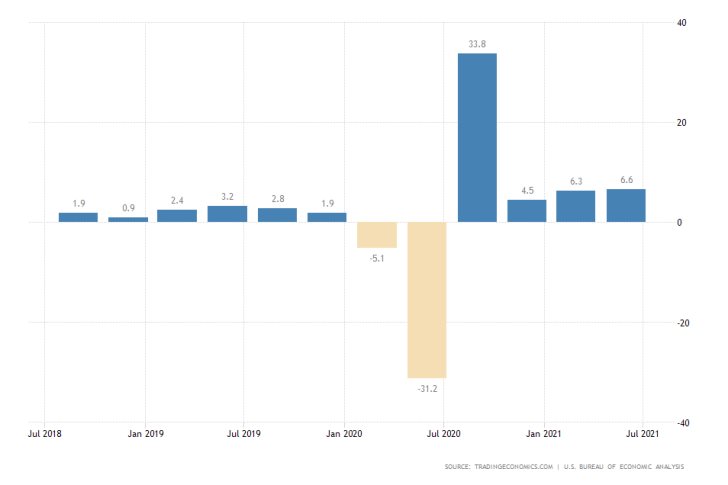

The U.S. Bureau of Economic Analysis is scheduled to post the final Gross Domestic Product numbers for the second quarter on Thursday. The advance reading showed a 6.5 per cent growth over the same period, whereas the final release is expected to underpin an upward revision of 0.2 per cent.

If realised, this would be the most robust quarterly expansion since the immediate rebound in the wake of the coronavirus crash, and it would also be inlined with the slightly more optimistic tone of the Federal Reserve.

The U.S. economy continues to be recovering, albeit at a bumpy and uneven pace. Inflation growth eased last month parallel to a global drop in consumption. That is why Thursday's data could show whether the U.S. economy is in a position to weather such bumps on the road.

Headline Inflation in the Eurozone to Consolidate Around 3.0 Per Cent

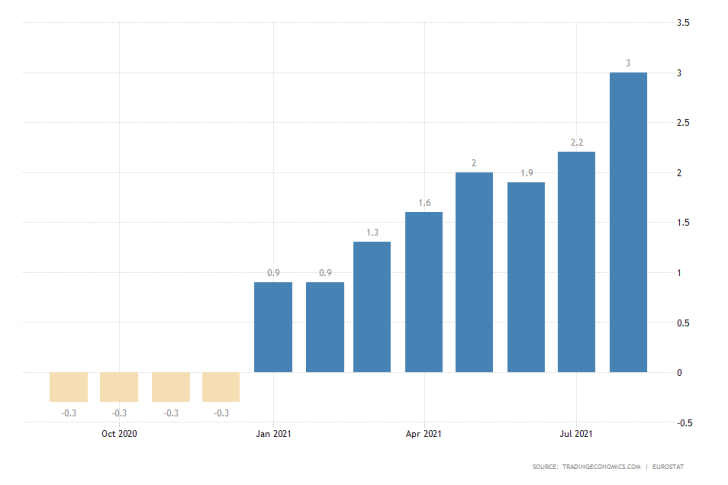

Again on Thursday, Eurostat will release the preliminary Consumer Price Index (CPI) findings for September. According to the consensus forecasts, headline inflation is expected to consolidate around the 3.0 per cent peak that was reached the month before.

Consumer prices in the Eurozone reached their highest level since November 2011 owing to a sharp pick-up in domestic demand coupled with the solid recovery of energy prices over the last quarter.

Even still, the economies of the bloc were not left unscathed by global ripples in demand. The recent supply bottlenecks, though reduced in large part, continue to weigh down on the industry.

Just last month, industrial output in Germany decreased markedly. It remains to be seen whether this would have any lasting impact on domestic demand in the Eurozone.

Nominal Recovery in Chinese Manufacturing Projected for September

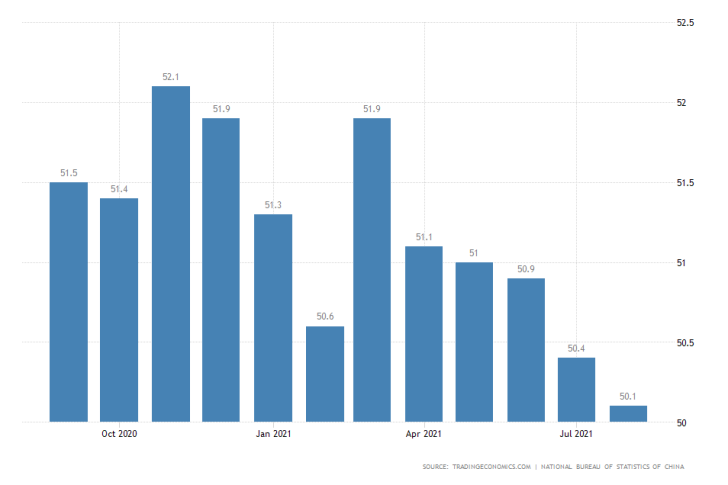

The official NBS manufacturing PMI for China will be released during the Asian session on Thursday. According to the consensus forecasts, factory activity in the world's biggest economy is expected to increase marginally by 0.2 per cent in September.

If realised, this would mean that the manufacturing PMI would reach 50.4 index points, barely above the 50.0 mark, indicating broad industry expansion. Even still, this would be a positive development given the last five months of consistently contracting factory activity.

As stated in the introduction, the one pair that is worth keeping track of this week is the EURUSD, owing to the major economic releases in the U.S. and Europe. The price action remains concentrated within the boundaries of a descending channel, which can be seen on the 4H chart below.

Moreover, it appears to be developing a major 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. It just finished establishing the second impulse leg (2-3), which is itself a minor 1-5 structure. Now, the price action appears to be developing the second retracement leg (3-4).

A potential pullback to the 61.8 per cent Fibonacci retracement level at 1.17583 may ensue before the final impulse leg (4-5) gets ready to probe the nearest swing low at 1.16650.

Other Prominent Events to Watch Out for:

Monday - U.S. MoM Durable Goods Orders.

Tuesday - U.S. MoM Consumer Sentiment; Japan MoM Retail Trade.

Wednesday - ECB President Christine Lagarde Speaks; FED Chair Jerome Powell Speaks; BOJ Chair Kuroda Speaks; BOE Bailey Speaks.

Thursday - UK QoQ GDP Growth Rate; Japan MoM Takan Large Manufacturing Index.

Friday - Canada MoM GDP Growth Rate; U.S. MoM Core PCE Price Index; U.S. MoM Manufacturing PMI.