Germany and France, the biggest and second-biggest economies in the Eurozone respectively, delivered encouraging services PMI and manufacturing PMI numbers for June.

The recorded industrial performance surpassed the consensus forecasts' initial projections, which were projecting robust improvements across the two sectors. The final results are demonstrative of sustainable economic recovery in the Eurozone.

The solid performance is attributed to the gradual easing of restrictions in the two countries, which has been going on over the last several weeks. With the economies being allowed to reopen, the general economic activity is once again on the rise.

Additionally, the comprehensive Pandemic Emergency Purchase Program (PEPP) of the ECB, which was intended to cushion the impact of the coronavirus fallout, and to foster recovery, is already showing its efficiency.

The intricate asset-purchasing facility of the Bank is so far proving quite useful in injecting liquidity where it is most needed – in the industry sectors that continue to reel from curbed activity.

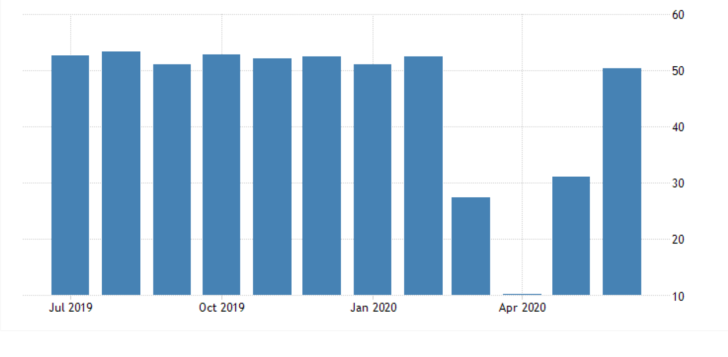

This is most evident in the French services sector as the PMI indicator made a tremendous monthly jump of nearly 20 points. As regards the French services sector, the industrial activity has almost returned to its pre-crash levels.

The German services PMI generated quite a robust 13-point jump too. This aspect of the German industry represents an important benchmark for economic stability. Manufacturing recuperated as well.

Today's data support investors' expectations that the EU is overall on the right track towards achieving recovery from the initial market crash.

Moreover, the pickup in industrial activity in the Eurozone's top two economies is likely going to bolster investors' confidence, which, in turn, would likely affect the European stock market positively.

Today's data also strengthened the Euro, which rose by nearly 0.30 per cent against the dollar following the release of the industrial numbers.

The EURUSD is currently continuing to appreciate, as per our projections from yesterday.

The expectations for the upswing's continued development are supported by the behaviour of the pair's price action, as can be seen on the 4H chart below.

Following the completion of a false rebound from the 23.6 per cent Fibonacci retracement level at 1.12706, the price action managed to break out above this pivotal resistance.

As the underlying bullish momentum continues to rise, the EURUSD is likely to continue advancing north, being supported by today's industrial data in France and Germany.

The next likely target level would be the minor resistance level at 1.13475. Market bulls, however, should be cautious if they plan to join an existing uptrend, as bearish corrections could emerge still.