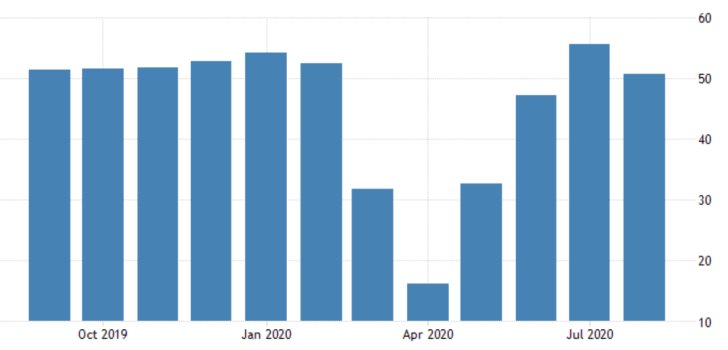

The overall industrial activity in the Eurozone fell in August even with the ongoing process of gradual easing of governmental restrictions in many countries.

The two largest economies in the Euro Area – France and Germany – registered worse-than-expected services and manufacturing performances, which underscores ECB's fears for a protracted and uneven recovery over the next quarters.

The French Services and Manufacturing PMIs missed the consensus forecasts markedly by 4.4 and 4 index points, respectively. Meanwhile, German manufacturing managed to exceed the initial market expectations by 0.8 index points, which is the only positive outcome from the report.

By far and large, however, the biggest industrial disappointment was also recorded in Germany. The Services PMI contracted by 4.8 index points from a month prior and missed the consensus forecasts by a margin of 4.5 index points.

The slump in German services represents a major point of concern for European policymakers and investors because this industrial sector occupies the largest portion of Germany's overall economy.

German growth depends vastly on the robust performance of the services industry, which continues to be reeling from the coronavirus fallout.

That is why the downbeat performance of the German Services PMI, which could be partially explained away by the effect of summer seasonality, had an immediate spillover effect on the euro.

The single currency fell by as much as 0.60 per cent against most other majors following the publication of Markit's report, which, in particular, catalysed the anticipated correction on the EURJPY pair.

As can be seen on the 4H chart below, the immediate market reaction to the news exacerbated the underlying bearish pressures already affecting the EURJPY, and the pair continued developing its latest 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory.

Nevertheless, the broader market sentiment continues to be ostensibly bullish, which is confirmed by the Ichimoku Cloud indicator.

The downswing could fall as low as the 23.6 per cent Fibonacci retracement level at 123.924 before the bearish pressures in the short-term are exhausted, and the price action resumes heading further north.

As was argued in yesterday's analysis of the pair, the market is currently in the process of establishing a broader bullish trend, which is why today's data is unlikely to reverse this.

Trendsharks Premium

Gold is undergoing a correction, as investors take profits to offset losses from falling stock prices, impacting their margins. However, we anticipate a renewed wave of [...]

The Swiss stock market index is mirroring its global counterparts, such as Germany 40 and US100, experiencing a sharp decline following the announcement of new [...]

We’re analyzing the weekly chart to grasp the broader market trend. Over the past three years, the US30 index has surged by 17,000 points, often resembling a nearly straight [...]

Over the past week, the DAX has experienced a sharp decline, plunging by an astonishing 3,400 points. This downward movement is not isolated, as its international counterparts, such as the UK100 and US100, are also facing significant [...]

EURUSD recently formed a double top at 1.0930, signaling a potential trend reversal, and has since begun a correction. After a 600-pip rally since early March, a pullback at this stage is both expected and healthy. Given these conditions, we are placing a [...]

Since early March, EURJPY has surged nearly 1,000 pips, providing us with several excellent trading opportunities. However, as the rally matures, many early buyers are beginning to take profits, leading to a noticeable slowdown in the uptrend. On Friday, the pair formed a [...]

The AUDJPY currency pair continues to be dominated by bullish momentum, as multiple golden cross patterns reaffirm the strength of the ongoing uptrend. Despite this, we are witnessing a much-needed [...]

The EURAUD currency pair appears to be undergoing a trend reversal, signaling a potential shift in market direction. A notable technical development is the formation of a Death Cross on the chart, a widely recognized bearish indicator that typically suggests a [...]

After securing an impressive 200-pip profit last week, the EURJPY currency pair is now undergoing a southward correction, retracing some of its recent gains. Despite this temporary pullback, the Golden Cross remains intact, reinforcing our view that the overall trend continues to be [...]

The appearance of a Golden Cross in Silver strengthens our analysis that the metal is currently in a strong uptrend, indicating further bullish momentum in the market. This technical pattern, where the short-term moving average crosses above the [...]

This trade presents a considerable level of risk and can be classified as an opportunistic move based on recent price action. The GBPUSD currency pair has experienced a substantial bullish rally, surging by nearly 500 pips in a strong upward movement. However, after this extended period of appreciation, the pair is showing signs of a potential [...]

The anticipated Death Cross on the SMI20 appears to be failing as price finds strong support at the 23% Fibonacci retracement level. After testing this area, the index has shown bullish strength, printing several large green candles, signaling an increase in [...]

A Golden Cross has just appeared on the USDJPY chart, signaling a potential bullish move. This technical pattern occurs when the 20 period moving average crosses above the 60 period moving average, a widely recognized indication of increasing [...]

After 2 months of a down trend, we finally see some indications of price recovery for Oil. The golden cross, a historic buy signal, supports this [...]

For the past month, the German DAX40 has experienced a remarkable 10% surge, reflecting strong bullish momentum. Despite ongoing market volatility and frequent pullbacks, every dip continues to attract fresh buyers, reinforcing the [...]

Oil continues its downward trajectory, despite occasional pullbacks. The overall trend remains bearish, reinforced by multiple Death Cross patterns, a classic sell signal indicating further weakness. Adding to this bearish outlook, the critical [...]

Over the past few days, gold has experienced a sharp decline of more than $100. This downturn can be attributed in part to traders securing profits to manage their margins, which are under strain due to the significant drop in major indices. Currently, gold has fallen below the [...]

The NASDAQ 100 index is showing strong bullish momentum, as evidenced by the formation of a Golden Cross on the chart. This classic buy signal occurs when the short moving average crosses above the long term moving average, suggesting that upward momentum is [...]

The EURAUD currency pair has encountered a significant resistance level, failing to break above the critical 61% Fibonacci retracement level. This suggests that bullish momentum is weakening, reinforcing the case for a potential downward move. Given this technical setup, we favor entering a [...]

The UK100 is experiencing a remarkable rally! Over the past few weeks, the British stock market index has surged nearly 800 points. Each minor dip has attracted more buyers, fueling the bullish momentum. However, since last week, we’ve observed a slight [...]