The global supply bottlenecks are turning into a major factor across different markets. This is prompting heightened inflation, the impact of which is felt on the EURUSD. Check out our last analysis of the pair for more information.

Despite a minor pullback on IHIS Markit manufacturing PMI index, Eurozone's factory employment grew by record-breaking levels in July because of persisting supply bottlenecks worldwide.

European factories are struggling to fill the massive orders, which is why they are hiring workers at a pace that has never been recorded before. It is precisely this discrepancy between supply and demand that is causing inflation to soar globally.

The EURUSD rallies amidst growing factory activity in the Eurozone and elsewhere. As can be seen on the 4H chart above, the pair's price action has been concentrated within an ascending regression channel in the short term.

The latter also appears to be taking the form of a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. Upon its completion, a minor dropdown to the 38.2 per cent Fibonacci retracement level at 1.18498 occurred.

This could be the first part of a currently evolving ABC correction. Keep in mind that the MACD indicator has recorded a bearish crossover in the underlying momentum recently.

If the current pullback peaks below the top at point 5, this could lead to a deeper bearish correction afterwards. On the condition that the price action reverses from the middle line of the channel and then breaks down below the 23.6 per cent Fibonacci at 1.18723, this could be followed by a subsequent dropdown to the 61.8 per cent Fibonacci at 1.18134.

It is interesting to point out that the 20-day MA (in red) is threading near the 23.6 per cent Fibonacci, the 50-day MA (in green) is converging with the 38.2 per cent Fibonacci, and the 100-day MA (in blue) has just crossed above the 61.8 per cent Fibonacci.

This makes the three Fibonacci thresholds even more significant support levels.

Eurozone factories scramble to hire workers; manufacturing growth eases in July

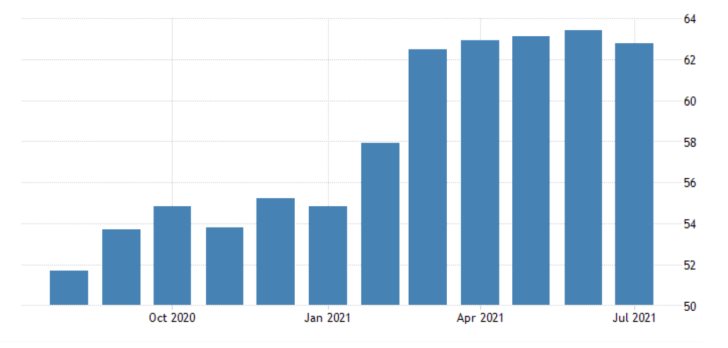

According to Markit's latest industry survey findings, Eurozone's manufacturing PMI was revised down to 62.8 in July from the 63.4 index points that were recorded a month prior.

Even still, the euro was bolstered by the report in the short term as inflation was shown to have grown yet again. This is owing to persisting supply chain disruptions that cause the aforementioned disparity between demand and supply.

"Operating capacities were tested in July, as evidenced by a considerable increase in backlogs of work across euro area goods producers. Firms responded by hiring additional staff at a rate unseen in 24 years of data collection. Job creation was especially marked in Germany and Austria."