ECB Has to Weigh in on the Growing Threat of Inflation in its Financial Stability Report

On Wednesday, the ECB is scheduled to post its newest Financial Stability Report, reflecting on the underlying risks to recovery and the latest financial trends in Europe. This report is released twice a year, which is why it is perceived as an important benchmark outlining the baseline scenarios for economic growth in Europe.

European asset markets are thus likely to fluctuate around the middle of the week, as the ECB weighs in on the growing threat of inflation to the global economy. It is currently running the risk of overheating due to the sharply rising prices worldwide.

This trend is fuelled by rallying commodity prices, particularly in the energy sector. The price of crude has been on the advance throughout the first quarter without registering any major corrections.

The ECB is expected to adjust its view on inflation because of these recent trends and potentially adopt a more cautionary stance. This is what is likely to drive markets on Wednesday, given what was pointed out in the previous report, last November:

"There was a remarkable recovery in financial asset prices over the summer, reflecting historically loose financial conditions and confidence in the monetary and fiscal policy response. […] equity and credit valuations seem increasingly contingent on, and sensitive to, changes in the benchmark yield curve, and investors could reassess asset valuations swiftly if the course of the pandemic were to lead to materially weaker economic outcomes."

ECB adopting a more cautionary stance on inflation could offset last week's strengthening of the euro, and stymie demand for the single currency. This could only happen if demand for lower-risk securities is bolstered in the near future.

British Consumer Prices Expected to be Doubled in April

Again on Wednesday, the Office for National Statistics is scheduled to publish the latest Consumer Price Index (CPI) data for April. According to the preliminary forecasts, inflation in the UK is likely to have doubled last month.

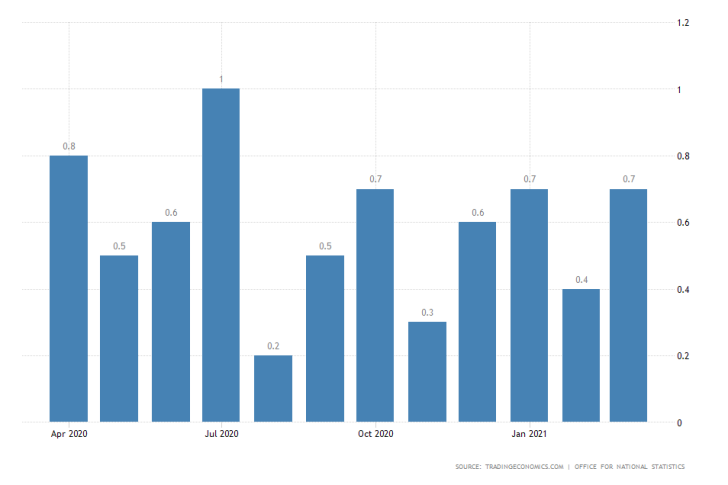

The index was upwardly revised to 0.7 per cent in March, measuring a marginal improvement from February's uptick of 0.4 per cent. In April, however, the index is expected to soar to 1.7 per cent because of the aforementioned global trends.

The projected doubling of headline inflation is expected to match the same trend that was already observed in the U.S. last week. The matching results are subject to the loose monetary policy conditions worldwide.

Furthermore, the better-than-expected GDP numbers in Q1 are also a major stimulant for the underlying growth in consumer prices.

The Tentative Recovery of Germany's Services Continues in May

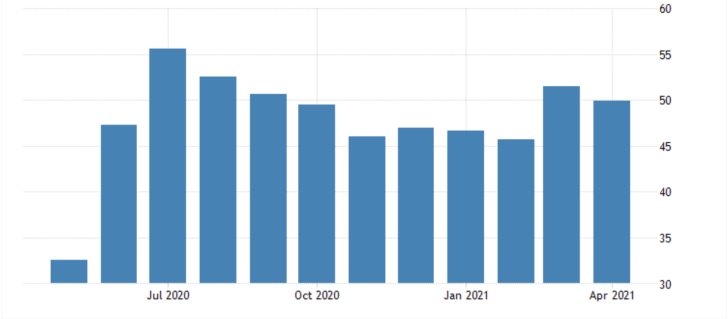

The Markit institute is set to post crucial industry numbers for countries in the Eurozone, the UK, and the U.S. on Friday. The German Services PMI data is likely to have the most sizable impact on asset prices, which is why it warrants a closer look.

According to the initial market forecasts, the index is expected to grow by 52.0 index points in May, an upward revision from the 49.9 index points that were recorded in April.

If realised, this would mark the strongest monthly performance since August last year, elucidating the improving but still tentative industrial recovery in the Eurozone's biggest economy.

The uneven vaccination process in Europe continues to weigh down on economic stabilisation; however, the situation is improving. As the German industry continues to recuperate, this is likely to affect the economy of the entire Eurozone.

As shown on the daily chart below, the EURGBP is of particular interest this week due to the three top-tier economic releases. The pair appears to be forming a new Accumulation range at the bottom of a major Markdown.

Given the expectations of the classic Wyckoff Cycle theory, this range can be perceived as an intermediate stage in the transition of the market from having a bearish to bullish orientation.

The termination of the preceding downtrend is further illustrated by the Stochastic RSI indicator. Given the expectations for the eventual emergence of a new uptrend, traders should observe the behaviour of the price action around the three major Fibonacci retracement levels.

Other Prominent Events to Watch for:

Monday - China y/y Retail Sales.

Tuesday - Japan q/q GDP Preliminary; Australia RBA Policy Minutes; UK Unemployment Rate; EU q/q GDP Preliminary; ECB President Lagarde Speech.

Wednesday - Canada m/m CPI; US Crude Oil Inventories; FED Policy Minutes.

Thursday - Australia Unemployment Rate; US Unemployment Claims.

Friday - Australia m/m Retail Sales; UK m/m Retail Sales; French Flash Services and Manufacturing PMI; EU Flash Manufacturing and Services PMI; UK Flash Manufacturing and Services PMI; Canada m/m Retail Sales; US Flash Manufacturing PMI.