ECB is Now Embroiled in Talks of Possible Policy Tapering

The Monetary Policy Decision of the ECB is set to prompt extra volatility outbursts on the euro, which is likely to have a sizable impact on currency markets. To understand the broader market sentiment of the single currency, check out our latest EURUSD analysis.

The interest rate decision of the European Central Bank is going to be the most prominent event taking place this week. The Governing Council of the ECB, with Chair Christine Lagarde, is deliberating on the current monetary policy stance on Thursday.

Even though the Council is almost certainly going to preserve the near-negative Main Refinancing Rate unchanged at 0.00 per cent, markets will pay especially close attention to Christine Lagarde and her colleagues' comments on inflation.

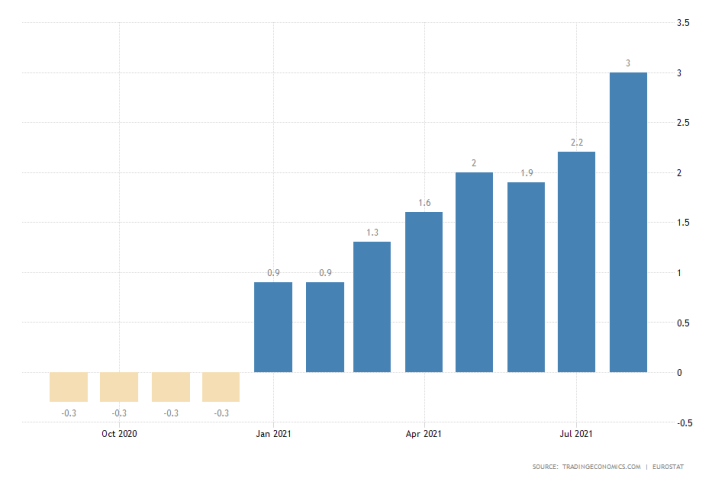

Headline inflation in the Eurozone reached 3.0 per cent in August, which is well above the lower band of the Council's medium-term projections.

With prices surging past the ECB's medium-term target for the first time since the beginning of the pandemic, market participants have started to weigh in on the possibility of ECB tapering its asset purchase facility sooner than initially forecasted.

Potential hawkish-sounding remarks in ECB's policy statement and hints at the possibility of dialling back the amount of liquidity sooner than initially forecasted would likely bolster the euro.

However, if the ECB stresses on the need to maintain its accommodative stance for longer in order to ensure that the recent jump in consumer prices is not a temporary occurrence, similarly to what the FED did recently, this is likely to have the opposite effect on the euro.

Japan's Economy to Continue Expanding at a Muted Pace

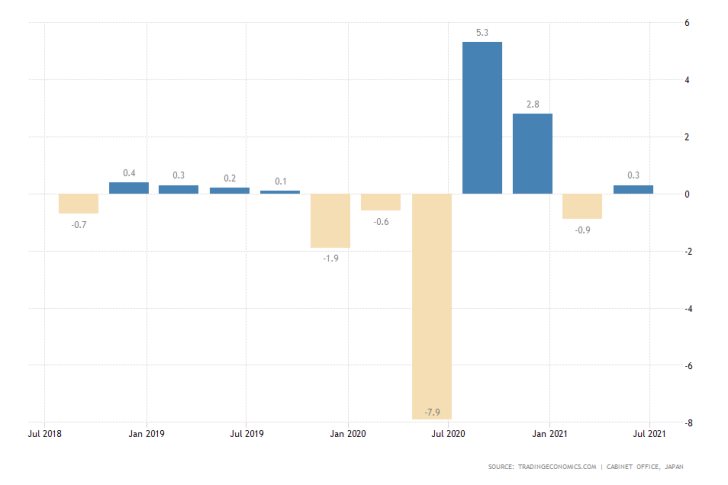

In the first hours of the Asian session on Wednesday, the Cabinet Office in Japan is scheduled to post the final growth numbers for the second quarter. According to the preliminary forecasts, the Japanese economy is expected to expand by 0.3 per cent, a GDP growth rate that would remain the same from the previous quarter.

Japan's economy continues to be affected adversely by transitionary global trends. On the one hand, solid energy demand continues to be a key determinant for growth, but on the other, the bumpy and uneven recovery elsewhere remains a major impediment for developed markets.

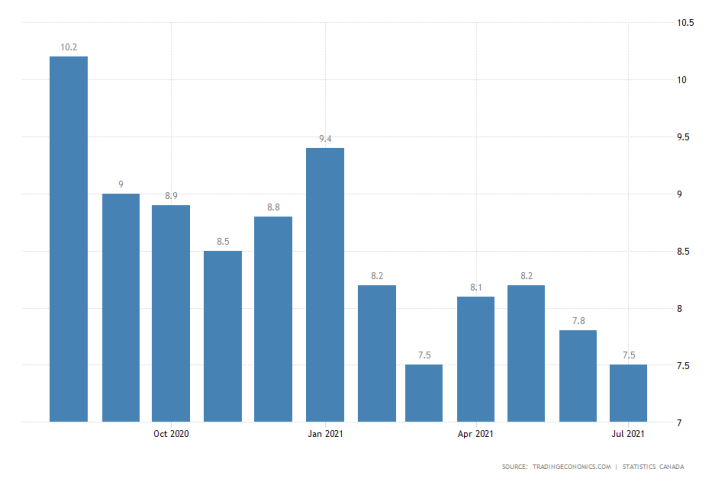

Canadian Unemployment Expected to Drop Marginally in August

On Friday, Statistics Canada will deliver the latest labour market data. According to the market forecasts, Canada's unemployment rate is expected to drop by 0.1 per cent from a month prior to 7.4 per cent. If realised, this would mark the lowest level of unemployment since the beginning of the pandemic.

The Canadian labour market has been improving for three consecutive months and the reason for that is partly owing to the aforementioned stabilisation of the energy market, reflected by crude's recent rally.

If the labour force survey delivers on these forecasts, the Canadian dollar is likely to be bolstered in the short term. Given the prominence of ECB's policy decision on Wednesday, the EURCAD pair is of particular interest.

As can be seen on the 4H chart below, the pair has recently broken down below the ascending trend line (in green), which implies rising bearish sentiment in the market. This is also reflected by the MACD indicator.

If the price action manages to penetrate below the 100-day MA (in blue), the next target would be the 61.8 per cent Fibonacci retracement level at 1.48354. The latter is currently converging with the 200-day MA (in orange).

Other Prominent Events to Watch for:

Tuesday - Australia RBA Cash Rate Decision; Japan Leading Economic Index Preliminary; EU QoQ GDP Growth Rate.

Wednesday - Canada BOC Rate Decision.

Thursday - China MoM Inflation Rate.

Friday - U.S. MoM PPI.