Earlier today, Statistics Canada released its monthly retail sales report, in which it was revealed that the Canadian economy had experienced a seesaw rebound from the slump that was registered in April.

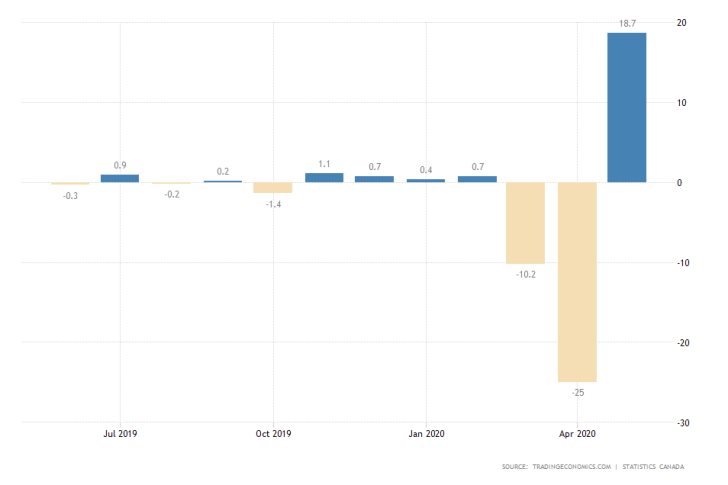

Retail sales soared by 18.7 per cent in May, which is the biggest hike on record but fell short of the initial projections of a 20 per cent gain. Thus, the retail industry managed to recuperate partially from the devastating 25 per cent crunch from a month prior.

May's slump was attributed to the government restrictions from that time, which encompassed Canada's combined effort to curtail the spread of the coronavirus. The period between mid-March and late-April saw the biggest slump in overall economic activity across the world from the start of the crisis onwards.

As the containment restrictions started to gradually ease, however, the activity was allowed to pick up once again. This is also demonstrated by the underlying improvement in the national labour market that was registered in June.

Now that prominent pharmaceutical and biotech companies have started to flaunt the success of their COVID-19 vaccine research, all prerequisites for a stable recovery seem to be in place.

Hence, the sudden jump in Canada's retail sales is unlikely to be a one-off event. Rather it could be perceived as an early indication of a lasting and profound road to recovery.

These results have lifted investors' optimism in Canada, which also had a positive impact on the value of the Canadian dollar. The loonie advanced against the greenback during today's trading session, as the latter weakened due to the strengthening euro.

As can be seen on the 4H chart below, the USDCAD broke down below the Accumulation range's lower boundary, and a snap reversal seems increasingly less likely.

Even though the price action remains concentrated below the 10-day MA (in red) and the 10-day EMA (in blue), there is yet hope for the market bulls. The underlying market sentiment remains range-trading, and the 'Oversold' reading of the Stochastic RSI could prompt heightened buying pressure in the near term.

It all depends on how the underlying fundamental factors develop from here on out, and whether the successful deal in Brussels would continue to pressure the value of the greenback indirectly.

Trendsharks Premium

Gold is undergoing a correction, as investors take profits to offset losses from falling stock prices, impacting their margins. However, we anticipate a renewed wave of [...]

The Swiss stock market index is mirroring its global counterparts, such as Germany 40 and US100, experiencing a sharp decline following the announcement of new [...]

We’re analyzing the weekly chart to grasp the broader market trend. Over the past three years, the US30 index has surged by 17,000 points, often resembling a nearly straight [...]

Over the past week, the DAX has experienced a sharp decline, plunging by an astonishing 3,400 points. This downward movement is not isolated, as its international counterparts, such as the UK100 and US100, are also facing significant [...]

EURUSD recently formed a double top at 1.0930, signaling a potential trend reversal, and has since begun a correction. After a 600-pip rally since early March, a pullback at this stage is both expected and healthy. Given these conditions, we are placing a [...]

Since early March, EURJPY has surged nearly 1,000 pips, providing us with several excellent trading opportunities. However, as the rally matures, many early buyers are beginning to take profits, leading to a noticeable slowdown in the uptrend. On Friday, the pair formed a [...]

The AUDJPY currency pair continues to be dominated by bullish momentum, as multiple golden cross patterns reaffirm the strength of the ongoing uptrend. Despite this, we are witnessing a much-needed [...]

The EURAUD currency pair appears to be undergoing a trend reversal, signaling a potential shift in market direction. A notable technical development is the formation of a Death Cross on the chart, a widely recognized bearish indicator that typically suggests a [...]

After securing an impressive 200-pip profit last week, the EURJPY currency pair is now undergoing a southward correction, retracing some of its recent gains. Despite this temporary pullback, the Golden Cross remains intact, reinforcing our view that the overall trend continues to be [...]

The appearance of a Golden Cross in Silver strengthens our analysis that the metal is currently in a strong uptrend, indicating further bullish momentum in the market. This technical pattern, where the short-term moving average crosses above the [...]

This trade presents a considerable level of risk and can be classified as an opportunistic move based on recent price action. The GBPUSD currency pair has experienced a substantial bullish rally, surging by nearly 500 pips in a strong upward movement. However, after this extended period of appreciation, the pair is showing signs of a potential [...]

The anticipated Death Cross on the SMI20 appears to be failing as price finds strong support at the 23% Fibonacci retracement level. After testing this area, the index has shown bullish strength, printing several large green candles, signaling an increase in [...]

A Golden Cross has just appeared on the USDJPY chart, signaling a potential bullish move. This technical pattern occurs when the 20 period moving average crosses above the 60 period moving average, a widely recognized indication of increasing [...]

After 2 months of a down trend, we finally see some indications of price recovery for Oil. The golden cross, a historic buy signal, supports this [...]

For the past month, the German DAX40 has experienced a remarkable 10% surge, reflecting strong bullish momentum. Despite ongoing market volatility and frequent pullbacks, every dip continues to attract fresh buyers, reinforcing the [...]

Oil continues its downward trajectory, despite occasional pullbacks. The overall trend remains bearish, reinforced by multiple Death Cross patterns, a classic sell signal indicating further weakness. Adding to this bearish outlook, the critical [...]

Over the past few days, gold has experienced a sharp decline of more than $100. This downturn can be attributed in part to traders securing profits to manage their margins, which are under strain due to the significant drop in major indices. Currently, gold has fallen below the [...]

The NASDAQ 100 index is showing strong bullish momentum, as evidenced by the formation of a Golden Cross on the chart. This classic buy signal occurs when the short moving average crosses above the long term moving average, suggesting that upward momentum is [...]

The EURAUD currency pair has encountered a significant resistance level, failing to break above the critical 61% Fibonacci retracement level. This suggests that bullish momentum is weakening, reinforcing the case for a potential downward move. Given this technical setup, we favor entering a [...]

The UK100 is experiencing a remarkable rally! Over the past few weeks, the British stock market index has surged nearly 800 points. Each minor dip has attracted more buyers, fueling the bullish momentum. However, since last week, we’ve observed a slight [...]