Early on Monday morning the British Office for National Statistics released a report on the three-month change in the GDP growth of the country, and the findings of the report sent mixed messages to investors, who are still left puzzled following the ongoing disarray of British politics. As the question of Theresa May’s most likely successor at 10 Downing remains unanswered, the national economy is doing its best to prepare for every possible situation that could follow the eventual divorce of the country with the EU.

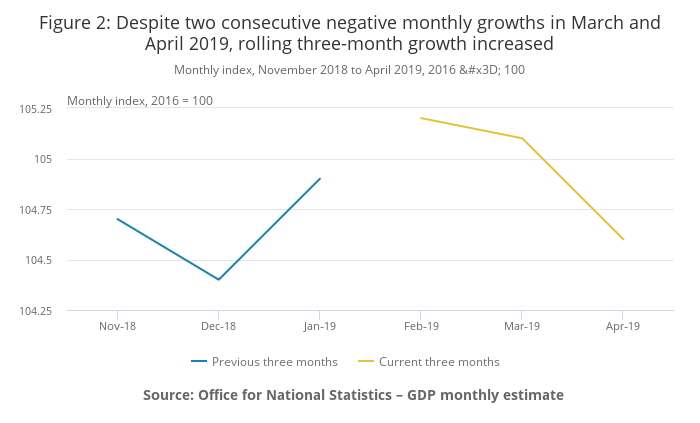

It was reported that the Gross Domestic Product of the UK grew with a negative 0.4% in April, which measures a sizable decrease from the 0.5% growth on quarter in the first three months of 2019, but for the moment the aggregate GDP growth for Q2 is still aggregating higher than the country's performance for the months of November 2018 to January 2019.

The current trend of falling production has been attributed to the early preparations of the British economy for the official leaving date of the country from the European Union. The Head of GDP Rob Kent-Smith commented on the performance by stating that:

"GDP growth showed some weakness across the latest three months, with the economy shrinking in the month of April mainly due to a dramatic fall in car production, with uncertainty ahead of the UK's original EU departure date leading to planned shutdowns. […] There was also widespread weakness across manufacturing in April, as the boos from the early completion of orders ahead of the UK's original EU departure date has faded."

Overall, the falling production rates have been acknowledged by officials and attributed to less alarming causes than it appears at first glances, such as national producers rushing to execute their orders ahead of time. Such a way of reasoning explains the massive surge in production for the month of February and the sharp drop in April.

For that reason, even though this significant drop in production when viewed on a month-to-month basis appears alarming, on an aggregate basis, the British industry as a whole appears somewhat resilient to such economic tremors.

In regards to wages, the British economy has managed to surpass the initial forecasts and boosted its performance. Employees’ weekly pay has now increased by 1.2% on the year when adjusted for inflation. According to the data released yesterday, between the first three months’ period of 2018 (February to April) and the same period of 2019, the regular pay of workers is estimated to have increased by 3.4% in nominal terms and 1.5% in real terms. [source]

The higher wages are expected to improve the aggregate consumer spending in the country, which in turn should support the steady inflation rate, which is currently sitting slightly above the target level at 2.1%.

For the UK, with all of the surrounding controversies around Brexit, stable monetary performance with a steady rate of inflation is of great importance for the long-term endurance of the national economy. For that reason, the continued surge in real wages is considered to be more than welcoming news in the eventful 2019.

Overall, the pound experienced a short-term intraday decrease of value, following the release of the GDP data with with 0.41% against the US dollar, however, the rise in weekly wages for British employees managed to somewhat compensate for the prior decrease and the GBPUSD pair increased with 0.30% during the next day’s trading session.