Christine Lagarde and her colleagues from the Governing Council of the European Central Bank have no reasons to fear elevated prices. At any rate, they do not seem to be too concerned about it in the first place, despite elevated investors and traders fears about inflation getting out of hand.

It is such fears of hyperinflation that manifest themselves in hopes for the adoption of a more hawkish policy stance of the Council; however, there are no real reasons to expect any transformational changes to ECB's policy direction on Thursday.

At the last policy meeting of the Council, which took place on the 22nd of April, ECB President Christine Lagarde reconfirmed the persistent need for the massively accommodative policy stance. The Bank's number one stressed that economic indicators are not yet robust enough to necessitate any major interventions, although headline inflation finally converged towards the seminal 2.0 per cent target level in May.

Pandemic Purchases Still Need to be Conducted at an Elevated Pace

Purchases under the Pandemic Emergency Purchasing Programme (PEPP), which has a total envelope of 1850 billion euros, continue at an accelerated pace because of persistent discrepancies between short term and long term recovery developments.

Lagarde expounded on the fact that near-term risks remain tilted to the downside, while mid-term risks are more balanced. This is due to the fact that pandemic uncertainty represents a somewhat smaller impediment to recovery in the medium term, while PEPP still needs to be carried out at a high pace in the short term in order to support the smooth operation of the financial system.

The international role of our single currency, the euro, stayed stable after the pandemic shock. This reflects the effectiveness of the unprecedented policy support measures that have been adopted in the euro area during the coronavirus crisis. https://t.co/PKMPUckmc1

— Christine Lagarde (@Lagarde) June 2, 2021

Even more importantly, changes to the PEPP were not even discussed last time because "it is simply premature". The ECB assesses weekly and monthly economic developments, the discrepancy between which elucidates a persistent spare capacity in the underlying recovery.

Sustained Discrepancies in Eurozone's Inflationary Pressures

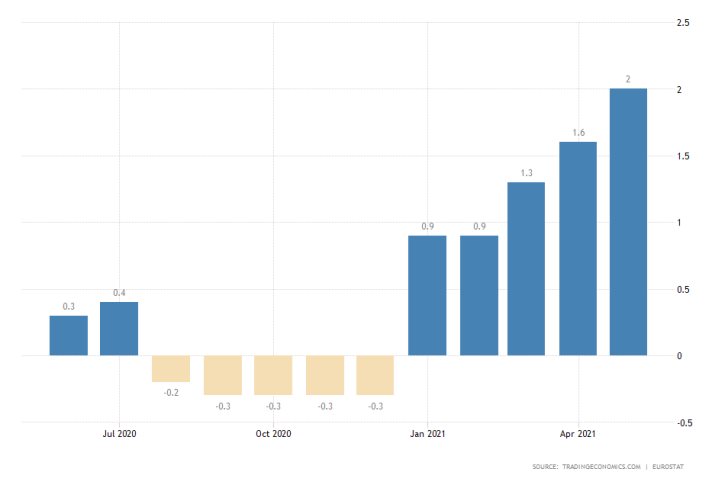

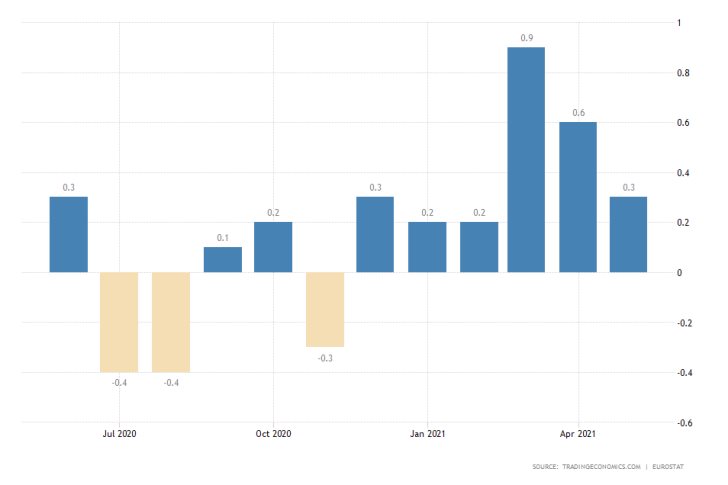

This trend is especially apparent in the consumer sector. Despite the fact that short term inflation surged in May, the consumer prices index (CPI) in the Eurozone has been depreciating for the last couple of months.

This discrepancy between headline inflation and consumer prices underlines the spare capacity that Christine Lagarde alluded to. It is precisely because of it that the Governing Council does not feel compelled to discuss slowing down the pace of ECB's pandemic purchases at the present rate.

The Inverse Impact of Energy Demand

The primary cause for the sluggish growth rate of long term inflation has to do with recent developments in the energy market. Short term inflation was bolstered by crude oil's rally over the last few weeks, as underpinned on the daily chart below. However, this has not been reflected on broader price trends as of yet.

Moreover, there seems to be an inverse relationship in effect between economic output and energy demand. In ideal terms, energy demand would be bolstered by heightened economic activity; however, it was precisely the opposite case that has been observed over the last few months.

The price of the commodity rose due to external factors such as OPEC's production cuts in the wake of the coronavirus crisis. The underlying rally of WTI's price did not reflect on a considerable uptick in global economic activity, even though it, too, has accelerated recently, which is the primary reason why central banks do not perceive the latest inflationary developments as final.

The price of crude oil is likely to consolidate below $70.00 per barrel before a bearish correction takes place. Such a development would likely ease down consumer price pressures in the near future even more, consequently driving near term inflation lower. This is largely inlined with ECB and FED's primary projections.

That is why inflation does not represent a significant concern to the ECB at the present rate, and the Governing Council justifiably remains opposed to the idea of easing the pace of its purchases.